Founders Financial Alliance LLC purchased a new position in Autodesk, Inc. (NASDAQ:ADSK - Free Report) during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 1,075 shares of the software company's stock, valued at approximately $281,000.

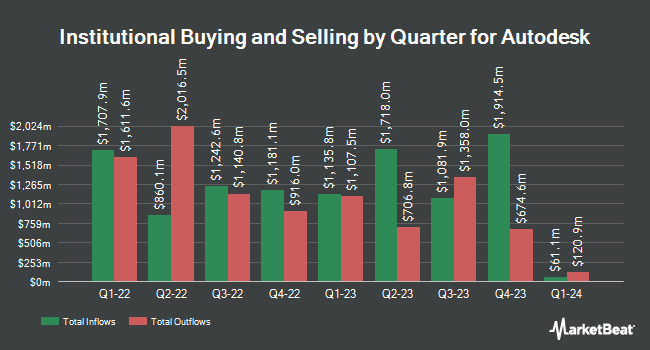

A number of other hedge funds have also recently made changes to their positions in the stock. Oregon Pacific Wealth Management LLC grew its holdings in shares of Autodesk by 4.0% in the first quarter. Oregon Pacific Wealth Management LLC now owns 999 shares of the software company's stock worth $262,000 after purchasing an additional 38 shares during the last quarter. GPS Wealth Strategies Group LLC grew its holdings in Autodesk by 30.1% during the 1st quarter. GPS Wealth Strategies Group LLC now owns 177 shares of the software company's stock worth $46,000 after acquiring an additional 41 shares in the last quarter. Johnson Financial Group Inc. grew its holdings in Autodesk by 30.2% during the 4th quarter. Johnson Financial Group Inc. now owns 181 shares of the software company's stock worth $56,000 after acquiring an additional 42 shares in the last quarter. Sky Investment Group LLC grew its holdings in Autodesk by 0.5% during the 1st quarter. Sky Investment Group LLC now owns 8,338 shares of the software company's stock worth $2,183,000 after acquiring an additional 42 shares in the last quarter. Finally, Cullen Frost Bankers Inc. grew its holdings in Autodesk by 3.9% during the 1st quarter. Cullen Frost Bankers Inc. now owns 1,123 shares of the software company's stock worth $294,000 after acquiring an additional 42 shares in the last quarter. 90.24% of the stock is currently owned by institutional investors.

Insider Transactions at Autodesk

In other Autodesk news, EVP Rebecca Pearce sold 3,251 shares of the firm's stock in a transaction that occurred on Thursday, July 3rd. The shares were sold at an average price of $315.00, for a total transaction of $1,024,065.00. Following the completion of the transaction, the executive vice president directly owned 19,440 shares of the company's stock, valued at approximately $6,123,600. This trade represents a 14.33% decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Over the last ninety days, insiders have sold 9,391 shares of company stock worth $2,909,885. Company insiders own 0.15% of the company's stock.

Autodesk Stock Performance

ADSK opened at $290.68 on Friday. Autodesk, Inc. has a 12-month low of $232.67 and a 12-month high of $326.62. The company has a current ratio of 0.65, a quick ratio of 0.65 and a debt-to-equity ratio of 0.76. The firm has a market capitalization of $62.21 billion, a PE ratio of 62.24, a P/E/G ratio of 2.80 and a beta of 1.46. The firm has a 50 day moving average of $300.24 and a two-hundred day moving average of $286.42.

Analyst Ratings Changes

Several research analysts have issued reports on the stock. Citigroup increased their target price on shares of Autodesk from $374.00 to $376.00 and gave the stock a "buy" rating in a report on Tuesday, May 27th. Rosenblatt Securities reiterated a "buy" rating and set a $340.00 target price on shares of Autodesk in a report on Tuesday, May 20th. The Goldman Sachs Group increased their target price on shares of Autodesk from $270.00 to $300.00 and gave the stock a "neutral" rating in a report on Friday, May 23rd. Royal Bank Of Canada reiterated an "outperform" rating and set a $345.00 target price (up from $313.03) on shares of Autodesk in a report on Friday, May 23rd. Finally, Wells Fargo & Company reiterated an "overweight" rating and set a $360.00 target price (up from $345.00) on shares of Autodesk in a report on Friday, May 23rd. Seven research analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Autodesk currently has a consensus rating of "Moderate Buy" and a consensus target price of $342.61.

Check Out Our Latest Stock Report on Autodesk

About Autodesk

(

Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.