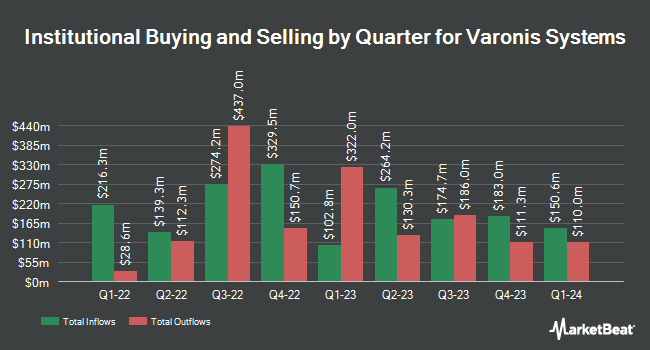

GAMMA Investing LLC grew its holdings in shares of Varonis Systems, Inc. (NASDAQ:VRNS - Free Report) by 4,782.1% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 14,158 shares of the technology company's stock after buying an additional 13,868 shares during the quarter. GAMMA Investing LLC's holdings in Varonis Systems were worth $573,000 at the end of the most recent reporting period.

Several other hedge funds have also recently made changes to their positions in the business. Vanguard Group Inc. raised its position in shares of Varonis Systems by 1.6% during the 4th quarter. Vanguard Group Inc. now owns 12,246,769 shares of the technology company's stock valued at $544,124,000 after buying an additional 193,210 shares in the last quarter. First Trust Advisors LP raised its position in shares of Varonis Systems by 4.8% during the 4th quarter. First Trust Advisors LP now owns 2,501,581 shares of the technology company's stock valued at $111,145,000 after buying an additional 113,573 shares in the last quarter. William Blair Investment Management LLC raised its position in shares of Varonis Systems by 2.4% during the 4th quarter. William Blair Investment Management LLC now owns 2,290,114 shares of the technology company's stock valued at $101,750,000 after buying an additional 52,971 shares in the last quarter. Pictet Asset Management Holding SA grew its holdings in Varonis Systems by 1.3% during the 4th quarter. Pictet Asset Management Holding SA now owns 2,287,544 shares of the technology company's stock valued at $101,636,000 after purchasing an additional 29,852 shares during the last quarter. Finally, Hood River Capital Management LLC grew its holdings in Varonis Systems by 12.3% during the 4th quarter. Hood River Capital Management LLC now owns 2,116,882 shares of the technology company's stock valued at $94,053,000 after purchasing an additional 231,998 shares during the last quarter. 95.65% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Varonis Systems

In other news, Director Den Bosch Fred Van sold 6,000 shares of the company's stock in a transaction that occurred on Wednesday, June 4th. The shares were sold at an average price of $50.00, for a total value of $300,000.00. Following the completion of the sale, the director now owns 131,666 shares of the company's stock, valued at approximately $6,583,300. This represents a 4.36% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 2.30% of the company's stock.

Analyst Ratings Changes

VRNS has been the topic of several analyst reports. Barclays cut their price target on shares of Varonis Systems from $60.00 to $52.00 and set an "overweight" rating on the stock in a report on Monday, April 14th. Royal Bank Of Canada upped their price target on shares of Varonis Systems from $55.00 to $58.00 and gave the company an "outperform" rating in a report on Wednesday, May 7th. Wall Street Zen upgraded shares of Varonis Systems from a "sell" rating to a "hold" rating in a report on Monday, April 28th. Jefferies Financial Group cut their price target on shares of Varonis Systems from $50.00 to $45.00 and set a "hold" rating on the stock in a report on Monday, March 31st. Finally, Cantor Fitzgerald reiterated an "overweight" rating and set a $60.00 price target on shares of Varonis Systems in a report on Tuesday, June 10th. Six analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, Varonis Systems presently has an average rating of "Moderate Buy" and a consensus target price of $55.06.

Check Out Our Latest Stock Analysis on Varonis Systems

Varonis Systems Trading Down 1.5%

VRNS stock traded down $0.73 during mid-day trading on Friday, reaching $48.98. The company had a trading volume of 1,958,990 shares, compared to its average volume of 1,521,679. The company has a debt-to-equity ratio of 1.23, a current ratio of 1.15 and a quick ratio of 1.15. The company has a market capitalization of $5.48 billion, a PE ratio of -60.47 and a beta of 0.76. The firm has a 50 day moving average of $45.87 and a 200 day moving average of $44.29. Varonis Systems, Inc. has a 12 month low of $36.53 and a 12 month high of $60.58.

Varonis Systems (NASDAQ:VRNS - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The technology company reported ($0.31) earnings per share for the quarter, missing the consensus estimate of ($0.05) by ($0.26). Varonis Systems had a negative return on equity of 20.01% and a negative net margin of 15.88%. The business had revenue of $136.42 million during the quarter, compared to analysts' expectations of $133.10 million. During the same period in the previous year, the company posted ($0.03) EPS. Varonis Systems's revenue for the quarter was up 19.6% on a year-over-year basis. On average, equities analysts predict that Varonis Systems, Inc. will post -0.83 earnings per share for the current fiscal year.

Varonis Systems Profile

(

Free Report)

Varonis Systems, Inc provides software products and services that allow enterprises to manage, analyze, alert, and secure enterprise data in North America, Europe, the Middle East, Africa, and internationally. Its software enables enterprises to protect data stored on premises and in the cloud, including sensitive files and emails; confidential personal data belonging to customers, and patients and employees' data; financial records; source code, strategic and product plans; and other intellectual property.

Featured Stories

Before you consider Varonis Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Varonis Systems wasn't on the list.

While Varonis Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.