Founders Financial Alliance LLC acquired a new stake in Equifax, Inc. (NYSE:EFX - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 1,249 shares of the credit services provider's stock, valued at approximately $304,000.

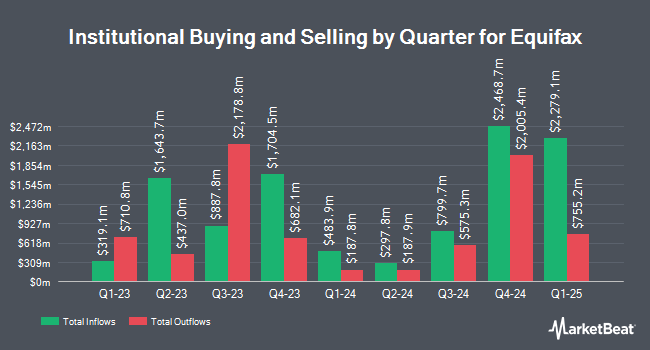

Other institutional investors also recently modified their holdings of the company. True Wealth Design LLC boosted its stake in Equifax by 1,920.0% during the 4th quarter. True Wealth Design LLC now owns 101 shares of the credit services provider's stock valued at $26,000 after purchasing an additional 96 shares during the last quarter. Ameriflex Group Inc. purchased a new stake in Equifax in the 4th quarter valued at about $28,000. N.E.W. Advisory Services LLC bought a new position in shares of Equifax in the first quarter valued at approximately $28,000. Colonial Trust Co SC increased its position in shares of Equifax by 505.0% during the fourth quarter. Colonial Trust Co SC now owns 121 shares of the credit services provider's stock valued at $31,000 after acquiring an additional 101 shares during the last quarter. Finally, City Holding Co. purchased a new stake in shares of Equifax during the 1st quarter worth approximately $34,000. 96.20% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Equifax

In other news, CEO Mark W. Begor sold 48,264 shares of the company's stock in a transaction that occurred on Monday, July 28th. The stock was sold at an average price of $241.71, for a total transaction of $11,665,891.44. Following the completion of the transaction, the chief executive officer directly owned 142,872 shares of the company's stock, valued at $34,533,591.12. This represents a 25.25% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. 1.40% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

EFX has been the subject of several research reports. BMO Capital Markets decreased their target price on Equifax from $280.00 to $260.00 and set a "market perform" rating for the company in a research report on Wednesday, July 23rd. Bank of America cut shares of Equifax from a "buy" rating to a "neutral" rating and lowered their price target for the company from $300.00 to $285.00 in a research report on Monday, June 23rd. Robert W. Baird cut their price objective on shares of Equifax from $310.00 to $289.00 and set an "outperform" rating on the stock in a report on Wednesday, July 23rd. Oppenheimer cut their price target on Equifax from $296.00 to $279.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 23rd. Finally, UBS Group cut their target price on Equifax from $315.00 to $278.00 and set a "buy" rating on the stock in a research note on Wednesday, July 23rd. Seven research analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $285.00.

Get Our Latest Stock Analysis on Equifax

Equifax Price Performance

Equifax stock traded up $12.75 during mid-day trading on Wednesday, hitting $253.74. The stock had a trading volume of 791,050 shares, compared to its average volume of 1,054,137. The company has a current ratio of 0.77, a quick ratio of 0.77 and a debt-to-equity ratio of 0.79. The firm's 50 day moving average is $255.67 and its 200 day moving average is $251.52. The firm has a market capitalization of $31.41 billion, a P/E ratio of 49.66, a P/E/G ratio of 2.89 and a beta of 1.64. Equifax, Inc. has a one year low of $199.98 and a one year high of $309.63.

Equifax (NYSE:EFX - Get Free Report) last issued its quarterly earnings data on Tuesday, July 22nd. The credit services provider reported $2.00 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.92 by $0.08. The firm had revenue of $1.54 billion for the quarter, compared to the consensus estimate of $1.51 billion. Equifax had a net margin of 10.95% and a return on equity of 18.89%. The company's quarterly revenue was up 7.4% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $1.82 EPS. On average, sell-side analysts forecast that Equifax, Inc. will post 7.58 earnings per share for the current fiscal year.

Equifax Profile

(

Free Report)

Equifax Inc operates as a data, analytics, and technology company. The company operates through three segments: Workforce Solutions, U.S. Information Solutions (USIS), and International. The Workforce Solutions segment offers services that enables customers to verify income, employment, educational history, criminal justice data, healthcare professional licensure, and sanctions of people in the United States; and employer customers with services that assist them in complying with and automating payroll-related and human resource management processes throughout the entire cycle of the employment relationship.

See Also

Before you consider Equifax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equifax wasn't on the list.

While Equifax currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.