Geneos Wealth Management Inc. raised its position in Old Republic International Corporation (NYSE:ORI - Free Report) by 518.0% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 14,196 shares of the insurance provider's stock after buying an additional 11,899 shares during the quarter. Geneos Wealth Management Inc.'s holdings in Old Republic International were worth $557,000 at the end of the most recent reporting period.

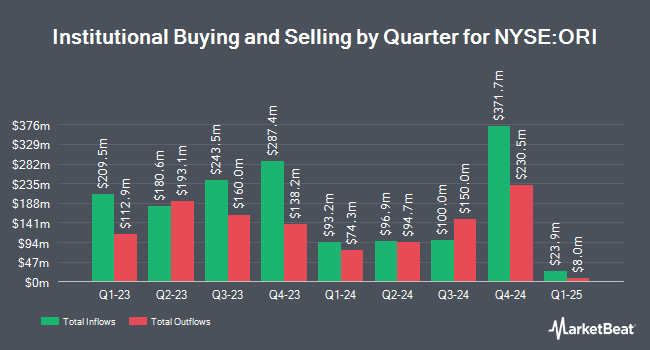

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Integrity Alliance LLC. acquired a new position in Old Republic International in the 1st quarter valued at $536,000. Bayforest Capital Ltd grew its holdings in Old Republic International by 740.5% in the 1st quarter. Bayforest Capital Ltd now owns 2,925 shares of the insurance provider's stock valued at $115,000 after buying an additional 2,577 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its position in shares of Old Republic International by 7.6% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,533,958 shares of the insurance provider's stock valued at $60,162,000 after acquiring an additional 108,711 shares during the period. Sciencast Management LP bought a new stake in shares of Old Republic International during the 1st quarter valued at $2,647,000. Finally, Goldman Sachs Group Inc. lifted its position in shares of Old Republic International by 10.3% during the 1st quarter. Goldman Sachs Group Inc. now owns 1,593,065 shares of the insurance provider's stock valued at $62,480,000 after acquiring an additional 148,891 shares during the period. 70.92% of the stock is owned by institutional investors and hedge funds.

Old Republic International Price Performance

Shares of ORI stock traded up $0.10 on Thursday, hitting $39.76. 1,089,500 shares of the company's stock were exchanged, compared to its average volume of 1,060,375. The company has a debt-to-equity ratio of 0.26, a current ratio of 0.25 and a quick ratio of 0.25. Old Republic International Corporation has a 12 month low of $33.00 and a 12 month high of $41.15. The stock has a market cap of $9.88 billion, a P/E ratio of 13.62 and a beta of 0.78. The company has a 50 day moving average of $38.30 and a 200 day moving average of $37.86.

Old Republic International (NYSE:ORI - Get Free Report) last announced its quarterly earnings data on Thursday, July 24th. The insurance provider reported $0.83 earnings per share for the quarter, topping the consensus estimate of $0.79 by $0.04. Old Republic International had a return on equity of 20.95% and a net margin of 10.31%.The business had revenue of $2.21 billion during the quarter, compared to the consensus estimate of $2.18 billion. The firm's quarterly revenue was up 10.1% on a year-over-year basis. On average, equities research analysts predict that Old Republic International Corporation will post 3.17 EPS for the current year.

Old Republic International Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 15th. Investors of record on Friday, September 5th were given a dividend of $0.29 per share. This represents a $1.16 annualized dividend and a dividend yield of 2.9%. The ex-dividend date was Friday, September 5th. Old Republic International's dividend payout ratio is currently 39.73%.

Analyst Ratings Changes

A number of analysts have recently weighed in on ORI shares. Wall Street Zen downgraded Old Republic International from a "buy" rating to a "hold" rating in a research report on Saturday, July 12th. Piper Sandler upped their target price on Old Republic International from $41.00 to $45.00 and gave the company an "overweight" rating in a research report on Tuesday, September 2nd. Two investment analysts have rated the stock with a Buy rating, According to data from MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus target price of $43.50.

Read Our Latest Report on ORI

Insider Buying and Selling

In related news, EVP Stephen J. Oberst sold 4,797 shares of the company's stock in a transaction on Thursday, August 21st. The stock was sold at an average price of $39.29, for a total transaction of $188,474.13. Following the completion of the sale, the executive vice president directly owned 54,661 shares in the company, valued at $2,147,630.69. This represents a 8.07% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, Director Therace Risch acquired 1,500 shares of the company's stock in a transaction that occurred on Tuesday, September 2nd. The shares were acquired at an average price of $39.90 per share, with a total value of $59,850.00. Following the completion of the transaction, the director owned 9,625 shares in the company, valued at $384,037.50. The trade was a 18.46% increase in their ownership of the stock. The disclosure for this purchase can be found here. 1.10% of the stock is owned by corporate insiders.

Old Republic International Company Profile

(

Free Report)

Old Republic International Corporation, through its subsidiaries, engages in the insurance underwriting and related services business primarily in the United States and Canada. It operates through three segments: General Insurance, Title Insurance, and Republic Financial Indemnity Group Run-off Business.

Featured Stories

Before you consider Old Republic International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old Republic International wasn't on the list.

While Old Republic International currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.