FourThought Financial Partners LLC purchased a new position in M/I Homes, Inc. (NYSE:MHO - Free Report) during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm purchased 2,069 shares of the construction company's stock, valued at approximately $236,000.

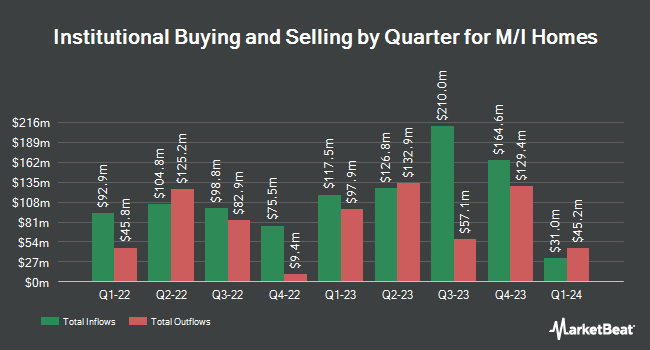

A number of other hedge funds and other institutional investors have also recently modified their holdings of MHO. Millennium Management LLC increased its stake in shares of M/I Homes by 85.5% in the fourth quarter. Millennium Management LLC now owns 238,826 shares of the construction company's stock worth $31,752,000 after purchasing an additional 110,086 shares in the last quarter. GAMMA Investing LLC increased its stake in shares of M/I Homes by 17,898.5% in the first quarter. GAMMA Investing LLC now owns 104,931 shares of the construction company's stock worth $11,981,000 after purchasing an additional 104,348 shares in the last quarter. Allianz Asset Management GmbH increased its stake in shares of M/I Homes by 77.5% in the first quarter. Allianz Asset Management GmbH now owns 229,065 shares of the construction company's stock worth $26,155,000 after purchasing an additional 100,029 shares in the last quarter. Assenagon Asset Management S.A. increased its stake in shares of M/I Homes by 81.7% in the first quarter. Assenagon Asset Management S.A. now owns 196,921 shares of the construction company's stock worth $22,484,000 after purchasing an additional 88,545 shares in the last quarter. Finally, Cerity Partners LLC increased its stake in shares of M/I Homes by 431.3% in the first quarter. Cerity Partners LLC now owns 91,324 shares of the construction company's stock worth $10,427,000 after purchasing an additional 74,136 shares in the last quarter. 95.14% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

MHO has been the subject of a number of analyst reports. Wall Street Zen cut shares of M/I Homes from a "buy" rating to a "hold" rating in a research note on Friday, April 25th. Raymond James Financial reduced their price objective on shares of M/I Homes from $168.00 to $140.00 and set a "strong-buy" rating for the company in a research note on Tuesday, April 29th.

Check Out Our Latest Stock Report on M/I Homes

M/I Homes Price Performance

MHO traded down $0.92 during trading on Thursday, hitting $119.90. 162,869 shares of the company traded hands, compared to its average volume of 280,684. The company has a market cap of $3.21 billion, a PE ratio of 6.58 and a beta of 1.64. The stock's 50-day simple moving average is $112.68 and its two-hundred day simple moving average is $115.31. M/I Homes, Inc. has a 1 year low of $100.22 and a 1 year high of $176.18. The company has a current ratio of 7.21, a quick ratio of 1.72 and a debt-to-equity ratio of 0.32.

M/I Homes (NYSE:MHO - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The construction company reported $4.42 earnings per share for the quarter, missing the consensus estimate of $4.43 by ($0.01). The company had revenue of $1.16 billion for the quarter, compared to analysts' expectations of $1.12 billion. M/I Homes had a net margin of 11.40% and a return on equity of 17.23%. The firm's revenue for the quarter was up 4.8% compared to the same quarter last year. As a group, sell-side analysts anticipate that M/I Homes, Inc. will post 18.44 earnings per share for the current fiscal year.

M/I Homes Company Profile

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

See Also

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.