GKV Capital Management Co. Inc. reduced its position in Alphabet Inc. (NASDAQ:GOOGL - Free Report) by 10.9% during the first quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 25,680 shares of the information services provider's stock after selling 3,130 shares during the period. Alphabet accounts for about 1.3% of GKV Capital Management Co. Inc.'s portfolio, making the stock its 22nd largest position. GKV Capital Management Co. Inc.'s holdings in Alphabet were worth $3,971,000 at the end of the most recent reporting period.

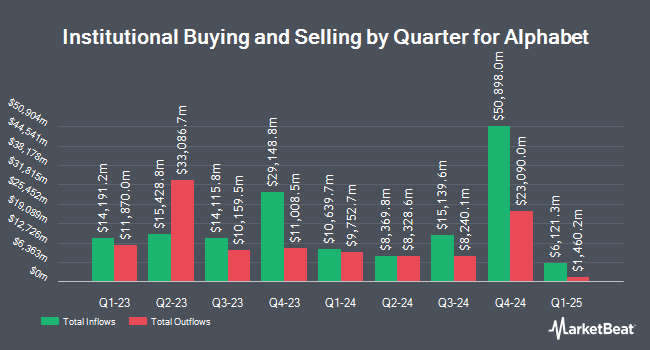

A number of other institutional investors have also modified their holdings of GOOGL. Nuveen LLC bought a new stake in shares of Alphabet in the 1st quarter valued at about $4,317,606,000. GAMMA Investing LLC boosted its stake in Alphabet by 16,993.2% in the 1st quarter. GAMMA Investing LLC now owns 16,062,457 shares of the information services provider's stock worth $2,483,898,000 after purchasing an additional 15,968,487 shares in the last quarter. Vanguard Group Inc. boosted its stake in Alphabet by 2.9% in the 1st quarter. Vanguard Group Inc. now owns 509,826,331 shares of the information services provider's stock worth $78,839,544,000 after purchasing an additional 14,307,345 shares in the last quarter. Assenagon Asset Management S.A. boosted its stake in Alphabet by 307.6% in the 1st quarter. Assenagon Asset Management S.A. now owns 10,302,644 shares of the information services provider's stock worth $1,593,201,000 after purchasing an additional 7,774,811 shares in the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in Alphabet in the 4th quarter worth approximately $1,375,509,000. 40.03% of the stock is currently owned by institutional investors.

Insider Activity at Alphabet

In related news, Director Kavitark Ram Shriram sold 15,000 shares of Alphabet stock in a transaction on Friday, July 18th. The shares were sold at an average price of $185.76, for a total value of $2,786,400.00. Following the sale, the director owned 240,400 shares of the company's stock, valued at approximately $44,656,704. This trade represents a 5.87% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider John Kent Walker sold 23,820 shares of Alphabet stock in a transaction on Monday, August 4th. The shares were sold at an average price of $194.70, for a total transaction of $4,637,754.00. Following the completion of the sale, the insider directly owned 42,999 shares in the company, valued at $8,371,905.30. This represents a 35.65% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 254,710 shares of company stock worth $47,225,230 over the last 90 days. 11.55% of the stock is owned by insiders.

Analyst Ratings Changes

GOOGL has been the subject of a number of recent analyst reports. Citizens Jmp upgraded shares of Alphabet from a "market perform" rating to an "outperform" rating and set a $220.00 target price for the company in a research note on Friday, June 27th. BNP Paribas Exane reissued a "neutral" rating and set a $172.00 price target on shares of Alphabet in a research report on Friday, June 27th. Morgan Stanley raised their price target on shares of Alphabet from $185.00 to $205.00 and gave the stock an "overweight" rating in a research report on Monday, July 21st. JMP Securities raised their price target on shares of Alphabet from $220.00 to $225.00 and gave the stock a "market outperform" rating in a research report on Thursday, July 24th. Finally, Needham & Company LLC reissued a "buy" rating and set a $220.00 price target on shares of Alphabet in a research report on Thursday, August 21st. Four analysts have rated the stock with a Strong Buy rating, twenty-nine have given a Buy rating and ten have given a Hold rating to the stock. According to MarketBeat, Alphabet presently has a consensus rating of "Moderate Buy" and an average target price of $211.79.

Check Out Our Latest Stock Report on GOOGL

Alphabet Stock Performance

Shares of NASDAQ:GOOGL traded down $2.28 during trading on Tuesday, hitting $210.63. 27,337,684 shares of the stock traded hands, compared to its average volume of 36,138,063. The company has a quick ratio of 1.90, a current ratio of 1.90 and a debt-to-equity ratio of 0.07. The company has a market cap of $2.55 trillion, a price-to-earnings ratio of 22.43, a P/E/G ratio of 1.43 and a beta of 1.01. The company has a fifty day moving average price of $191.39 and a two-hundred day moving average price of $174.16. Alphabet Inc. has a 52-week low of $140.53 and a 52-week high of $214.65.

Alphabet (NASDAQ:GOOGL - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The information services provider reported $2.31 earnings per share for the quarter, beating the consensus estimate of $2.15 by $0.16. The firm had revenue of $96.43 billion during the quarter, compared to analyst estimates of $93.60 billion. Alphabet had a net margin of 31.12% and a return on equity of 34.31%. As a group, equities analysts predict that Alphabet Inc. will post 8.9 EPS for the current year.

Alphabet Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, September 15th. Investors of record on Monday, September 8th will be paid a $0.21 dividend. The ex-dividend date of this dividend is Monday, September 8th. This represents a $0.84 dividend on an annualized basis and a yield of 0.4%. Alphabet's dividend payout ratio (DPR) is currently 8.95%.

About Alphabet

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Read More

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report