Foyston Gordon & Payne Inc increased its position in shares of SEI Investments Company (NASDAQ:SEIC - Free Report) by 18.4% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 141,742 shares of the asset manager's stock after acquiring an additional 22,019 shares during the quarter. SEI Investments makes up about 2.7% of Foyston Gordon & Payne Inc's portfolio, making the stock its 13th biggest holding. Foyston Gordon & Payne Inc owned approximately 0.11% of SEI Investments worth $11,003,000 at the end of the most recent reporting period.

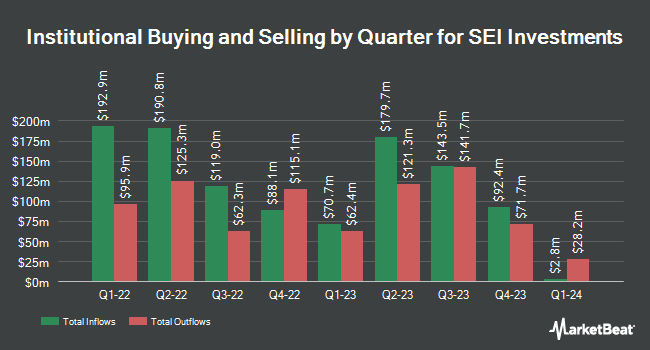

Other institutional investors and hedge funds have also recently modified their holdings of the company. Versant Capital Management Inc boosted its position in shares of SEI Investments by 156.1% during the 1st quarter. Versant Capital Management Inc now owns 543 shares of the asset manager's stock valued at $42,000 after acquiring an additional 331 shares during the last quarter. First Horizon Advisors Inc. boosted its position in shares of SEI Investments by 38.9% during the 1st quarter. First Horizon Advisors Inc. now owns 803 shares of the asset manager's stock valued at $62,000 after acquiring an additional 225 shares during the last quarter. Farther Finance Advisors LLC boosted its position in shares of SEI Investments by 104.3% during the 1st quarter. Farther Finance Advisors LLC now owns 1,334 shares of the asset manager's stock valued at $103,000 after acquiring an additional 681 shares during the last quarter. Cullen Frost Bankers Inc. boosted its position in shares of SEI Investments by 1,563.4% during the 1st quarter. Cullen Frost Bankers Inc. now owns 1,364 shares of the asset manager's stock valued at $106,000 after acquiring an additional 1,282 shares during the last quarter. Finally, Harel Insurance Investments & Financial Services Ltd. acquired a new position in shares of SEI Investments during the 1st quarter valued at about $132,000. Institutional investors and hedge funds own 70.59% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have commented on SEIC shares. Morgan Stanley reaffirmed an "overweight" rating and issued a $100.00 target price (up previously from $84.00) on shares of SEI Investments in a research report on Thursday, June 26th. Keefe, Bruyette & Woods reaffirmed a "market perform" rating and issued a $98.00 target price (down previously from $100.00) on shares of SEI Investments in a research report on Thursday, July 24th. Piper Sandler decreased their target price on shares of SEI Investments from $96.00 to $93.00 and set a "neutral" rating on the stock in a research report on Thursday, July 24th. William Blair reaffirmed a "market perform" rating on shares of SEI Investments in a research report on Thursday, April 24th. Finally, Raymond James Financial upped their target price on shares of SEI Investments from $115.00 to $118.00 and gave the company an "outperform" rating in a research report on Thursday, July 24th. Three analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company's stock. According to MarketBeat.com, SEI Investments has a consensus rating of "Moderate Buy" and a consensus target price of $102.00.

Read Our Latest Report on SEI Investments

Insider Activity at SEI Investments

In other news, CEO Ryan Hicke sold 35,000 shares of the stock in a transaction that occurred on Tuesday, August 19th. The stock was sold at an average price of $88.30, for a total value of $3,090,500.00. Following the completion of the sale, the chief executive officer directly owned 171,260 shares of the company's stock, valued at approximately $15,122,258. This represents a 16.97% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Mark Andrew Warner sold 5,000 shares of the stock in a transaction that occurred on Tuesday, July 29th. The shares were sold at an average price of $88.75, for a total value of $443,750.00. Following the completion of the sale, the insider directly owned 1,300 shares of the company's stock, valued at $115,375. The trade was a 79.37% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 181,126 shares of company stock valued at $15,540,849 over the last three months. 14.60% of the stock is owned by corporate insiders.

SEI Investments Stock Up 2.7%

NASDAQ:SEIC traded up $2.3650 on Friday, reaching $90.5050. 187,969 shares of the company's stock were exchanged, compared to its average volume of 844,013. The firm has a market capitalization of $11.19 billion, a price-to-earnings ratio of 16.98, a price-to-earnings-growth ratio of 1.37 and a beta of 0.95. The business has a fifty day moving average of $88.94 and a 200-day moving average of $82.48. SEI Investments Company has a 52-week low of $64.66 and a 52-week high of $93.96.

SEI Investments (NASDAQ:SEIC - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The asset manager reported $1.78 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.18 by $0.60. SEI Investments had a net margin of 31.25% and a return on equity of 29.96%. The company had revenue of $559.60 million for the quarter, compared to analyst estimates of $550.72 million. During the same period in the prior year, the firm earned $1.05 earnings per share. The business's revenue for the quarter was up 7.8% compared to the same quarter last year. As a group, equities analysts anticipate that SEI Investments Company will post 4.86 earnings per share for the current year.

SEI Investments Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, June 17th. Investors of record on Monday, June 9th were paid a dividend of $0.49 per share. The ex-dividend date was Monday, June 9th. This is a positive change from SEI Investments's previous quarterly dividend of $0.46. This represents a $1.96 dividend on an annualized basis and a dividend yield of 2.2%. SEI Investments's payout ratio is currently 18.39%.

SEI Investments Company Profile

(

Free Report)

SEI Investments Company is a publicly owned asset management holding company. Through its subsidiaries, the firm provides wealth management, retirement and investment solutions, asset management, asset administration, investment processing outsourcing solutions, financial services, and investment advisory services to its clients.

Recommended Stories

Before you consider SEI Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEI Investments wasn't on the list.

While SEI Investments currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.