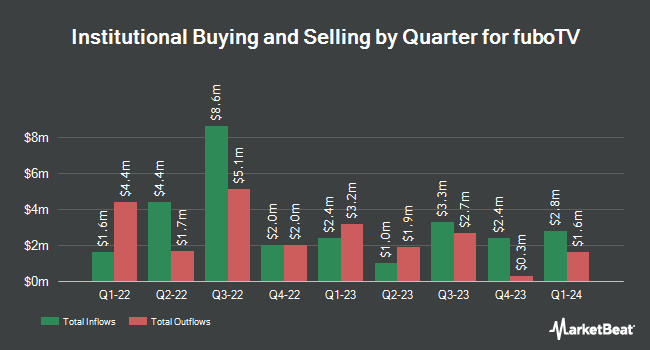

Goldman Sachs Group Inc. trimmed its holdings in shares of fuboTV Inc. (NYSE:FUBO - Free Report) by 46.3% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 2,569,833 shares of the company's stock after selling 2,216,415 shares during the period. Goldman Sachs Group Inc. owned 0.75% of fuboTV worth $7,504,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors have also recently added to or reduced their stakes in the company. Focus Partners Wealth purchased a new stake in fuboTV during the 1st quarter worth $30,000. Wealthcare Advisory Partners LLC purchased a new position in fuboTV in the 1st quarter valued at about $34,000. Cresset Asset Management LLC purchased a new position in fuboTV in the 1st quarter valued at about $38,000. Valeo Financial Advisors LLC purchased a new position in fuboTV in the 1st quarter valued at about $45,000. Finally, Wealthspan Partners LLC purchased a new stake in shares of fuboTV in the 1st quarter valued at approximately $48,000. 39.31% of the stock is owned by hedge funds and other institutional investors.

fuboTV Price Performance

FUBO stock traded up $0.03 during midday trading on Friday, hitting $4.41. The company's stock had a trading volume of 4,388,191 shares, compared to its average volume of 25,232,104. The company has a quick ratio of 0.69, a current ratio of 0.69 and a debt-to-equity ratio of 0.47. The company has a 50 day moving average of $3.72 and a two-hundred day moving average of $3.34. fuboTV Inc. has a 12 month low of $1.21 and a 12 month high of $6.45. The firm has a market capitalization of $1.51 billion, a price-to-earnings ratio of 16.97 and a beta of 2.36.

Insider Buying and Selling

In other fuboTV news, Director Ignacio Figueras sold 66,061 shares of the stock in a transaction dated Wednesday, July 30th. The stock was sold at an average price of $4.26, for a total value of $281,419.86. Following the sale, the director owned 402,009 shares of the company's stock, valued at $1,712,558.34. This trade represents a 14.11% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Chairman Edgar Bronfman, Jr. sold 59,694 shares of fuboTV stock in a transaction that occurred on Tuesday, August 12th. The stock was sold at an average price of $3.62, for a total value of $216,092.28. Following the transaction, the chairman directly owned 8,673 shares in the company, valued at approximately $31,396.26. This trade represents a 87.31% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 426,849 shares of company stock worth $1,660,612 over the last ninety days. 5.30% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

A number of research firms have commented on FUBO. Wedbush restated an "outperform" rating and issued a $6.00 price target (up from $5.00) on shares of fuboTV in a research report on Wednesday, July 30th. Needham & Company LLC increased their price target on shares of fuboTV from $3.00 to $4.25 and gave the company a "buy" rating in a research note on Wednesday, July 30th. Finally, Wall Street Zen lowered shares of fuboTV from a "buy" rating to a "hold" rating in a report on Sunday, August 10th. One equities research analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating and one has issued a Hold rating to the company's stock. According to data from MarketBeat.com, fuboTV presently has an average rating of "Buy" and a consensus price target of $4.63.

Get Our Latest Research Report on fuboTV

fuboTV Profile

(

Free Report)

fuboTV, Inc engages in providing subscription to sports, news, and entertainment content. It offers its services through streaming devices and on television, mobile phones, tablets, and computers. The company was founded by David Gandler, Alberto Horihuela Suarez, and Sung Ho Choi on February 20, 2009 and is headquartered in New York, NY.

Featured Articles

Before you consider fuboTV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and fuboTV wasn't on the list.

While fuboTV currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.