GDS Wealth Management boosted its stake in STERIS plc (NYSE:STE - Free Report) by 7.9% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 62,842 shares of the medical equipment provider's stock after purchasing an additional 4,599 shares during the period. GDS Wealth Management owned approximately 0.06% of STERIS worth $14,243,000 at the end of the most recent quarter.

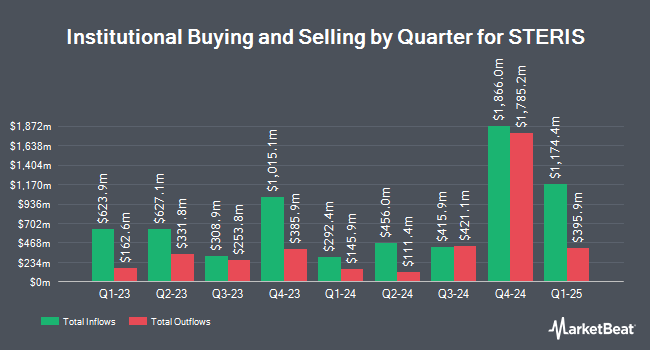

A number of other large investors have also added to or reduced their stakes in STE. Grove Bank & Trust grew its position in shares of STERIS by 4,733.3% during the 1st quarter. Grove Bank & Trust now owns 145 shares of the medical equipment provider's stock valued at $33,000 after acquiring an additional 142 shares during the period. Zions Bancorporation National Association UT bought a new stake in shares of STERIS during the 1st quarter valued at $37,000. ORG Wealth Partners LLC bought a new stake in shares of STERIS during the 1st quarter valued at $43,000. Golden State Wealth Management LLC grew its position in shares of STERIS by 503.0% during the 1st quarter. Golden State Wealth Management LLC now owns 199 shares of the medical equipment provider's stock valued at $45,000 after acquiring an additional 166 shares during the period. Finally, Costello Asset Management INC bought a new stake in shares of STERIS during the 1st quarter valued at $45,000. Institutional investors own 94.69% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently issued reports on the stock. Morgan Stanley boosted their price objective on shares of STERIS from $276.00 to $295.00 and gave the company an "overweight" rating in a research report on Friday, August 8th. JMP Securities boosted their price objective on shares of STERIS from $265.00 to $280.00 and gave the company a "market outperform" rating in a research report on Friday, May 16th. Citigroup reissued an "outperform" rating on shares of STERIS in a research report on Friday, May 16th. Stephens reissued an "overweight" rating and set a $250.00 price objective on shares of STERIS in a research report on Thursday, May 15th. Finally, KeyCorp lifted their target price on shares of STERIS from $277.00 to $288.00 and gave the company an "overweight" rating in a research note on Tuesday, July 22nd. Six analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $273.50.

Get Our Latest Analysis on STE

Insiders Place Their Bets

In other STERIS news, CEO Daniel A. Carestio sold 17,626 shares of the business's stock in a transaction on Thursday, June 5th. The shares were sold at an average price of $242.56, for a total value of $4,275,362.56. Following the sale, the chief executive officer owned 51,385 shares in the company, valued at $12,463,945.60. The trade was a 25.54% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, VP Renato Tamaro sold 3,204 shares of the business's stock in a transaction on Wednesday, August 20th. The stock was sold at an average price of $249.24, for a total transaction of $798,564.96. Following the completion of the sale, the vice president owned 7,221 shares in the company, valued at approximately $1,799,762.04. The trade was a 30.73% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 36,335 shares of company stock worth $8,822,302. 1.07% of the stock is owned by corporate insiders.

STERIS Price Performance

Shares of STE traded up $4.2320 during trading hours on Friday, reaching $251.7320. 375,557 shares of the stock traded hands, compared to its average volume of 556,042. The company has a current ratio of 2.22, a quick ratio of 1.53 and a debt-to-equity ratio of 0.27. STERIS plc has a 52-week low of $200.98 and a 52-week high of $252.79. The company's 50-day moving average price is $234.96 and its two-hundred day moving average price is $230.51. The company has a market cap of $24.79 billion, a P/E ratio of 38.55 and a beta of 0.92.

STERIS (NYSE:STE - Get Free Report) last released its earnings results on Wednesday, August 6th. The medical equipment provider reported $2.34 earnings per share for the quarter, beating analysts' consensus estimates of $2.32 by $0.02. The company had revenue of $1.40 billion for the quarter, compared to analysts' expectations of $1.36 billion. STERIS had a net margin of 11.61% and a return on equity of 14.17%. STERIS's revenue for the quarter was up 8.8% on a year-over-year basis. During the same quarter in the previous year, the company earned $2.03 EPS. On average, analysts anticipate that STERIS plc will post 9.08 earnings per share for the current year.

STERIS Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, September 26th. Shareholders of record on Thursday, September 4th will be paid a $0.63 dividend. This represents a $2.52 annualized dividend and a yield of 1.0%. The ex-dividend date is Thursday, September 4th. This is an increase from STERIS's previous quarterly dividend of $0.57. STERIS's dividend payout ratio is presently 34.92%.

STERIS Company Profile

(

Free Report)

STERIS plc provides infection prevention products and services worldwide. It operates through four segments: Healthcare, Applied Sterilization Technologies, Life Sciences, and Dental. The Healthcare segment offers cleaning chemistries and sterility assurance products; automated endoscope reprocessing system and tracking products; endoscopy accessories, washers, sterilizers, and other pieces of capital equipment for the operation of a sterile processing department; and equipment used directly in the operating room, including surgical tables, lights, and connectivity solutions, as well as equipment management services.

Read More

Before you consider STERIS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STERIS wasn't on the list.

While STERIS currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.