Goldman Sachs Group Inc. reduced its holdings in Gladstone Commercial Corporation (NASDAQ:GOOD - Free Report) by 33.8% in the 1st quarter, according to the company in its most recent filing with the SEC. The firm owned 300,942 shares of the real estate investment trust's stock after selling 153,564 shares during the quarter. Goldman Sachs Group Inc. owned approximately 0.65% of Gladstone Commercial worth $4,508,000 as of its most recent SEC filing.

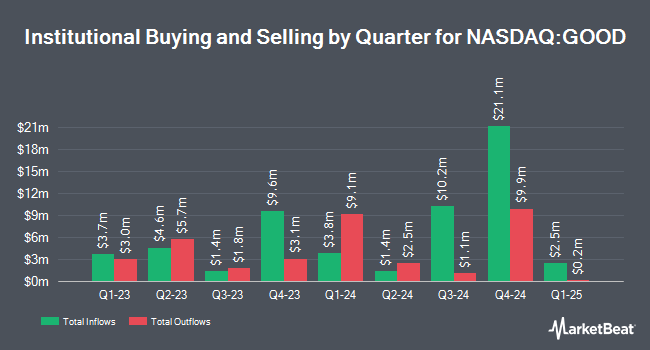

Other institutional investors also recently modified their holdings of the company. Millennium Management LLC boosted its stake in shares of Gladstone Commercial by 103.1% in the 4th quarter. Millennium Management LLC now owns 40,937 shares of the real estate investment trust's stock valued at $665,000 after purchasing an additional 20,776 shares during the last quarter. SG Americas Securities LLC boosted its stake in shares of Gladstone Commercial by 384.0% in the 1st quarter. SG Americas Securities LLC now owns 83,441 shares of the real estate investment trust's stock valued at $1,250,000 after purchasing an additional 66,201 shares during the last quarter. GSA Capital Partners LLP bought a new stake in shares of Gladstone Commercial in the 1st quarter valued at $547,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its stake in shares of Gladstone Commercial by 36.0% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 62,097 shares of the real estate investment trust's stock valued at $1,008,000 after purchasing an additional 16,422 shares during the last quarter. Finally, Squarepoint Ops LLC bought a new stake in shares of Gladstone Commercial in the 4th quarter valued at $205,000. 45.51% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Wall Street Zen lowered shares of Gladstone Commercial from a "hold" rating to a "sell" rating in a research note on Saturday, August 9th. One investment analyst has rated the stock with a Strong Buy rating and one has issued a Hold rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus target price of $15.00.

Get Our Latest Report on Gladstone Commercial

Gladstone Commercial Stock Down 1.2%

NASDAQ GOOD traded down $0.15 on Friday, hitting $12.88. 739,283 shares of the company were exchanged, compared to its average volume of 437,755. The company has a market cap of $599.69 million, a PE ratio of 35.78, a PEG ratio of 1.44 and a beta of 1.16. Gladstone Commercial Corporation has a 12 month low of $12.67 and a 12 month high of $17.88. The stock has a fifty day moving average of $13.28 and a 200-day moving average of $13.97. The company has a current ratio of 2.91, a quick ratio of 2.91 and a debt-to-equity ratio of 4.50.

Gladstone Commercial (NASDAQ:GOOD - Get Free Report) last issued its earnings results on Wednesday, August 6th. The real estate investment trust reported $0.35 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.35. The business had revenue of $39.53 million for the quarter, compared to analyst estimates of $38.32 million. Gladstone Commercial had a net margin of 18.67% and a return on equity of 16.37%. As a group, analysts forecast that Gladstone Commercial Corporation will post 1.45 earnings per share for the current year.

Gladstone Commercial Dividend Announcement

The firm also recently disclosed a monthly dividend, which was paid on Thursday, July 31st. Shareholders of record on Monday, July 21st were paid a $0.10 dividend. This represents a c) dividend on an annualized basis and a dividend yield of 9.3%. The ex-dividend date of this dividend was Monday, July 21st. Gladstone Commercial's dividend payout ratio (DPR) is 333.33%.

About Gladstone Commercial

(

Free Report)

Gladstone Commercial Corporation is a real estate investment trust focused on acquiring, owning, and operating net leased industrial and office properties across the United States. Including payments through January 2024, Gladstone Commercial has paid 229 consecutive monthly cash distributions on its common stock.

Further Reading

Before you consider Gladstone Commercial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gladstone Commercial wasn't on the list.

While Gladstone Commercial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.