Goldman Sachs Group Inc. lessened its holdings in Advantage Solutions Inc. (NASDAQ:ADV - Free Report) by 44.5% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 356,382 shares of the company's stock after selling 285,448 shares during the period. Goldman Sachs Group Inc. owned 0.11% of Advantage Solutions worth $538,000 as of its most recent filing with the Securities and Exchange Commission.

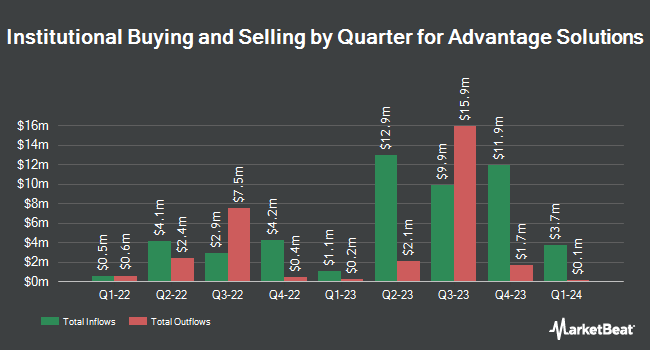

Several other large investors have also recently bought and sold shares of the stock. Charles Schwab Investment Management Inc. lifted its holdings in Advantage Solutions by 63.9% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 1,048,305 shares of the company's stock worth $1,583,000 after purchasing an additional 408,802 shares during the last quarter. Millennium Management LLC grew its stake in shares of Advantage Solutions by 193.5% in the fourth quarter. Millennium Management LLC now owns 600,149 shares of the company's stock valued at $1,752,000 after acquiring an additional 395,651 shares in the last quarter. Nuveen LLC bought a new position in Advantage Solutions during the first quarter worth about $594,000. Contrarian Capital Management L.L.C. boosted its holdings in Advantage Solutions by 13.5% in the 1st quarter. Contrarian Capital Management L.L.C. now owns 1,451,140 shares of the company's stock valued at $2,191,000 after purchasing an additional 173,000 shares during the period. Finally, Inspire Investing LLC raised its position in shares of Advantage Solutions by 68.0% in the first quarter. Inspire Investing LLC now owns 231,825 shares of the company's stock valued at $350,000 after buying an additional 93,794 shares in the last quarter. 49.82% of the stock is owned by institutional investors.

Advantage Solutions Stock Performance

ADV opened at $1.61 on Friday. The company has a debt-to-equity ratio of 2.43, a quick ratio of 1.96 and a current ratio of 1.96. Advantage Solutions Inc. has a 52-week low of $1.04 and a 52-week high of $4.04. The firm has a market cap of $524.78 million, a P/E ratio of -1.71 and a beta of 2.19. The business's fifty day moving average is $1.71 and its 200-day moving average is $1.50.

Advantage Solutions Profile

(

Free Report)

Advantage Solutions Inc provides business solutions to consumer goods manufacturers and retailers in North America and internationally. It operates in two segments, Sales and Marketing. The Sales segment offers brand-centric services, such as headquarter relationship management; analytics, insights, and intelligence; and brand-centric merchandising services.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Advantage Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advantage Solutions wasn't on the list.

While Advantage Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.