Zurcher Kantonalbank Zurich Cantonalbank lowered its position in shares of FTI Consulting, Inc. (NYSE:FCN - Free Report) by 35.5% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 9,246 shares of the business services provider's stock after selling 5,099 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank's holdings in FTI Consulting were worth $1,517,000 as of its most recent SEC filing.

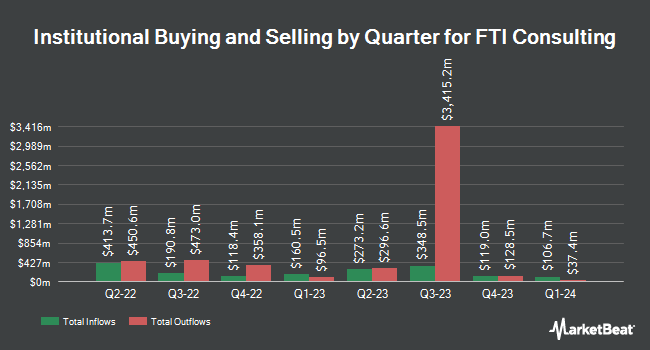

Several other large investors have also added to or reduced their stakes in FCN. Mirae Asset Global Investments Co. Ltd. purchased a new stake in FTI Consulting during the 1st quarter valued at $30,000. Signaturefd LLC raised its holdings in FTI Consulting by 65.3% during the 1st quarter. Signaturefd LLC now owns 205 shares of the business services provider's stock valued at $34,000 after buying an additional 81 shares during the period. GeoWealth Management LLC raised its holdings in FTI Consulting by 46.0% during the 4th quarter. GeoWealth Management LLC now owns 181 shares of the business services provider's stock valued at $35,000 after buying an additional 57 shares during the period. Quarry LP grew its position in FTI Consulting by 115.4% in the 4th quarter. Quarry LP now owns 349 shares of the business services provider's stock valued at $67,000 after acquiring an additional 187 shares during the last quarter. Finally, Curat Global LLC bought a new position in FTI Consulting in the 1st quarter valued at $89,000. Hedge funds and other institutional investors own 99.36% of the company's stock.

Analyst Ratings Changes

Separately, William Blair reaffirmed an "outperform" rating on shares of FTI Consulting in a research report on Friday, April 25th.

Check Out Our Latest Stock Analysis on FTI Consulting

FTI Consulting Trading Down 0.3%

FTI Consulting stock traded down $0.45 during mid-day trading on Wednesday, hitting $167.97. The company's stock had a trading volume of 236,520 shares, compared to its average volume of 376,213. The company has a 50 day moving average of $164.29 and a 200-day moving average of $168.79. The stock has a market cap of $5.44 billion, a PE ratio of 23.66 and a beta of 0.18. The company has a debt-to-equity ratio of 0.25, a quick ratio of 2.11 and a current ratio of 2.11. FTI Consulting, Inc. has a one year low of $151.75 and a one year high of $231.65.

FTI Consulting (NYSE:FCN - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The business services provider reported $2.13 EPS for the quarter, beating the consensus estimate of $1.87 by $0.26. The firm had revenue of $943.66 million for the quarter, compared to analyst estimates of $928.38 million. FTI Consulting had a return on equity of 12.88% and a net margin of 6.82%. The business's revenue for the quarter was down .6% on a year-over-year basis. During the same quarter last year, the firm posted $2.34 earnings per share. On average, research analysts anticipate that FTI Consulting, Inc. will post 8.55 EPS for the current year.

FTI Consulting declared that its Board of Directors has approved a stock repurchase plan on Thursday, April 24th that permits the company to buyback $400.00 million in outstanding shares. This buyback authorization permits the business services provider to reacquire up to 6.9% of its stock through open market purchases. Stock buyback plans are typically an indication that the company's management believes its stock is undervalued.

FTI Consulting Profile

(

Free Report)

FTI Consulting, Inc provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide. The company operates through Corporate Finance & Restructuring, Forensic and Litigation Consulting, Economic Consulting, Technology, and Strategic Communications segments. The Corporate Finance & Restructuring segment provides business transformation and strategy, transactions, and turnaround and restructuring services.

Featured Articles

Before you consider FTI Consulting, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTI Consulting wasn't on the list.

While FTI Consulting currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.