Generali Investments CEE investicni spolecnost a.s. lifted its stake in shares of Gen Digital Inc. (NASDAQ:GEN - Free Report) by 15.5% during the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 170,049 shares of the company's stock after purchasing an additional 22,884 shares during the period. Generali Investments CEE investicni spolecnost a.s.'s holdings in Gen Digital were worth $4,999,000 as of its most recent SEC filing.

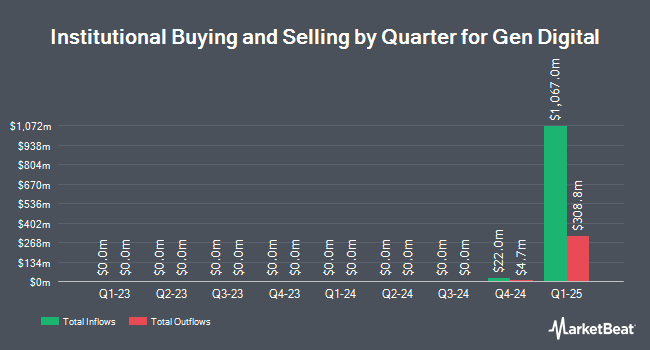

Several other institutional investors and hedge funds have also made changes to their positions in GEN. Wellington Management Group LLP boosted its holdings in shares of Gen Digital by 98.8% during the 4th quarter. Wellington Management Group LLP now owns 114,699 shares of the company's stock worth $3,140,000 after purchasing an additional 56,993 shares during the last quarter. GAMMA Investing LLC boosted its holdings in shares of Gen Digital by 2,954.9% during the 1st quarter. GAMMA Investing LLC now owns 322,169 shares of the company's stock worth $8,550,000 after purchasing an additional 311,623 shares during the last quarter. Rhumbline Advisers boosted its holdings in shares of Gen Digital by 6.6% during the 1st quarter. Rhumbline Advisers now owns 1,116,301 shares of the company's stock worth $29,627,000 after purchasing an additional 69,558 shares during the last quarter. Czech National Bank boosted its holdings in shares of Gen Digital by 5.9% during the 1st quarter. Czech National Bank now owns 124,568 shares of the company's stock worth $3,306,000 after purchasing an additional 6,995 shares during the last quarter. Finally, Merit Financial Group LLC acquired a new position in shares of Gen Digital during the 1st quarter worth approximately $273,000. 81.38% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research analysts have recently weighed in on the company. B. Riley initiated coverage on Gen Digital in a report on Monday, July 14th. They set a "buy" rating and a $46.00 target price on the stock. Evercore ISI initiated coverage on Gen Digital in a report on Tuesday, July 1st. They issued an "outperform" rating and a $35.00 price objective on the stock. Royal Bank Of Canada upped their price objective on Gen Digital from $32.00 to $33.00 and gave the company a "sector perform" rating in a report on Friday, August 8th. Barclays upped their price objective on Gen Digital from $32.00 to $33.00 and gave the company an "equal weight" rating in a report on Friday, August 8th. Finally, Morgan Stanley upped their price objective on Gen Digital from $25.00 to $32.00 and gave the company an "equal weight" rating in a report on Tuesday, September 2nd. One investment analyst has rated the stock with a Strong Buy rating, three have given a Buy rating and three have given a Hold rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $36.50.

Read Our Latest Report on Gen Digital

Gen Digital Stock Down 1.4%

Shares of NASDAQ GEN opened at $28.39 on Wednesday. The firm has a market cap of $17.48 billion, a price-to-earnings ratio of 29.27, a PEG ratio of 0.97 and a beta of 0.99. The company has a quick ratio of 0.50, a current ratio of 0.50 and a debt-to-equity ratio of 3.63. Gen Digital Inc. has a 52-week low of $22.74 and a 52-week high of $32.22. The business's 50 day moving average is $29.89 and its two-hundred day moving average is $28.48.

Gen Digital (NASDAQ:GEN - Get Free Report) last announced its earnings results on Thursday, August 7th. The company reported $0.64 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.60 by $0.04. The company had revenue of $1.26 billion for the quarter, compared to analyst estimates of $1.19 billion. Gen Digital had a return on equity of 57.99% and a net margin of 14.12%.The firm's quarterly revenue was up 30.3% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.53 earnings per share. Gen Digital has set its Q2 2026 guidance at 0.600-0.620 EPS. FY 2026 guidance at 2.490-2.560 EPS. Research analysts predict that Gen Digital Inc. will post 2.05 EPS for the current year.

Gen Digital Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, September 10th. Shareholders of record on Monday, August 18th were given a $0.125 dividend. The ex-dividend date of this dividend was Monday, August 18th. This represents a $0.50 dividend on an annualized basis and a yield of 1.8%. Gen Digital's payout ratio is presently 51.55%.

Gen Digital Profile

(

Free Report)

Gen Digital Inc engages in the provision of cyber safety solutions for consumers in the United States, Canada, Latin America, Europe, the Middle East, Africa, the Asia Pacific, and Japan. The company offers security and performance products under Norton, Avast, Avira, AVG, and CCleaner brands that provide real-time protection and maintenance for PCs, Macs, and mobile devices against malware, viruses, adware, and other online threats.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gen Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gen Digital wasn't on the list.

While Gen Digital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.