Fuller & Thaler Asset Management Inc. increased its stake in shares of Option Care Health, Inc. (NASDAQ:OPCH - Free Report) by 30.8% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,204,481 shares of the company's stock after purchasing an additional 989,048 shares during the period. Fuller & Thaler Asset Management Inc. owned approximately 2.57% of Option Care Health worth $146,947,000 as of its most recent SEC filing.

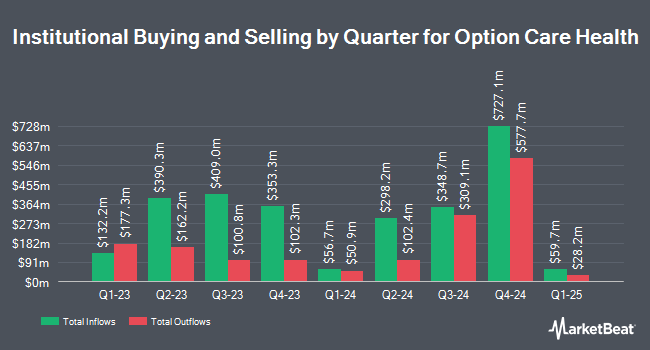

A number of other institutional investors have also made changes to their positions in OPCH. Brooklyn Investment Group grew its stake in Option Care Health by 186.6% in the first quarter. Brooklyn Investment Group now owns 1,198 shares of the company's stock valued at $42,000 after acquiring an additional 780 shares during the period. Bessemer Group Inc. grew its stake in Option Care Health by 62.3% in the first quarter. Bessemer Group Inc. now owns 1,560 shares of the company's stock valued at $54,000 after acquiring an additional 599 shares during the period. Public Employees Retirement System of Ohio grew its stake in Option Care Health by 21.6% in the fourth quarter. Public Employees Retirement System of Ohio now owns 1,870 shares of the company's stock valued at $43,000 after acquiring an additional 332 shares during the period. Wealthquest Corp acquired a new position in Option Care Health in the first quarter valued at about $66,000. Finally, Farther Finance Advisors LLC grew its stake in Option Care Health by 434.8% in the first quarter. Farther Finance Advisors LLC now owns 1,920 shares of the company's stock valued at $67,000 after acquiring an additional 1,561 shares during the period. 98.05% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

OPCH has been the subject of a number of research analyst reports. JMP Securities boosted their target price on Option Care Health from $36.00 to $38.00 and gave the company a "market outperform" rating in a research note on Thursday, July 31st. UBS Group raised Option Care Health from a "neutral" rating to a "buy" rating and boosted their target price for the company from $38.00 to $40.00 in a research note on Wednesday, April 30th. Barrington Research reissued an "outperform" rating and issued a $38.00 target price on shares of Option Care Health in a research note on Thursday, July 10th. Finally, Citigroup reissued an "outperform" rating on shares of Option Care Health in a research note on Thursday, July 31st. Eight equities research analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. Based on data from MarketBeat, Option Care Health currently has a consensus rating of "Moderate Buy" and an average target price of $35.75.

Read Our Latest Stock Report on OPCH

Insider Activity

In other Option Care Health news, Director Harry M. Jansen Kraemer, Jr. acquired 36,000 shares of the company's stock in a transaction on Wednesday, August 20th. The shares were purchased at an average price of $27.15 per share, for a total transaction of $977,400.00. Following the completion of the purchase, the director directly owned 375,390 shares of the company's stock, valued at approximately $10,191,838.50. This represents a 10.61% increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Timothy P. Sullivan acquired 20,000 shares of the company's stock in a transaction on Thursday, August 21st. The stock was acquired at an average price of $27.51 per share, for a total transaction of $550,200.00. Following the purchase, the director directly owned 49,229 shares of the company's stock, valued at approximately $1,354,289.79. This trade represents a 68.43% increase in their ownership of the stock. The disclosure for this purchase can be found here. Corporate insiders own 0.64% of the company's stock.

Option Care Health Stock Up 3.2%

Shares of Option Care Health stock traded up $0.90 during trading on Friday, reaching $28.74. The stock had a trading volume of 2,369,675 shares, compared to its average volume of 1,937,741. Option Care Health, Inc. has a 52 week low of $21.39 and a 52 week high of $35.53. The company has a market capitalization of $4.66 billion, a price-to-earnings ratio of 22.99, a P/E/G ratio of 1.76 and a beta of 0.79. The company has a current ratio of 1.52, a quick ratio of 1.00 and a debt-to-equity ratio of 0.81. The stock has a fifty day moving average price of $29.92 and a two-hundred day moving average price of $31.75.

Option Care Health (NASDAQ:OPCH - Get Free Report) last released its earnings results on Wednesday, July 30th. The company reported $0.41 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.40 by $0.01. Option Care Health had a return on equity of 17.53% and a net margin of 3.93%.The business had revenue of $1.42 billion for the quarter, compared to analyst estimates of $1.35 billion. During the same quarter in the prior year, the company posted $0.30 earnings per share. Option Care Health's revenue was up 15.4% on a year-over-year basis. Option Care Health has set its FY 2025 guidance at 1.650-1.720 EPS. Sell-side analysts predict that Option Care Health, Inc. will post 1.22 EPS for the current fiscal year.

Option Care Health Profile

(

Free Report)

Option Care Health, Inc offers home and alternate site infusion services in the United States. The company provides anti-infective therapies; home infusion services to treat heart failures; home parenteral nutrition and enteral nutrition support services for numerous acute and chronic conditions, such as stroke, cancer, and gastrointestinal diseases; immunoglobulin infusion therapies for the treatment of immune deficiencies; and treatments for chronic inflammatory disorders, including crohn's disease, plaque psoriasis, psoriatic arthritis, rheumatoid arthritis, ulcerative colitis, and other chronic inflammatory disorders.

Featured Articles

Before you consider Option Care Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Option Care Health wasn't on the list.

While Option Care Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.