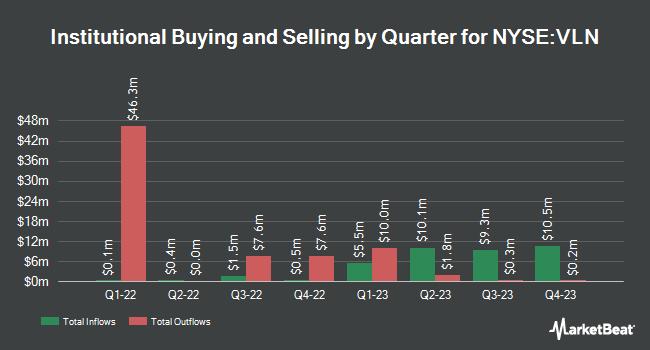

Goldman Sachs Group Inc. lessened its holdings in Valens Semiconductor, Ltd. (NYSE:VLN - Free Report) by 86.1% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 43,208 shares of the company's stock after selling 267,848 shares during the period. Goldman Sachs Group Inc.'s holdings in Valens Semiconductor were worth $88,000 as of its most recent SEC filing.

A number of other hedge funds have also made changes to their positions in VLN. Jane Street Group LLC purchased a new position in shares of Valens Semiconductor in the 4th quarter valued at $52,000. St. Louis Trust Co purchased a new position in shares of Valens Semiconductor in the 1st quarter valued at $120,000. Northern Trust Corp raised its stake in shares of Valens Semiconductor by 106.3% in the 4th quarter. Northern Trust Corp now owns 59,100 shares of the company's stock valued at $154,000 after acquiring an additional 30,448 shares during the period. XTX Topco Ltd increased its stake in Valens Semiconductor by 100.8% during the 1st quarter. XTX Topco Ltd now owns 138,229 shares of the company's stock worth $282,000 after buying an additional 69,389 shares during the period. Finally, Bank of America Corp DE lifted its holdings in Valens Semiconductor by 1,266.5% in the 4th quarter. Bank of America Corp DE now owns 120,420 shares of the company's stock worth $313,000 after buying an additional 111,608 shares in the last quarter. Hedge funds and other institutional investors own 33.90% of the company's stock.

Valens Semiconductor Stock Down 1.9%

Shares of NYSE VLN opened at $1.80 on Wednesday. Valens Semiconductor, Ltd. has a fifty-two week low of $1.67 and a fifty-two week high of $3.50. The business has a 50 day moving average price of $2.12 and a two-hundred day moving average price of $2.27. The firm has a market cap of $190.88 million, a PE ratio of -5.61 and a beta of 0.26.

About Valens Semiconductor

(

Free Report)

Valens Semiconductor Ltd. engages in the provision of semiconductor products for the audio-video and automotive industries. The company offers HDBaseT technology, which enables the simultaneous delivery of ultra-high-definition digital video and audio, Ethernet, USB, control signals, and power through a single long-reach cable.

Featured Articles

Want to see what other hedge funds are holding VLN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Valens Semiconductor, Ltd. (NYSE:VLN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Valens Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valens Semiconductor wasn't on the list.

While Valens Semiconductor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.