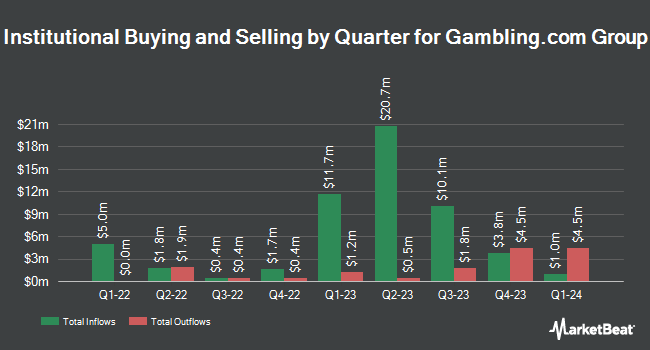

Goldman Sachs Group Inc. trimmed its stake in shares of Gambling.com Group Limited (NASDAQ:GAMB - Free Report) by 41.1% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 106,752 shares of the company's stock after selling 74,347 shares during the period. Goldman Sachs Group Inc. owned about 0.31% of Gambling.com Group worth $1,347,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also made changes to their positions in the stock. Northern Trust Corp raised its holdings in shares of Gambling.com Group by 0.9% during the fourth quarter. Northern Trust Corp now owns 109,928 shares of the company's stock worth $1,548,000 after acquiring an additional 1,003 shares during the period. Ameriprise Financial Inc. raised its holdings in shares of Gambling.com Group by 1.7% during the fourth quarter. Ameriprise Financial Inc. now owns 120,007 shares of the company's stock worth $1,690,000 after acquiring an additional 2,017 shares during the period. Hsbc Holdings PLC raised its holdings in shares of Gambling.com Group by 14.8% during the first quarter. Hsbc Holdings PLC now owns 17,834 shares of the company's stock worth $224,000 after acquiring an additional 2,302 shares during the period. American Century Companies Inc. raised its holdings in shares of Gambling.com Group by 5.9% during the first quarter. American Century Companies Inc. now owns 41,902 shares of the company's stock worth $529,000 after acquiring an additional 2,352 shares during the period. Finally, Simplex Trading LLC raised its holdings in shares of Gambling.com Group by 191.0% during the first quarter. Simplex Trading LLC now owns 3,899 shares of the company's stock worth $49,000 after acquiring an additional 2,559 shares during the period. 72.26% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

GAMB has been the topic of a number of research analyst reports. BTIG Research dropped their price objective on shares of Gambling.com Group from $19.00 to $12.00 and set a "buy" rating on the stock in a report on Friday, August 15th. Stifel Nicolaus decreased their target price on shares of Gambling.com Group from $18.00 to $15.00 and set a "buy" rating for the company in a research report on Friday, August 15th. Truist Financial downgraded shares of Gambling.com Group from a "buy" rating to a "hold" rating and decreased their target price for the company from $17.00 to $11.00 in a research report on Friday, August 15th. Jefferies Financial Group decreased their target price on shares of Gambling.com Group from $18.00 to $15.00 and set a "buy" rating for the company in a research report on Friday, August 15th. Finally, Zacks Research downgraded shares of Gambling.com Group from a "strong-buy" rating to a "hold" rating in a research report on Monday, September 1st. Seven research analysts have rated the stock with a Buy rating and two have issued a Hold rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $16.00.

Get Our Latest Research Report on GAMB

Gambling.com Group Stock Performance

Shares of GAMB traded down $0.08 during midday trading on Tuesday, reaching $8.41. The stock had a trading volume of 305,320 shares, compared to its average volume of 480,262. The firm has a 50 day simple moving average of $9.42 and a 200-day simple moving average of $11.31. Gambling.com Group Limited has a one year low of $7.93 and a one year high of $17.14. The firm has a market cap of $300.32 million, a PE ratio of 21.09 and a beta of 0.89. The company has a current ratio of 0.59, a quick ratio of 0.59 and a debt-to-equity ratio of 0.57.

Gambling.com Group (NASDAQ:GAMB - Get Free Report) last announced its quarterly earnings data on Thursday, August 14th. The company reported $0.37 EPS for the quarter, beating analysts' consensus estimates of $0.12 by $0.25. Gambling.com Group had a net margin of 9.66% and a return on equity of 38.04%. The company had revenue of $39.59 million during the quarter, compared to the consensus estimate of $38.93 million. Gambling.com Group has set its FY 2025 guidance at EPS. As a group, sell-side analysts anticipate that Gambling.com Group Limited will post 0.88 EPS for the current year.

About Gambling.com Group

(

Free Report)

Gambling.com Group Limited operates as a performance marketing company for the online gambling industry worldwide. It provides digital marketing services for the iGaming and social casino products. The company's focus is on online casino, online sports betting, and fantasy sports industry. It publishes various branded websites, including Gambling.com, Casinos.com, RotoWire.com, and Bookies.com.

Recommended Stories

Before you consider Gambling.com Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gambling.com Group wasn't on the list.

While Gambling.com Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.