Gamco Investors INC. ET AL cut its stake in Kraft Heinz Company (NASDAQ:KHC - Free Report) by 29.8% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 161,006 shares of the company's stock after selling 68,265 shares during the period. Gamco Investors INC. ET AL's holdings in Kraft Heinz were worth $4,899,000 at the end of the most recent reporting period.

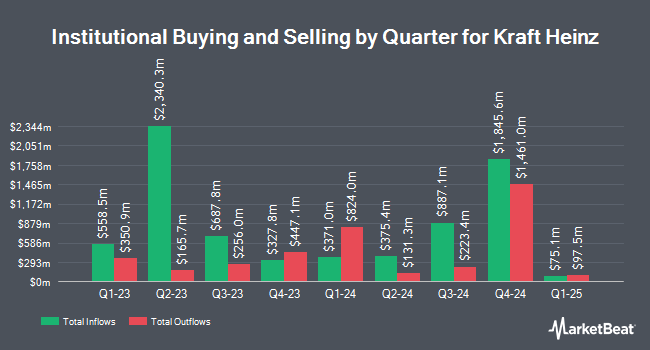

Several other institutional investors have also recently added to or reduced their stakes in KHC. Vanguard Group Inc. raised its holdings in Kraft Heinz by 12.7% in the first quarter. Vanguard Group Inc. now owns 101,980,834 shares of the company's stock valued at $3,103,277,000 after acquiring an additional 11,472,071 shares in the last quarter. Pacer Advisors Inc. raised its holdings in Kraft Heinz by 4,390.7% in the first quarter. Pacer Advisors Inc. now owns 7,444,062 shares of the company's stock valued at $226,523,000 after acquiring an additional 7,278,295 shares in the last quarter. Southeastern Asset Management Inc. TN acquired a new stake in Kraft Heinz in the fourth quarter valued at $87,080,000. Fairfax Financial Holdings Ltd. Can raised its holdings in Kraft Heinz by 341.9% in the fourth quarter. Fairfax Financial Holdings Ltd. Can now owns 3,314,000 shares of the company's stock valued at $101,773,000 after acquiring an additional 2,564,000 shares in the last quarter. Finally, Nuveen LLC acquired a new stake in Kraft Heinz in the first quarter valued at $61,110,000. 78.17% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In related news, Director Elio Leoni Sceti sold 25,000 shares of the company's stock in a transaction dated Friday, July 18th. The shares were sold at an average price of $27.91, for a total value of $697,750.00. Following the completion of the sale, the director owned 40,000 shares of the company's stock, valued at $1,116,400. This represents a 38.46% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 0.35% of the stock is owned by insiders.

Kraft Heinz Stock Performance

Shares of Kraft Heinz stock traded up $0.33 during trading on Friday, hitting $27.97. 23,587,253 shares of the stock were exchanged, compared to its average volume of 11,126,702. The stock's fifty day moving average is $27.34 and its 200 day moving average is $28.29. The stock has a market cap of $33.11 billion, a PE ratio of -6.23, a P/E/G ratio of 3.26 and a beta of 0.23. The company has a debt-to-equity ratio of 0.47, a quick ratio of 0.66 and a current ratio of 1.07. Kraft Heinz Company has a 12 month low of $25.44 and a 12 month high of $36.53.

Kraft Heinz (NASDAQ:KHC - Get Free Report) last released its quarterly earnings results on Wednesday, July 30th. The company reported $0.69 EPS for the quarter, topping the consensus estimate of $0.64 by $0.05. The business had revenue of $6.35 billion during the quarter, compared to analyst estimates of $6.26 billion. Kraft Heinz had a negative net margin of 20.83% and a positive return on equity of 7.40%. The company's quarterly revenue was down 1.9% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.78 earnings per share. Kraft Heinz has set its FY 2025 guidance at 2.510-2.670 EPS. As a group, sell-side analysts anticipate that Kraft Heinz Company will post 2.68 EPS for the current year.

Kraft Heinz Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, September 26th. Investors of record on Friday, August 29th will be issued a $0.40 dividend. The ex-dividend date of this dividend is Friday, August 29th. This represents a $1.60 annualized dividend and a yield of 5.7%. Kraft Heinz's dividend payout ratio is presently -35.63%.

Wall Street Analysts Forecast Growth

Several analysts have weighed in on KHC shares. JPMorgan Chase & Co. started coverage on shares of Kraft Heinz in a research note on Wednesday, August 20th. They set a "neutral" rating and a $27.00 target price for the company. DZ Bank lowered shares of Kraft Heinz from a "buy" rating to a "hold" rating and set a $31.00 target price for the company. in a research note on Friday, May 9th. Wells Fargo & Company boosted their target price on shares of Kraft Heinz from $27.00 to $29.00 and gave the company an "equal weight" rating in a research note on Monday, July 14th. Mizuho set a $29.00 target price on shares of Kraft Heinz and gave the company a "neutral" rating in a research note on Wednesday, May 28th. Finally, UBS Group boosted their target price on shares of Kraft Heinz from $29.00 to $30.00 and gave the company a "neutral" rating in a research note on Thursday, July 31st. Sixteen equities research analysts have rated the stock with a Hold rating and three have assigned a Sell rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Reduce" and a consensus target price of $30.12.

Check Out Our Latest Stock Report on KHC

Kraft Heinz Company Profile

(

Free Report)

The Kraft Heinz Company, together with its subsidiaries, manufactures and markets food and beverage products in North America and internationally. Its products include condiments and sauces, cheese and dairy products, meals, meats, refreshment beverages, coffee, and other grocery products under the Kraft, Oscar Mayer, Heinz, Philadelphia, Lunchables, Velveeta, Ore-Ida, Maxwell House, Kool-Aid, Jell-O, Heinz, ABC, Master, Quero, Kraft, Golden Circle, Wattie's, Pudliszki, and Plasmon brands.

See Also

Before you consider Kraft Heinz, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kraft Heinz wasn't on the list.

While Kraft Heinz currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report