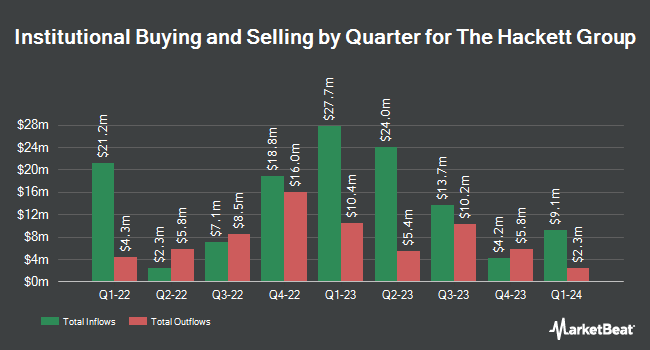

Goldman Sachs Group Inc. reduced its stake in The Hackett Group, Inc. (NASDAQ:HCKT - Free Report) by 60.2% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 183,740 shares of the business services provider's stock after selling 278,237 shares during the period. Goldman Sachs Group Inc. owned approximately 0.66% of The Hackett Group worth $5,369,000 as of its most recent SEC filing.

A number of other institutional investors have also recently modified their holdings of HCKT. Northern Trust Corp grew its stake in shares of The Hackett Group by 7.1% in the fourth quarter. Northern Trust Corp now owns 284,120 shares of the business services provider's stock worth $8,728,000 after acquiring an additional 18,746 shares during the last quarter. Ameriprise Financial Inc. boosted its position in shares of The Hackett Group by 18.9% during the fourth quarter. Ameriprise Financial Inc. now owns 18,872 shares of the business services provider's stock valued at $580,000 after buying an additional 3,004 shares during the last quarter. Deutsche Bank AG boosted its position in shares of The Hackett Group by 72.2% during the fourth quarter. Deutsche Bank AG now owns 20,657 shares of the business services provider's stock valued at $635,000 after buying an additional 8,658 shares during the last quarter. Lazard Asset Management LLC boosted its position in shares of The Hackett Group by 981.7% during the fourth quarter. Lazard Asset Management LLC now owns 23,721 shares of the business services provider's stock valued at $727,000 after buying an additional 21,528 shares during the last quarter. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its position in shares of The Hackett Group by 3.6% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 14,393 shares of the business services provider's stock valued at $442,000 after buying an additional 503 shares during the last quarter. 78.12% of the stock is owned by hedge funds and other institutional investors.

The Hackett Group Trading Down 4.2%

HCKT stock traded down $0.87 during midday trading on Friday, hitting $19.82. 640,553 shares of the company's stock were exchanged, compared to its average volume of 229,661. The business has a 50-day simple moving average of $21.59 and a two-hundred day simple moving average of $24.56. The company has a current ratio of 1.71, a quick ratio of 1.71 and a debt-to-equity ratio of 0.19. The stock has a market capitalization of $545.25 million, a PE ratio of 33.03, a P/E/G ratio of 1.42 and a beta of 1.02. The Hackett Group, Inc. has a 1-year low of $19.39 and a 1-year high of $34.02.

The Hackett Group Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, October 3rd. Shareholders of record on Friday, September 19th will be paid a dividend of $0.12 per share. The ex-dividend date of this dividend is Friday, September 19th. This represents a $0.48 annualized dividend and a yield of 2.4%. The Hackett Group's dividend payout ratio (DPR) is 80.00%.

Analysts Set New Price Targets

HCKT has been the topic of several recent analyst reports. Wall Street Zen cut The Hackett Group from a "buy" rating to a "hold" rating in a research report on Monday, July 21st. Barrington Research reissued an "outperform" rating and set a $27.00 target price on shares of The Hackett Group in a research note on Thursday, September 4th. Three research analysts have rated the stock with a Buy rating, Based on data from MarketBeat, the stock presently has an average rating of "Buy" and an average price target of $29.67.

View Our Latest Research Report on The Hackett Group

About The Hackett Group

(

Free Report)

The Hackett Group, Inc operates as an intellectual property-based executive advisory, strategic consulting, and digital transformation company in the United States, Europe, and internationally. The company operates through three segments: Global Strategy & Business Transformation, Oracle Solutions, and SAP Solutions.

Read More

Before you consider The Hackett Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hackett Group wasn't on the list.

While The Hackett Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.