Goldman Sachs Group Inc. trimmed its position in Claros Mortgage Trust, Inc. (NYSE:CMTG - Free Report) by 96.3% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 405,921 shares of the company's stock after selling 10,543,521 shares during the period. Goldman Sachs Group Inc. owned approximately 0.29% of Claros Mortgage Trust worth $1,514,000 as of its most recent SEC filing.

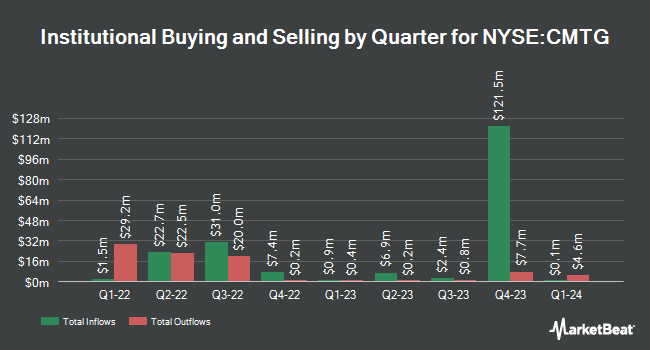

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the company. MetLife Investment Management LLC lifted its holdings in Claros Mortgage Trust by 10.5% in the first quarter. MetLife Investment Management LLC now owns 52,762 shares of the company's stock valued at $197,000 after acquiring an additional 5,016 shares during the period. ProShare Advisors LLC grew its holdings in Claros Mortgage Trust by 49.0% in the 4th quarter. ProShare Advisors LLC now owns 24,311 shares of the company's stock valued at $110,000 after buying an additional 7,999 shares during the period. XTX Topco Ltd grew its holdings in Claros Mortgage Trust by 43.8% in the 1st quarter. XTX Topco Ltd now owns 31,812 shares of the company's stock valued at $119,000 after buying an additional 9,695 shares during the period. BNP Paribas Financial Markets purchased a new stake in Claros Mortgage Trust in the 4th quarter valued at about $46,000. Finally, Squarepoint Ops LLC purchased a new stake in shares of Claros Mortgage Trust during the 4th quarter worth about $46,000. 89.53% of the stock is currently owned by hedge funds and other institutional investors.

Claros Mortgage Trust Stock Performance

Shares of CMTG stock traded down $0.07 on Tuesday, hitting $3.65. 122,132 shares of the stock traded hands, compared to its average volume of 950,370. The company has a debt-to-equity ratio of 1.92, a current ratio of 30.23 and a quick ratio of 30.23. The company has a market capitalization of $509.64 million, a PE ratio of -1.22 and a beta of 1.23. Claros Mortgage Trust, Inc. has a 1-year low of $2.13 and a 1-year high of $8.03. The company's fifty day moving average is $3.41 and its 200 day moving average is $3.10.

Wall Street Analysts Forecast Growth

Separately, Keefe, Bruyette & Woods boosted their target price on Claros Mortgage Trust from $2.75 to $3.00 and gave the stock an "underperform" rating in a report on Tuesday, August 12th. One equities research analyst has rated the stock with a Buy rating, one has given a Hold rating and two have given a Sell rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Reduce" and an average target price of $4.13.

View Our Latest Report on CMTG

Claros Mortgage Trust Profile

(

Free Report)

Claros Mortgage Trust, Inc operates as a real estate investment trust. It focuses on originating senior and subordinate loans on transitional commercial real estate assets in the United States. The company has elected to be taxed as a real estate investment trust. As a result, it would not be subject to corporate income tax on that portion of its net income that is distributed to shareholders.

Featured Stories

Before you consider Claros Mortgage Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Claros Mortgage Trust wasn't on the list.

While Claros Mortgage Trust currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.