Franklin Street Advisors Inc. NC lessened its stake in shares of The Home Depot, Inc. (NYSE:HD - Free Report) by 3.2% during the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 23,085 shares of the home improvement retailer's stock after selling 753 shares during the period. Franklin Street Advisors Inc. NC's holdings in Home Depot were worth $8,464,000 at the end of the most recent reporting period.

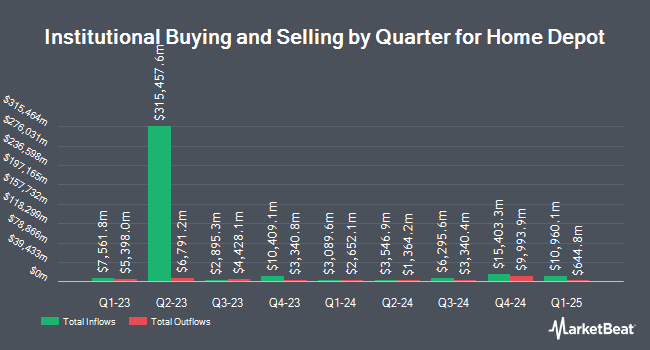

Other large investors also recently bought and sold shares of the company. Legend Financial Advisors Inc. acquired a new stake in Home Depot during the 2nd quarter valued at approximately $28,000. Abound Financial LLC acquired a new stake in Home Depot during the 1st quarter valued at approximately $31,000. Iron Horse Wealth Management LLC lifted its stake in Home Depot by 86.8% during the 1st quarter. Iron Horse Wealth Management LLC now owns 99 shares of the home improvement retailer's stock valued at $36,000 after acquiring an additional 46 shares during the period. Global X Japan Co. Ltd. acquired a new stake in Home Depot during the 2nd quarter valued at approximately $40,000. Finally, Compass Financial Services Inc acquired a new stake in Home Depot during the 1st quarter valued at approximately $41,000. Hedge funds and other institutional investors own 70.86% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have commented on the stock. Truist Financial lifted their price objective on shares of Home Depot from $417.00 to $433.00 and gave the company a "buy" rating in a research note on Wednesday, August 13th. Wolfe Research initiated coverage on shares of Home Depot in a research note on Thursday, September 18th. They set an "outperform" rating and a $497.00 price objective for the company. Mizuho increased their price target on shares of Home Depot from $435.00 to $450.00 and gave the stock an "outperform" rating in a report on Wednesday, August 20th. Wells Fargo & Company raised their price target on shares of Home Depot from $420.00 to $450.00 and gave the company an "overweight" rating in a research report on Wednesday, August 20th. Finally, Oppenheimer raised their price target on shares of Home Depot from $400.00 to $420.00 and gave the company a "market perform" rating in a research report on Thursday, September 25th. One equities research analyst has rated the stock with a Strong Buy rating, twenty have assigned a Buy rating and six have assigned a Hold rating to the company. According to data from MarketBeat.com, Home Depot has an average rating of "Moderate Buy" and a consensus price target of $436.40.

Check Out Our Latest Analysis on Home Depot

Insider Activity at Home Depot

In other Home Depot news, CFO Richard V. Mcphail sold 3,369 shares of the company's stock in a transaction on Wednesday, August 20th. The shares were sold at an average price of $403.66, for a total transaction of $1,359,930.54. Following the completion of the transaction, the chief financial officer directly owned 45,455 shares in the company, valued at approximately $18,348,365.30. This represents a 6.90% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, EVP Teresa Wynn Roseborough sold 5,483 shares of the company's stock in a transaction on Friday, August 22nd. The stock was sold at an average price of $413.23, for a total transaction of $2,265,740.09. Following the transaction, the executive vice president owned 16,057 shares of the company's stock, valued at $6,635,234.11. This represents a 25.45% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 48,835 shares of company stock valued at $19,623,432 in the last three months. Company insiders own 0.10% of the company's stock.

Home Depot Stock Performance

NYSE:HD opened at $394.88 on Friday. The company has a debt-to-equity ratio of 4.31, a quick ratio of 0.34 and a current ratio of 1.15. The company has a fifty day moving average of $402.63 and a two-hundred day moving average of $376.21. The stock has a market capitalization of $393.06 billion, a PE ratio of 26.83, a P/E/G ratio of 3.75 and a beta of 1.00. The Home Depot, Inc. has a fifty-two week low of $326.31 and a fifty-two week high of $439.37.

Home Depot (NYSE:HD - Get Free Report) last posted its quarterly earnings data on Tuesday, August 19th. The home improvement retailer reported $4.68 earnings per share for the quarter, missing analysts' consensus estimates of $4.69 by ($0.01). The company had revenue of $45.28 billion for the quarter, compared to analyst estimates of $45.43 billion. Home Depot had a return on equity of 193.99% and a net margin of 8.86%.The business's revenue was up 4.9% on a year-over-year basis. During the same quarter in the prior year, the company posted $4.60 earnings per share. Home Depot has set its FY 2025 guidance at 14.940-14.940 EPS. As a group, research analysts forecast that The Home Depot, Inc. will post 15.13 earnings per share for the current fiscal year.

Home Depot Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Thursday, September 18th. Shareholders of record on Thursday, September 4th were given a dividend of $2.30 per share. The ex-dividend date was Thursday, September 4th. This represents a $9.20 dividend on an annualized basis and a yield of 2.3%. Home Depot's dividend payout ratio is currently 62.50%.

Home Depot Profile

(

Free Report)

The Home Depot, Inc operates as a home improvement retailer in the United States and internationally. It sells various building materials, home improvement products, lawn and garden products, and décor products, as well as facilities maintenance, repair, and operations products. The company also offers installation services for flooring, water heaters, bath, garage doors, cabinets, cabinet makeovers, countertops, sheds, furnaces and central air systems, and windows.

Featured Articles

Want to see what other hedge funds are holding HD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Home Depot, Inc. (NYSE:HD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report