Goldman Sachs Group Inc. trimmed its stake in shares of HealthStream, Inc. (NASDAQ:HSTM - Free Report) by 26.6% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 155,286 shares of the technology company's stock after selling 56,367 shares during the quarter. Goldman Sachs Group Inc. owned approximately 0.51% of HealthStream worth $4,997,000 at the end of the most recent quarter.

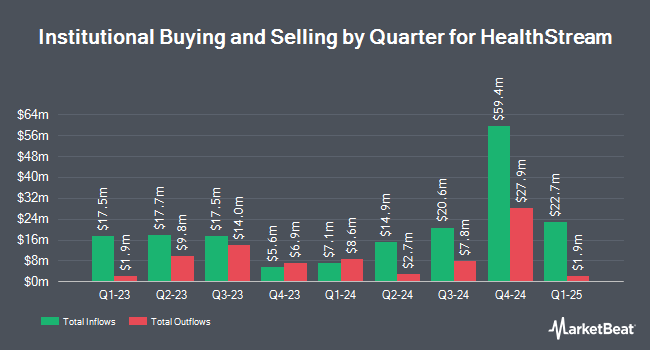

A number of other large investors have also recently added to or reduced their stakes in HSTM. Diversified Trust Co lifted its position in shares of HealthStream by 5.0% in the 1st quarter. Diversified Trust Co now owns 9,174 shares of the technology company's stock worth $295,000 after buying an additional 441 shares during the last quarter. GAMMA Investing LLC lifted its stake in HealthStream by 30.8% in the first quarter. GAMMA Investing LLC now owns 2,082 shares of the technology company's stock valued at $67,000 after acquiring an additional 490 shares during the last quarter. First Horizon Advisors Inc. lifted its stake in shares of HealthStream by 99.6% in the first quarter. First Horizon Advisors Inc. now owns 1,056 shares of the technology company's stock worth $34,000 after buying an additional 527 shares during the last quarter. PNC Financial Services Group Inc. lifted its stake in shares of HealthStream by 62.5% in the first quarter. PNC Financial Services Group Inc. now owns 2,625 shares of the technology company's stock worth $84,000 after buying an additional 1,010 shares during the last quarter. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its position in HealthStream by 1.1% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 99,514 shares of the technology company's stock worth $3,202,000 after acquiring an additional 1,047 shares during the period. 69.58% of the stock is currently owned by institutional investors.

Insider Activity

In other news, EVP Kevin P. O'hara sold 2,000 shares of HealthStream stock in a transaction that occurred on Wednesday, August 27th. The shares were sold at an average price of $27.97, for a total value of $55,940.00. Following the sale, the executive vice president directly owned 17,137 shares in the company, valued at $479,321.89. This trade represents a 10.45% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 20.50% of the stock is owned by company insiders.

HealthStream Stock Performance

HealthStream stock traded down $0.17 during trading hours on Friday, reaching $29.00. 498,110 shares of the company's stock traded hands, compared to its average volume of 181,721. HealthStream, Inc. has a fifty-two week low of $25.36 and a fifty-two week high of $34.24. The firm has a market capitalization of $859.56 million, a price-to-earnings ratio of 43.28, a PEG ratio of 3.66 and a beta of 0.47. The firm's 50 day moving average is $27.30 and its 200-day moving average is $28.96.

HealthStream (NASDAQ:HSTM - Get Free Report) last announced its quarterly earnings results on Monday, August 4th. The technology company reported $0.18 earnings per share for the quarter, beating analysts' consensus estimates of $0.16 by $0.02. The business had revenue of $74.40 million for the quarter, compared to the consensus estimate of $74.39 million. HealthStream had a net margin of 6.89% and a return on equity of 5.70%. HealthStream has set its FY 2025 guidance at EPS. Analysts predict that HealthStream, Inc. will post 0.63 EPS for the current year.

HealthStream Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, August 29th. Stockholders of record on Monday, August 18th were issued a $0.031 dividend. The ex-dividend date was Monday, August 18th. This represents a $0.12 dividend on an annualized basis and a dividend yield of 0.4%. HealthStream's dividend payout ratio (DPR) is 17.91%.

Wall Street Analysts Forecast Growth

Separately, Canaccord Genuity Group lowered their target price on shares of HealthStream from $29.00 to $28.00 and set a "hold" rating on the stock in a report on Thursday, August 7th. One research analyst has rated the stock with a Strong Buy rating, two have given a Buy rating and two have issued a Hold rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $31.00.

Get Our Latest Analysis on HealthStream

HealthStream Profile

(

Free Report)

HealthStream, Inc provides Software-as-a-Service (SaaS) based applications for healthcare organizations in the United States. The company's solutions help healthcare organizations in meeting their ongoing clinical development, talent management, training, education, assessment, competency management, safety and compliance, and scheduling, as well as provider credentialing, privileging, and enrollment needs.

See Also

Before you consider HealthStream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HealthStream wasn't on the list.

While HealthStream currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.