Gabelli Funds LLC decreased its holdings in shares of Fiserv, Inc. (NYSE:FI - Free Report) by 31.9% in the 1st quarter, according to its most recent 13F filing with the SEC. The fund owned 9,550 shares of the business services provider's stock after selling 4,480 shares during the period. Gabelli Funds LLC's holdings in Fiserv were worth $2,109,000 at the end of the most recent reporting period.

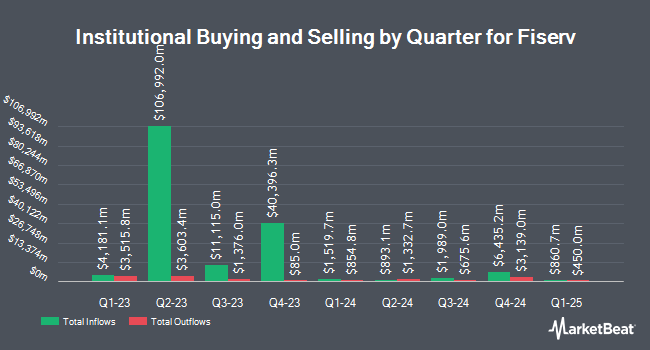

Several other institutional investors and hedge funds also recently made changes to their positions in FI. Brighton Jones LLC raised its position in shares of Fiserv by 91.9% during the 4th quarter. Brighton Jones LLC now owns 4,245 shares of the business services provider's stock valued at $872,000 after acquiring an additional 2,033 shares during the last quarter. Quarry LP increased its position in shares of Fiserv by 51.9% in the 4th quarter. Quarry LP now owns 205 shares of the business services provider's stock valued at $42,000 after buying an additional 70 shares in the last quarter. Bison Wealth LLC increased its position in shares of Fiserv by 5.3% in the 4th quarter. Bison Wealth LLC now owns 2,299 shares of the business services provider's stock valued at $472,000 after buying an additional 116 shares in the last quarter. Freestone Grove Partners LP bought a new stake in shares of Fiserv in the 4th quarter valued at $683,000. Finally, Mercer Global Advisors Inc. ADV increased its position in shares of Fiserv by 13.5% in the 4th quarter. Mercer Global Advisors Inc. ADV now owns 183,795 shares of the business services provider's stock valued at $37,755,000 after buying an additional 21,861 shares in the last quarter. Institutional investors own 90.98% of the company's stock.

Analyst Ratings Changes

FI has been the subject of a number of recent analyst reports. KeyCorp lowered their price objective on shares of Fiserv from $250.00 to $200.00 and set an "overweight" rating for the company in a research report on Thursday, July 24th. Robert W. Baird lowered their target price on Fiserv from $225.00 to $185.00 and set an "outperform" rating for the company in a report on Thursday, July 24th. UBS Group lowered their target price on Fiserv from $225.00 to $170.00 and set a "buy" rating for the company in a report on Friday, July 25th. Stephens lowered their target price on Fiserv from $240.00 to $180.00 and set an "overweight" rating for the company in a report on Thursday, July 24th. Finally, Barclays set a $175.00 target price on Fiserv and gave the stock an "overweight" rating in a report on Monday, July 28th. One investment analyst has rated the stock with a Strong Buy rating, twenty-one have given a Buy rating, two have issued a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat, Fiserv has an average rating of "Moderate Buy" and an average price target of $207.36.

View Our Latest Stock Analysis on Fiserv

Fiserv Stock Performance

NYSE:FI traded down $1.44 during mid-day trading on Tuesday, hitting $136.74. The stock had a trading volume of 4,911,876 shares, compared to its average volume of 4,450,029. Fiserv, Inc. has a twelve month low of $128.22 and a twelve month high of $238.59. The stock has a market cap of $74.33 billion, a price-to-earnings ratio of 22.83, a PEG ratio of 0.90 and a beta of 0.94. The company's 50 day simple moving average is $151.06 and its 200 day simple moving average is $180.49. The company has a debt-to-equity ratio of 1.09, a quick ratio of 1.09 and a current ratio of 1.09.

Fiserv (NYSE:FI - Get Free Report) last issued its earnings results on Wednesday, July 23rd. The business services provider reported $2.47 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.43 by $0.04. The business had revenue of $5.20 billion during the quarter, compared to the consensus estimate of $5.20 billion. Fiserv had a net margin of 16.00% and a return on equity of 19.69%. Fiserv's revenue was up 8.0% on a year-over-year basis. During the same period last year, the business posted $2.13 EPS. Fiserv has set its FY 2025 guidance at 10.150-10.30 EPS. On average, equities research analysts forecast that Fiserv, Inc. will post 10.23 earnings per share for the current year.

Fiserv Profile

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Featured Articles

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.