FSM Wealth Advisors LLC grew its holdings in International Business Machines Corporation (NYSE:IBM - Free Report) by 112.1% in the 2nd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 6,457 shares of the technology company's stock after purchasing an additional 3,412 shares during the quarter. FSM Wealth Advisors LLC's holdings in International Business Machines were worth $1,888,000 at the end of the most recent reporting period.

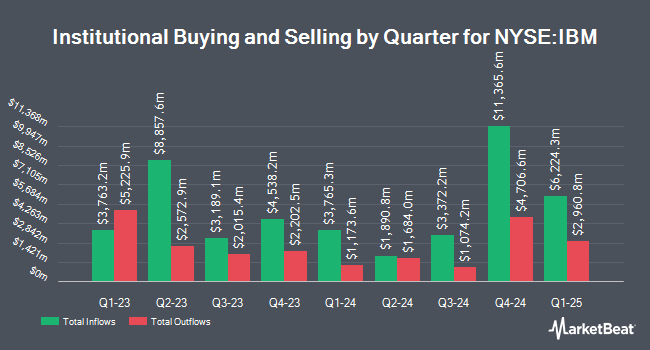

Other hedge funds and other institutional investors have also made changes to their positions in the company. Family CFO Inc purchased a new position in shares of International Business Machines in the second quarter valued at approximately $25,000. Christopher J. Hasenberg Inc purchased a new position in shares of International Business Machines in the first quarter valued at approximately $27,000. SSA Swiss Advisors AG purchased a new position in shares of International Business Machines in the first quarter valued at approximately $28,000. Highline Wealth Partners LLC boosted its stake in shares of International Business Machines by 85.0% in the second quarter. Highline Wealth Partners LLC now owns 111 shares of the technology company's stock valued at $33,000 after purchasing an additional 51 shares during the period. Finally, Dagco Inc. acquired a new stake in International Business Machines in the first quarter valued at approximately $31,000. Hedge funds and other institutional investors own 58.96% of the company's stock.

International Business Machines Stock Performance

NYSE:IBM opened at $272.29 on Thursday. The firm's fifty day moving average price is $263.92 and its 200 day moving average price is $262.56. International Business Machines Corporation has a 1-year low of $203.51 and a 1-year high of $301.04. The company has a debt-to-equity ratio of 2.00, a current ratio of 0.91 and a quick ratio of 0.87. The firm has a market cap of $253.06 billion, a price-to-earnings ratio of 44.20, a price-to-earnings-growth ratio of 4.34 and a beta of 0.73.

International Business Machines (NYSE:IBM - Get Free Report) last posted its quarterly earnings data on Wednesday, October 22nd. The technology company reported $2.65 earnings per share for the quarter, beating analysts' consensus estimates of $2.45 by $0.20. International Business Machines had a net margin of 9.11% and a return on equity of 37.62%. The firm had revenue of $16.33 billion for the quarter, compared to analyst estimates of $16.10 billion. During the same period last year, the firm posted $2.30 EPS. International Business Machines's quarterly revenue was up 9.1% on a year-over-year basis. International Business Machines has set its FY 2025 guidance at EPS. On average, sell-side analysts expect that International Business Machines Corporation will post 10.78 EPS for the current year.

International Business Machines Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 10th. Stockholders of record on Monday, November 10th will be paid a dividend of $1.68 per share. The ex-dividend date of this dividend is Monday, November 10th. This represents a $6.72 dividend on an annualized basis and a dividend yield of 2.5%. International Business Machines's dividend payout ratio is 109.09%.

Wall Street Analyst Weigh In

Several brokerages recently weighed in on IBM. JPMorgan Chase & Co. raised their target price on shares of International Business Machines from $244.00 to $290.00 and gave the company a "neutral" rating in a report on Thursday, July 24th. Bank of America boosted their price objective on shares of International Business Machines from $310.00 to $315.00 and gave the stock a "buy" rating in a research report on Thursday. Sanford C. Bernstein assumed coverage on shares of International Business Machines in a research report on Monday, September 15th. They set a "market perform" rating and a $280.00 price objective for the company. Wall Street Zen downgraded shares of International Business Machines from a "buy" rating to a "hold" rating in a research report on Saturday, October 18th. Finally, Erste Group Bank downgraded shares of International Business Machines from a "buy" rating to a "hold" rating in a research report on Thursday, August 14th. One research analyst has rated the stock with a Strong Buy rating, seven have issued a Buy rating, eight have given a Hold rating and one has given a Sell rating to the stock. Based on data from MarketBeat.com, International Business Machines presently has a consensus rating of "Hold" and an average price target of $288.31.

Check Out Our Latest Research Report on International Business Machines

International Business Machines Company Profile

(

Free Report)

International Business Machines Corporation, together with its subsidiaries, provides integrated solutions and services worldwide. The company operates through Software, Consulting, Infrastructure, and Financing segments. The Software segment offers a hybrid cloud and AI platforms that allows clients to realize their digital and AI transformations across the applications, data, and environments in which they operate.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider International Business Machines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Business Machines wasn't on the list.

While International Business Machines currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.