Franklin Street Advisors Inc. NC boosted its holdings in shares of Accenture PLC (NYSE:ACN - Free Report) by 28.3% in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 59,089 shares of the information technology services provider's stock after purchasing an additional 13,047 shares during the period. Franklin Street Advisors Inc. NC's holdings in Accenture were worth $17,661,000 as of its most recent SEC filing.

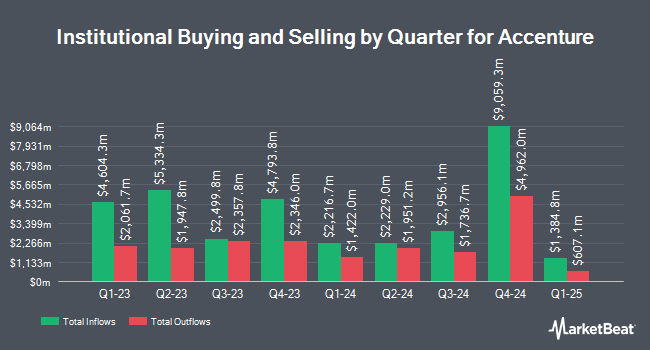

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Vanguard Group Inc. lifted its stake in Accenture by 5.7% during the first quarter. Vanguard Group Inc. now owns 63,814,234 shares of the information technology services provider's stock worth $19,912,594,000 after purchasing an additional 3,419,577 shares during the period. Price T Rowe Associates Inc. MD raised its stake in shares of Accenture by 63.9% in the first quarter. Price T Rowe Associates Inc. MD now owns 8,953,621 shares of the information technology services provider's stock valued at $2,793,889,000 after acquiring an additional 3,490,569 shares during the last quarter. Goldman Sachs Group Inc. raised its stake in shares of Accenture by 3.5% in the first quarter. Goldman Sachs Group Inc. now owns 6,766,369 shares of the information technology services provider's stock valued at $2,111,378,000 after acquiring an additional 228,939 shares during the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its stake in shares of Accenture by 2.1% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 6,163,393 shares of the information technology services provider's stock valued at $1,923,225,000 after acquiring an additional 126,548 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. raised its stake in shares of Accenture by 3.3% in the first quarter. Charles Schwab Investment Management Inc. now owns 5,129,053 shares of the information technology services provider's stock valued at $1,600,470,000 after acquiring an additional 164,573 shares during the last quarter. Institutional investors own 75.14% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts have recently issued reports on the stock. Stifel Nicolaus cut their target price on shares of Accenture from $355.00 to $315.00 and set a "buy" rating for the company in a research note on Tuesday, September 16th. Guggenheim dropped their price objective on shares of Accenture from $305.00 to $285.00 and set a "buy" rating for the company in a research report on Friday, September 26th. The Goldman Sachs Group dropped their price objective on shares of Accenture from $370.00 to $330.00 and set a "buy" rating for the company in a research report on Friday, September 26th. Wall Street Zen upgraded shares of Accenture from a "hold" rating to a "buy" rating in a research report on Friday. Finally, Weiss Ratings restated a "hold (c-)" rating on shares of Accenture in a research report on Saturday, September 27th. One analyst has rated the stock with a Strong Buy rating, fourteen have issued a Buy rating, ten have assigned a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $300.22.

Read Our Latest Report on ACN

Accenture Stock Performance

Shares of Accenture stock opened at $245.39 on Friday. The firm has a fifty day moving average of $249.57 and a two-hundred day moving average of $283.65. The stock has a market capitalization of $153.69 billion, a price-to-earnings ratio of 20.20, a PEG ratio of 2.13 and a beta of 1.28. Accenture PLC has a 52 week low of $229.40 and a 52 week high of $398.35. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.46 and a current ratio of 1.42.

Accenture (NYSE:ACN - Get Free Report) last issued its earnings results on Thursday, September 25th. The information technology services provider reported $3.03 EPS for the quarter, beating the consensus estimate of $2.98 by $0.05. The company had revenue of $17.60 billion during the quarter, compared to analysts' expectations of $17.34 billion. Accenture had a net margin of 11.02% and a return on equity of 26.45%. The business's revenue for the quarter was up 7.3% compared to the same quarter last year. During the same quarter in the previous year, the company posted $2.66 EPS. Accenture has set its FY 2026 guidance at 13.190-13.570 EPS. Q1 2026 guidance at EPS. As a group, equities research analysts predict that Accenture PLC will post 12.73 EPS for the current year.

Accenture Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, November 14th. Investors of record on Friday, October 10th will be given a $1.63 dividend. The ex-dividend date is Friday, October 10th. This represents a $6.52 dividend on an annualized basis and a dividend yield of 2.7%. This is an increase from Accenture's previous quarterly dividend of $1.48. Accenture's dividend payout ratio is currently 48.72%.

Insider Activity at Accenture

In related news, insider Angela Beatty sold 203 shares of the company's stock in a transaction on Friday, July 11th. The shares were sold at an average price of $282.34, for a total value of $57,315.02. Following the completion of the sale, the insider owned 5,249 shares in the company, valued at $1,482,002.66. This represents a 3.72% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO Julie Spellman Sweet sold 2,251 shares of the company's stock in a transaction on Friday, July 11th. The shares were sold at an average price of $282.45, for a total transaction of $635,794.95. Following the completion of the sale, the chief executive officer owned 8,109 shares of the company's stock, valued at approximately $2,290,387.05. This represents a 21.73% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 2,954 shares of company stock worth $834,280 in the last quarter. Corporate insiders own 0.02% of the company's stock.

Accenture Company Profile

(

Free Report)

Accenture plc, a professional services company, provides strategy and consulting, industry X, song, and technology and operation services worldwide. The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software and quality engineering, data management; intelligent automation comprising robotic process automation, natural language processing, and virtual agents; and application management services, as well as software engineering services; strategy and consulting services; data and analytics strategy, data discovery and augmentation, data management and beyond, data democratization, and industrialized solutions comprising turnkey analytics and artificial intelligence (AI) solutions; metaverse; and sustainability services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Accenture, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Accenture wasn't on the list.

While Accenture currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report