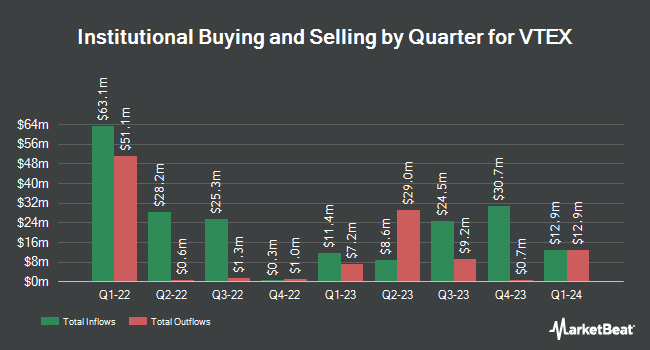

Goldman Sachs Group Inc. boosted its holdings in shares of VTEX (NYSE:VTEX - Free Report) by 61.6% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 220,758 shares of the company's stock after buying an additional 84,189 shares during the quarter. Goldman Sachs Group Inc. owned approximately 0.12% of VTEX worth $1,119,000 as of its most recent SEC filing.

Other hedge funds also recently bought and sold shares of the company. Northern Trust Corp increased its holdings in shares of VTEX by 245.2% in the 4th quarter. Northern Trust Corp now owns 136,898 shares of the company's stock valued at $806,000 after acquiring an additional 97,239 shares during the period. BNP Paribas Financial Markets bought a new position in VTEX in the fourth quarter worth about $248,000. Bank of America Corp DE raised its holdings in VTEX by 279.3% in the fourth quarter. Bank of America Corp DE now owns 80,068 shares of the company's stock worth $472,000 after purchasing an additional 58,958 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in VTEX by 15.8% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 26,712 shares of the company's stock worth $157,000 after purchasing an additional 3,644 shares in the last quarter. Finally, Nuveen Asset Management LLC raised its holdings in VTEX by 1,082.4% in the fourth quarter. Nuveen Asset Management LLC now owns 876,508 shares of the company's stock worth $5,163,000 after purchasing an additional 802,381 shares in the last quarter. Hedge funds and other institutional investors own 63.69% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have weighed in on the company. UBS Group lowered their price target on VTEX from $10.00 to $8.00 and set a "buy" rating for the company in a report on Friday, August 22nd. JPMorgan Chase & Co. reissued a "neutral" rating and set a $6.00 target price (down previously from $7.50) on shares of VTEX in a research report on Friday, August 8th. Jefferies Financial Group raised shares of VTEX from a "hold" rating to a "buy" rating and decreased their price target for the stock from $7.30 to $6.50 in a report on Wednesday, September 17th. Citigroup initiated coverage on shares of VTEX in a report on Monday, June 23rd. They set a "buy" rating and a $10.00 price objective on the stock. Finally, Wall Street Zen raised VTEX from a "hold" rating to a "buy" rating in a research report on Saturday, August 16th. Three investment analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company. Based on data from MarketBeat.com, VTEX currently has an average rating of "Moderate Buy" and a consensus price target of $7.63.

Check Out Our Latest Stock Report on VTEX

VTEX Stock Performance

Shares of NYSE:VTEX traded up $0.11 during trading on Monday, hitting $4.64. 974,810 shares of the stock traded hands, compared to its average volume of 1,230,641. The company has a market cap of $848.19 million, a price-to-earnings ratio of 56.62 and a beta of 1.32. VTEX has a 52-week low of $3.91 and a 52-week high of $7.58. The company has a quick ratio of 3.31, a current ratio of 3.31 and a debt-to-equity ratio of 0.01. The company has a fifty day moving average price of $4.92 and a two-hundred day moving average price of $5.43.

VTEX (NYSE:VTEX - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The company reported $0.02 earnings per share for the quarter, hitting analysts' consensus estimates of $0.02. The company had revenue of $58.80 million during the quarter, compared to analysts' expectations of $60.35 million. VTEX had a return on equity of 5.27% and a net margin of 5.80%. VTEX has set its FY 2025 guidance at EPS. As a group, equities analysts predict that VTEX will post 0.08 EPS for the current year.

About VTEX

(

Free Report)

VTEX provides software-as-a-service digital commerce platform for enterprise brands and retailers. Its platform enables customers to execute their commerce strategy, including building online stores, integrating, and managing orders across channels, and creating marketplaces to sell products from third-party vendors.

Recommended Stories

Before you consider VTEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VTEX wasn't on the list.

While VTEX currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.