Goldman Sachs Group Inc. increased its holdings in shares of Inspire Medical Systems, Inc. (NYSE:INSP - Free Report) by 57.9% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 51,422 shares of the company's stock after buying an additional 18,857 shares during the quarter. Goldman Sachs Group Inc. owned 0.17% of Inspire Medical Systems worth $8,190,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

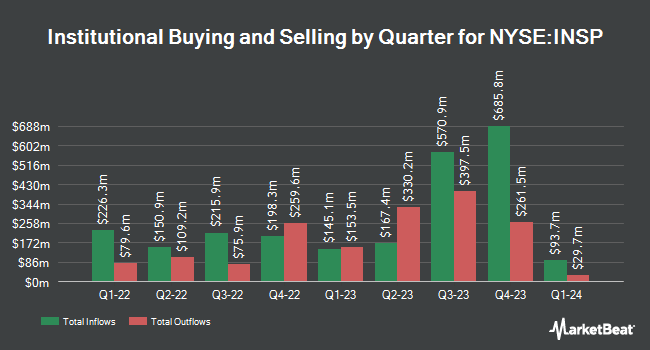

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Parallel Advisors LLC lifted its position in Inspire Medical Systems by 356.5% during the 1st quarter. Parallel Advisors LLC now owns 210 shares of the company's stock worth $33,000 after acquiring an additional 164 shares during the period. Quarry LP lifted its position in Inspire Medical Systems by 2,127.3% during the 1st quarter. Quarry LP now owns 245 shares of the company's stock worth $39,000 after acquiring an additional 234 shares during the period. Banque Transatlantique SA acquired a new stake in Inspire Medical Systems during the 1st quarter worth about $46,000. Smartleaf Asset Management LLC lifted its position in Inspire Medical Systems by 27.2% during the 1st quarter. Smartleaf Asset Management LLC now owns 454 shares of the company's stock worth $71,000 after acquiring an additional 97 shares during the period. Finally, GAMMA Investing LLC lifted its position in Inspire Medical Systems by 253.7% during the 1st quarter. GAMMA Investing LLC now owns 573 shares of the company's stock worth $91,000 after acquiring an additional 411 shares during the period. 94.91% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In other news, CFO Richard Buchholz sold 11,000 shares of the stock in a transaction that occurred on Friday, August 29th. The stock was sold at an average price of $93.39, for a total transaction of $1,027,290.00. Following the transaction, the chief financial officer owned 44,867 shares in the company, valued at $4,190,129.13. This trade represents a 19.69% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. 4.10% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

INSP has been the subject of a number of research reports. JPMorgan Chase & Co. cut Inspire Medical Systems from an "overweight" rating to a "neutral" rating and lowered their price target for the stock from $195.00 to $110.00 in a research report on Tuesday, August 5th. Lake Street Capital set a $150.00 price target on Inspire Medical Systems and gave the stock a "buy" rating in a research report on Tuesday, August 5th. Stifel Nicolaus set a $140.00 price target on Inspire Medical Systems and gave the stock a "hold" rating in a research report on Tuesday, August 5th. Evercore ISI assumed coverage on Inspire Medical Systems in a report on Tuesday, September 2nd. They issued an "outperform" rating and a $150.00 price objective for the company. Finally, Wells Fargo & Company dropped their target price on Inspire Medical Systems from $174.00 to $101.00 and set an "equal weight" rating on the stock in a report on Tuesday, August 5th. Eight equities research analysts have rated the stock with a Buy rating and six have given a Hold rating to the company. According to data from MarketBeat, Inspire Medical Systems currently has an average rating of "Moderate Buy" and a consensus target price of $164.50.

Check Out Our Latest Stock Analysis on Inspire Medical Systems

Inspire Medical Systems Price Performance

INSP stock traded down $2.47 during mid-day trading on Friday, reaching $80.93. 136,252 shares of the company's stock were exchanged, compared to its average volume of 715,175. Inspire Medical Systems, Inc. has a 12-month low of $73.92 and a 12-month high of $218.52. The stock's 50 day moving average is $100.67 and its 200 day moving average is $132.00. The company has a market cap of $2.39 billion, a price-to-earnings ratio of 46.78, a price-to-earnings-growth ratio of 2.50 and a beta of 1.15.

Inspire Medical Systems (NYSE:INSP - Get Free Report) last posted its quarterly earnings data on Monday, August 4th. The company reported $0.45 EPS for the quarter, beating analysts' consensus estimates of $0.22 by $0.23. Inspire Medical Systems had a return on equity of 10.38% and a net margin of 6.17%.The business had revenue of $217.09 million during the quarter, compared to analysts' expectations of $214.50 million. During the same period in the previous year, the business earned $0.32 earnings per share. The business's revenue was up 10.8% compared to the same quarter last year. Inspire Medical Systems has set its FY 2025 guidance at 0.400-0.500 EPS. On average, research analysts forecast that Inspire Medical Systems, Inc. will post 2.16 earnings per share for the current fiscal year.

Inspire Medical Systems declared that its Board of Directors has initiated a share repurchase plan on Monday, August 11th that allows the company to buyback $200.00 million in outstanding shares. This buyback authorization allows the company to buy up to 8.6% of its stock through open market purchases. Stock buyback plans are often a sign that the company's board of directors believes its stock is undervalued.

About Inspire Medical Systems

(

Free Report)

Inspire Medical Systems, Inc, a medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally. The company offers Inspire system, a neurostimulation technology that provides a safe and effective treatment for moderate to severe OSA.

Read More

Before you consider Inspire Medical Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inspire Medical Systems wasn't on the list.

While Inspire Medical Systems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.