GAMMA Investing LLC raised its stake in shares of Equity LifeStyle Properties, Inc. (NYSE:ELS - Free Report) by 6,967.3% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 124,596 shares of the real estate investment trust's stock after buying an additional 122,833 shares during the quarter. GAMMA Investing LLC owned about 0.07% of Equity LifeStyle Properties worth $8,311,000 at the end of the most recent reporting period.

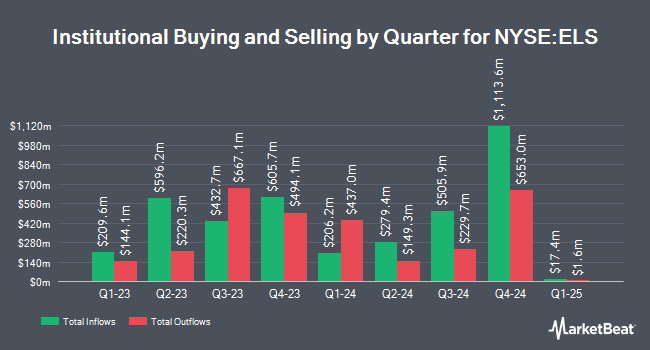

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in ELS. Wellington Management Group LLP lifted its position in Equity LifeStyle Properties by 5.9% during the fourth quarter. Wellington Management Group LLP now owns 12,054 shares of the real estate investment trust's stock valued at $803,000 after buying an additional 673 shares in the last quarter. California State Teachers Retirement System grew its holdings in shares of Equity LifeStyle Properties by 15.7% during the fourth quarter. California State Teachers Retirement System now owns 272,969 shares of the real estate investment trust's stock valued at $18,180,000 after purchasing an additional 37,057 shares during the last quarter. Wealth Enhancement Advisory Services LLC grew its position in Equity LifeStyle Properties by 6.2% in the 4th quarter. Wealth Enhancement Advisory Services LLC now owns 13,874 shares of the real estate investment trust's stock worth $924,000 after purchasing an additional 816 shares during the last quarter. Lansforsakringar Fondforvaltning AB publ bought a new position in shares of Equity LifeStyle Properties in the fourth quarter worth $2,550,000. Finally, Cim LLC lifted its holdings in Equity LifeStyle Properties by 1.3% in the fourth quarter. Cim LLC now owns 42,053 shares of the real estate investment trust's stock worth $2,801,000 after purchasing an additional 546 shares during the period. 97.21% of the stock is currently owned by hedge funds and other institutional investors.

Equity LifeStyle Properties Stock Performance

Shares of NYSE ELS traded up $0.35 during midday trading on Thursday, hitting $62.98. 1,061,826 shares of the company's stock were exchanged, compared to its average volume of 1,329,091. The firm has a market capitalization of $12.04 billion, a PE ratio of 32.30, a price-to-earnings-growth ratio of 3.02 and a beta of 0.73. The company's 50 day moving average price is $63.80 and its 200 day moving average price is $66.10. Equity LifeStyle Properties, Inc. has a 12 month low of $58.86 and a 12 month high of $76.60. The company has a quick ratio of 0.03, a current ratio of 0.02 and a debt-to-equity ratio of 0.15.

Equity LifeStyle Properties (NYSE:ELS - Get Free Report) last issued its quarterly earnings data on Monday, April 21st. The real estate investment trust reported $0.83 earnings per share for the quarter, hitting the consensus estimate of $0.83. Equity LifeStyle Properties had a net margin of 24.05% and a return on equity of 23.12%. The business had revenue of $327.21 million during the quarter, compared to analysts' expectations of $391.34 million. During the same quarter in the previous year, the company earned $0.59 EPS. As a group, analysts predict that Equity LifeStyle Properties, Inc. will post 3.07 earnings per share for the current fiscal year.

Equity LifeStyle Properties Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, July 11th. Investors of record on Friday, June 27th will be issued a dividend of $0.515 per share. This represents a $2.06 annualized dividend and a dividend yield of 3.27%. The ex-dividend date is Friday, June 27th. Equity LifeStyle Properties's dividend payout ratio (DPR) is 106.74%.

Insider Activity at Equity LifeStyle Properties

In related news, CFO Paul Seavey sold 10,000 shares of the business's stock in a transaction on Wednesday, May 7th. The shares were sold at an average price of $64.72, for a total transaction of $647,200.00. Following the transaction, the chief financial officer now owns 78,162 shares in the company, valued at $5,058,644.64. The trade was a 11.34% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 1.40% of the stock is owned by company insiders.

Analyst Ratings Changes

A number of equities analysts recently weighed in on ELS shares. BMO Capital Markets decreased their price target on Equity LifeStyle Properties from $78.00 to $77.00 and set an "outperform" rating for the company in a research report on Tuesday, April 22nd. Jefferies Financial Group began coverage on Equity LifeStyle Properties in a research note on Tuesday, April 8th. They issued a "buy" rating and a $80.00 price target for the company. Truist Financial decreased their price target on Equity LifeStyle Properties from $72.00 to $71.00 and set a "buy" rating for the company in a research note on Thursday, May 1st. Finally, Barclays began coverage on shares of Equity LifeStyle Properties in a research note on Thursday, May 29th. They issued an "equal weight" rating and a $70.00 price objective for the company. Four equities research analysts have rated the stock with a hold rating, six have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $73.90.

Get Our Latest Research Report on ELS

About Equity LifeStyle Properties

(

Free Report)

Equity LifeStyle Properties, Inc is a real estate investment trust, which engages in the ownership and operation of lifestyle-oriented properties consisting primarily of manufactured home, and recreational vehicle communities. It operates through the following segments: Property Operations and Home Sales and Rentals Operations.

Featured Articles

Before you consider Equity Lifestyle Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity Lifestyle Properties wasn't on the list.

While Equity Lifestyle Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.