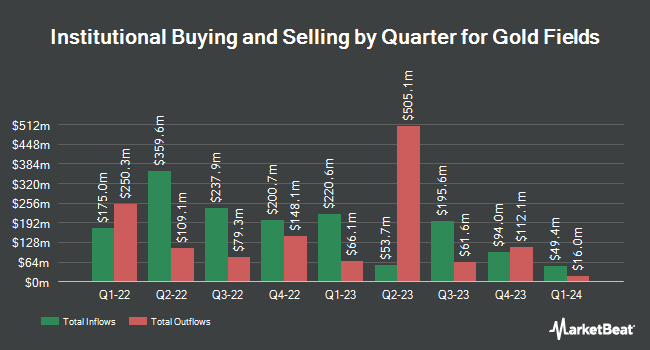

Assenagon Asset Management S.A. lessened its holdings in shares of Gold Fields Limited (NYSE:GFI - Free Report) by 50.5% during the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 65,291 shares of the company's stock after selling 66,639 shares during the quarter. Assenagon Asset Management S.A.'s holdings in Gold Fields were worth $1,545,000 at the end of the most recent quarter.

Other institutional investors have also made changes to their positions in the company. Richardson Financial Services Inc. bought a new stake in shares of Gold Fields during the first quarter valued at approximately $26,000. Banque Cantonale Vaudoise bought a new stake in shares of Gold Fields during the first quarter valued at approximately $44,000. SVB Wealth LLC bought a new stake in shares of Gold Fields during the first quarter valued at approximately $48,000. NewEdge Advisors LLC increased its position in shares of Gold Fields by 2,152.0% during the first quarter. NewEdge Advisors LLC now owns 2,252 shares of the company's stock valued at $50,000 after purchasing an additional 2,152 shares during the period. Finally, GAMMA Investing LLC increased its position in shares of Gold Fields by 21.0% during the first quarter. GAMMA Investing LLC now owns 3,742 shares of the company's stock valued at $83,000 after purchasing an additional 649 shares during the period. 24.81% of the stock is currently owned by institutional investors and hedge funds.

Gold Fields Trading Up 3.7%

NYSE:GFI opened at $40.79 on Friday. Gold Fields Limited has a 1-year low of $12.98 and a 1-year high of $42.74. The business's 50-day moving average price is $32.47 and its two-hundred day moving average price is $26.16. The company has a current ratio of 1.89, a quick ratio of 0.73 and a debt-to-equity ratio of 0.40. The firm has a market capitalization of $36.51 billion, a price-to-earnings ratio of 17.36, a PEG ratio of 0.40 and a beta of 0.47.

Gold Fields Increases Dividend

The firm also recently declared a semi-annual dividend, which was paid on Thursday, September 25th. Shareholders of record on Friday, September 12th were issued a $0.3993 dividend. This represents a dividend yield of 130.0%. This is an increase from Gold Fields's previous semi-annual dividend of $0.38. The ex-dividend date was Friday, September 12th. Gold Fields's dividend payout ratio is currently 27.23%.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on the company. Canaccord Genuity Group assumed coverage on Gold Fields in a research report on Monday, July 28th. They issued a "buy" rating and a $33.00 price target on the stock. Capital One Financial set a $32.00 price target on Gold Fields in a research report on Friday, August 22nd. Wall Street Zen upgraded Gold Fields from a "buy" rating to a "strong-buy" rating in a research report on Friday. Finally, BMO Capital Markets upped their price target on Gold Fields from $24.00 to $32.00 and gave the company a "market perform" rating in a research report on Monday, August 25th. Two investment analysts have rated the stock with a Buy rating and five have issued a Hold rating to the stock. According to MarketBeat.com, Gold Fields currently has an average rating of "Hold" and an average price target of $26.63.

Check Out Our Latest Stock Analysis on Gold Fields

Gold Fields Profile

(

Free Report)

Gold Fields Limited operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. It also explores for copper and silver deposits. The company was founded in 1887 and is based in Sandton, South Africa.

Recommended Stories

Want to see what other hedge funds are holding GFI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Gold Fields Limited (NYSE:GFI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gold Fields, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Fields wasn't on the list.

While Gold Fields currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.