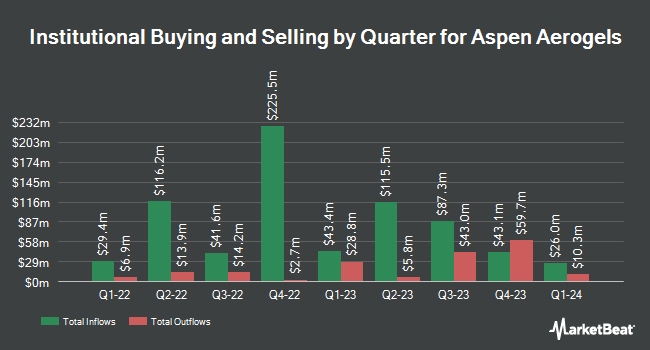

Gagnon Advisors LLC acquired a new stake in Aspen Aerogels, Inc. (NYSE:ASPN - Free Report) in the second quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 565,570 shares of the construction company's stock, valued at approximately $3,348,000. Aspen Aerogels comprises about 2.2% of Gagnon Advisors LLC's holdings, making the stock its 20th largest position. Gagnon Advisors LLC owned 0.69% of Aspen Aerogels at the end of the most recent quarter.

A number of other hedge funds also recently made changes to their positions in ASPN. Wealth Enhancement Advisory Services LLC acquired a new stake in shares of Aspen Aerogels in the fourth quarter valued at approximately $129,000. GAMMA Investing LLC lifted its holdings in Aspen Aerogels by 1,998.7% during the 1st quarter. GAMMA Investing LLC now owns 3,316 shares of the construction company's stock worth $210,000 after purchasing an additional 3,158 shares during the last quarter. SG Americas Securities LLC acquired a new stake in Aspen Aerogels during the 1st quarter worth approximately $431,000. Exchange Traded Concepts LLC lifted its holdings in Aspen Aerogels by 460.4% during the 1st quarter. Exchange Traded Concepts LLC now owns 7,436 shares of the construction company's stock worth $48,000 after purchasing an additional 6,109 shares during the last quarter. Finally, Bouvel Investment Partners LLC lifted its holdings in Aspen Aerogels by 41.4% during the 1st quarter. Bouvel Investment Partners LLC now owns 90,992 shares of the construction company's stock worth $581,000 after purchasing an additional 26,629 shares during the last quarter. 97.64% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In other news, CAO Santhosh P. Daniel sold 4,410 shares of Aspen Aerogels stock in a transaction on Tuesday, August 12th. The stock was sold at an average price of $7.31, for a total value of $32,237.10. Following the transaction, the chief accounting officer owned 19,879 shares in the company, valued at approximately $145,315.49. This trade represents a 18.16% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders own 3.40% of the company's stock.

Aspen Aerogels Price Performance

Shares of NYSE ASPN opened at $8.09 on Wednesday. The stock has a market capitalization of $665.88 million, a PE ratio of -2.12 and a beta of 2.80. The company has a debt-to-equity ratio of 0.34, a current ratio of 3.98 and a quick ratio of 3.31. The business has a fifty day moving average price of $7.13 and a two-hundred day moving average price of $6.46. Aspen Aerogels, Inc. has a fifty-two week low of $4.16 and a fifty-two week high of $26.90.

Aspen Aerogels (NYSE:ASPN - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The construction company reported ($0.04) earnings per share for the quarter, beating the consensus estimate of ($0.12) by $0.08. The firm had revenue of $78.02 million during the quarter, compared to analysts' expectations of $72.53 million. Aspen Aerogels had a positive return on equity of 2.92% and a negative net margin of 78.53%.The company's quarterly revenue was down 33.8% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.21 EPS. Aspen Aerogels has set its FY 2025 guidance at -3.860--3.730 EPS. As a group, equities analysts predict that Aspen Aerogels, Inc. will post 0.17 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research firms recently weighed in on ASPN. Barclays cut Aspen Aerogels from an "equal weight" rating to an "underweight" rating and lifted their price target for the stock from $7.00 to $16.00 in a report on Monday, August 11th. Weiss Ratings reissued a "sell (d)" rating on shares of Aspen Aerogels in a report on Saturday, September 27th. Finally, Canaccord Genuity Group dropped their price target on Aspen Aerogels from $11.00 to $10.00 and set a "buy" rating for the company in a report on Friday, August 8th. One analyst has rated the stock with a Strong Buy rating, six have issued a Buy rating, two have given a Hold rating and two have given a Sell rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $19.50.

Check Out Our Latest Research Report on Aspen Aerogels

About Aspen Aerogels

(

Free Report)

Aspen Aerogels, Inc designs, develops, manufactures, and sells aerogel insulation products primarily for use in the energy infrastructure and sustainable insulation materials markets in the United States, Asia, Canada, Europe, and Latin America. It operates in two segments, Energy Industrial and Thermal Barrier.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Aspen Aerogels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aspen Aerogels wasn't on the list.

While Aspen Aerogels currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.