Foundations Investment Advisors LLC grew its position in shares of AdvanSix (NYSE:ASIX - Free Report) by 221.5% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 25,133 shares of the company's stock after purchasing an additional 17,316 shares during the period. Foundations Investment Advisors LLC owned 0.09% of AdvanSix worth $569,000 at the end of the most recent quarter.

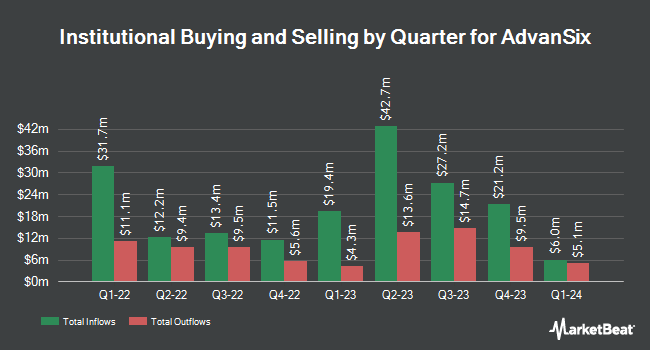

Several other hedge funds also recently modified their holdings of the company. Victory Capital Management Inc. boosted its position in shares of AdvanSix by 0.6% in the first quarter. Victory Capital Management Inc. now owns 2,407,512 shares of the company's stock worth $54,530,000 after acquiring an additional 15,367 shares during the last quarter. Vanguard Group Inc. raised its holdings in AdvanSix by 1.5% in the fourth quarter. Vanguard Group Inc. now owns 1,951,100 shares of the company's stock valued at $55,587,000 after buying an additional 27,981 shares during the period. Dimensional Fund Advisors LP raised its holdings in AdvanSix by 0.8% in the fourth quarter. Dimensional Fund Advisors LP now owns 1,578,908 shares of the company's stock valued at $44,982,000 after buying an additional 12,793 shares during the period. Wellington Management Group LLP raised its holdings in AdvanSix by 43.5% in the fourth quarter. Wellington Management Group LLP now owns 673,885 shares of the company's stock valued at $19,199,000 after buying an additional 204,200 shares during the period. Finally, Geode Capital Management LLC raised its holdings in AdvanSix by 0.6% in the fourth quarter. Geode Capital Management LLC now owns 602,303 shares of the company's stock valued at $17,164,000 after buying an additional 3,818 shares during the period. 86.39% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research analysts recently commented on the stock. Piper Sandler set a $32.00 price target on shares of AdvanSix in a report on Monday, May 19th. Wall Street Zen lowered shares of AdvanSix from a "strong-buy" rating to a "buy" rating in a research note on Saturday.

Read Our Latest Research Report on ASIX

AdvanSix Stock Down 0.3%

Shares of NYSE:ASIX traded down $0.06 during midday trading on Monday, reaching $19.13. The company had a trading volume of 85,584 shares, compared to its average volume of 181,707. The company has a debt-to-equity ratio of 0.29, a current ratio of 1.35 and a quick ratio of 0.66. The stock's fifty day moving average price is $23.34 and its 200-day moving average price is $24.50. The stock has a market capitalization of $512.96 million, a P/E ratio of 6.76 and a beta of 1.60. AdvanSix has a one year low of $18.44 and a one year high of $33.00.

AdvanSix Company Profile

(

Free Report)

AdvanSix Inc engages in the manufacture and sale of polymer resins in the United States and internationally. It offers Nylon 6, a polymer resin, which is a synthetic material used to produce fibers, filaments, engineered plastics, and films. The company also provides caprolactam to manufacture polymer resins; ammonium sulfate fertilizers to distributors, farm cooperatives, and retailers; and acetone that are used in the production of adhesives, paints, coatings, solvents, herbicides, and engineered plastic resins, as well as other intermediate chemicals, including phenol, monoisopropylamine, dipropylamine, monoallylamine, alpha-methylstyrene, cyclohexanone, methyl ethyl ketoxime, acetaldehyde oxime, 2-pentanone oxime, cyclohexanol, sulfuric acid, ammonia, and carbon dioxide.

Featured Stories

Before you consider AdvanSix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AdvanSix wasn't on the list.

While AdvanSix currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.