Janney Montgomery Scott LLC raised its position in shares of Gen Digital Inc. (NASDAQ:GEN - Free Report) by 3,511.0% during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 391,176 shares of the company's stock after buying an additional 380,343 shares during the quarter. Janney Montgomery Scott LLC owned about 0.06% of Gen Digital worth $11,501,000 at the end of the most recent quarter.

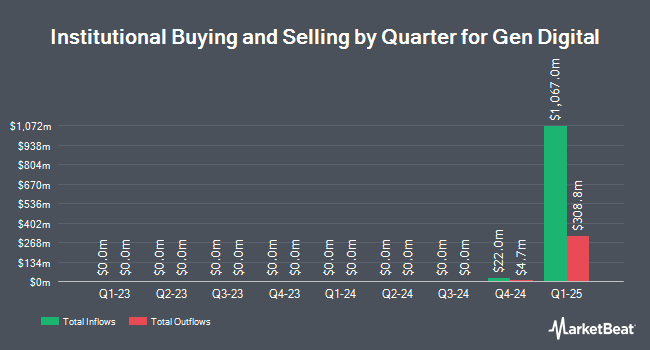

Several other institutional investors and hedge funds have also recently bought and sold shares of the company. Rise Advisors LLC grew its holdings in shares of Gen Digital by 19.2% during the first quarter. Rise Advisors LLC now owns 2,361 shares of the company's stock valued at $63,000 after purchasing an additional 381 shares during the last quarter. Nissay Asset Management Corp Japan ADV grew its holdings in shares of Gen Digital by 0.6% during the first quarter. Nissay Asset Management Corp Japan ADV now owns 69,927 shares of the company's stock valued at $1,856,000 after purchasing an additional 427 shares during the last quarter. Alps Advisors Inc. grew its holdings in shares of Gen Digital by 1.5% during the first quarter. Alps Advisors Inc. now owns 31,540 shares of the company's stock valued at $837,000 after purchasing an additional 465 shares during the last quarter. Sumitomo Mitsui DS Asset Management Company Ltd grew its holdings in shares of Gen Digital by 0.7% during the second quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 78,602 shares of the company's stock valued at $2,311,000 after purchasing an additional 570 shares during the last quarter. Finally, Greenleaf Trust grew its holdings in shares of Gen Digital by 3.9% during the first quarter. Greenleaf Trust now owns 18,001 shares of the company's stock valued at $478,000 after purchasing an additional 668 shares during the last quarter. Institutional investors and hedge funds own 81.38% of the company's stock.

Gen Digital Stock Performance

Shares of GEN stock opened at $27.82 on Friday. The business has a 50 day simple moving average of $29.74 and a 200 day simple moving average of $28.48. The company has a debt-to-equity ratio of 3.63, a current ratio of 0.50 and a quick ratio of 0.50. The firm has a market capitalization of $17.13 billion, a price-to-earnings ratio of 28.68, a price-to-earnings-growth ratio of 0.95 and a beta of 0.94. Gen Digital Inc. has a 12-month low of $22.74 and a 12-month high of $32.22.

Gen Digital (NASDAQ:GEN - Get Free Report) last issued its quarterly earnings results on Thursday, August 7th. The company reported $0.64 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.60 by $0.04. The firm had revenue of $1.26 billion during the quarter, compared to analyst estimates of $1.19 billion. Gen Digital had a return on equity of 57.99% and a net margin of 14.12%.The firm's quarterly revenue was up 30.3% on a year-over-year basis. During the same period last year, the company posted $0.53 EPS. Gen Digital has set its Q2 2026 guidance at 0.600-0.620 EPS. FY 2026 guidance at 2.490-2.560 EPS. On average, equities research analysts anticipate that Gen Digital Inc. will post 2.05 EPS for the current year.

Gen Digital Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, September 10th. Shareholders of record on Monday, August 18th were paid a dividend of $0.125 per share. This represents a $0.50 dividend on an annualized basis and a yield of 1.8%. The ex-dividend date of this dividend was Monday, August 18th. Gen Digital's dividend payout ratio (DPR) is presently 51.55%.

Analysts Set New Price Targets

Several research firms have recently commented on GEN. Royal Bank Of Canada upped their target price on Gen Digital from $32.00 to $33.00 and gave the company a "sector perform" rating in a report on Friday, August 8th. Barclays upped their target price on Gen Digital from $32.00 to $33.00 and gave the company an "equal weight" rating in a report on Friday, August 8th. Evercore ISI began coverage on Gen Digital in a report on Tuesday, July 1st. They set an "outperform" rating and a $35.00 target price for the company. Weiss Ratings reaffirmed a "hold (c+)" rating on shares of Gen Digital in a report on Saturday, September 27th. Finally, B. Riley began coverage on Gen Digital in a report on Monday, July 14th. They issued a "buy" rating and a $46.00 price objective for the company. One investment analyst has rated the stock with a Strong Buy rating, three have given a Buy rating and five have issued a Hold rating to the company. According to data from MarketBeat, Gen Digital presently has a consensus rating of "Moderate Buy" and an average target price of $35.71.

Check Out Our Latest Report on Gen Digital

About Gen Digital

(

Free Report)

Gen Digital Inc engages in the provision of cyber safety solutions for consumers in the United States, Canada, Latin America, Europe, the Middle East, Africa, the Asia Pacific, and Japan. The company offers security and performance products under Norton, Avast, Avira, AVG, and CCleaner brands that provide real-time protection and maintenance for PCs, Macs, and mobile devices against malware, viruses, adware, and other online threats.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gen Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gen Digital wasn't on the list.

While Gen Digital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.