Pallas Capital Advisors LLC cut its position in shares of GitLab Inc. (NASDAQ:GTLB - Free Report) by 43.2% in the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 10,407 shares of the company's stock after selling 7,921 shares during the quarter. Pallas Capital Advisors LLC's holdings in GitLab were worth $469,000 at the end of the most recent quarter.

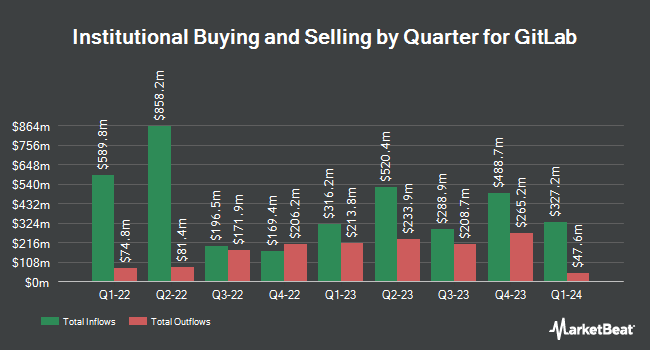

Several other institutional investors and hedge funds also recently added to or reduced their stakes in GTLB. MetLife Investment Management LLC boosted its position in shares of GitLab by 3.2% in the first quarter. MetLife Investment Management LLC now owns 7,762 shares of the company's stock worth $365,000 after buying an additional 242 shares during the period. Cullen Frost Bankers Inc. boosted its holdings in GitLab by 174.9% in the first quarter. Cullen Frost Bankers Inc. now owns 525 shares of the company's stock valued at $25,000 after purchasing an additional 334 shares during the last quarter. Park Avenue Securities LLC boosted its holdings in GitLab by 5.3% in the first quarter. Park Avenue Securities LLC now owns 7,601 shares of the company's stock valued at $357,000 after purchasing an additional 381 shares during the last quarter. GAMMA Investing LLC boosted its holdings in GitLab by 114.2% in the first quarter. GAMMA Investing LLC now owns 919 shares of the company's stock valued at $43,000 after purchasing an additional 490 shares during the last quarter. Finally, Amalgamated Bank boosted its holdings in GitLab by 7.2% in the first quarter. Amalgamated Bank now owns 8,537 shares of the company's stock valued at $401,000 after purchasing an additional 571 shares during the last quarter. 95.04% of the stock is currently owned by institutional investors and hedge funds.

GitLab Stock Performance

Shares of GitLab stock traded up $0.55 on Tuesday, reaching $50.03. 1,150,104 shares of the company were exchanged, compared to its average volume of 3,827,286. The company's 50-day moving average is $45.74 and its two-hundred day moving average is $46.23. The firm has a market cap of $8.34 billion, a price-to-earnings ratio of -1,247.93 and a beta of 0.74. GitLab Inc. has a 1-year low of $37.90 and a 1-year high of $74.18.

Insider Transactions at GitLab

In other news, Director Karen Blasing sold 3,250 shares of the stock in a transaction that occurred on Monday, September 15th. The stock was sold at an average price of $50.08, for a total transaction of $162,760.00. Following the sale, the director directly owned 100,639 shares in the company, valued at approximately $5,040,001.12. This represents a 3.13% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Sytse Sijbrandij sold 108,600 shares of the stock in a transaction that occurred on Monday, September 15th. The stock was sold at an average price of $50.14, for a total value of $5,445,204.00. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 1,054,852 shares of company stock worth $50,219,603. 21.36% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

A number of brokerages recently commented on GTLB. Guggenheim began coverage on GitLab in a report on Thursday, September 11th. They issued a "buy" rating and a $70.00 price target for the company. KeyCorp reduced their price target on GitLab from $60.00 to $53.00 and set an "overweight" rating for the company in a report on Thursday, September 4th. BTIG Research reduced their target price on GitLab from $67.00 to $57.00 and set a "buy" rating on the stock in a report on Thursday, September 4th. Truist Financial reduced their target price on GitLab from $75.00 to $55.00 and set a "buy" rating on the stock in a report on Thursday, September 4th. Finally, FBN Securities raised GitLab to a "strong-buy" rating in a report on Thursday, September 4th. One investment analyst has rated the stock with a Strong Buy rating, twenty have assigned a Buy rating and six have issued a Hold rating to the stock. According to data from MarketBeat, GitLab currently has an average rating of "Moderate Buy" and a consensus price target of $58.88.

Read Our Latest Report on GTLB

GitLab Company Profile

(

Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

Featured Stories

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.