Goldman Sachs Group Inc. reduced its position in Kaiser Aluminum Corporation (NASDAQ:KALU - Free Report) by 53.2% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 52,675 shares of the industrial products company's stock after selling 59,768 shares during the quarter. Goldman Sachs Group Inc. owned 0.33% of Kaiser Aluminum worth $3,193,000 as of its most recent SEC filing.

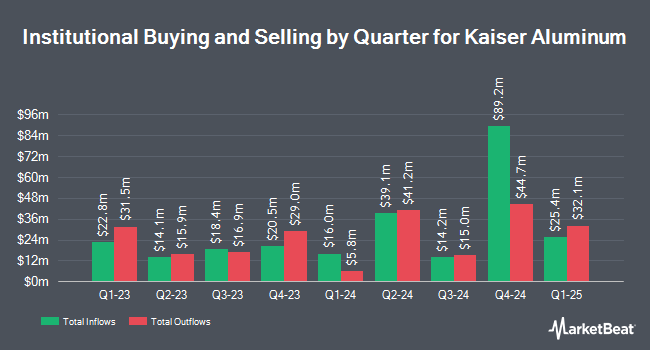

Several other institutional investors and hedge funds have also recently made changes to their positions in the company. Third Avenue Management LLC raised its holdings in shares of Kaiser Aluminum by 0.3% in the first quarter. Third Avenue Management LLC now owns 79,828 shares of the industrial products company's stock valued at $4,839,000 after acquiring an additional 205 shares in the last quarter. Cetera Investment Advisers raised its holdings in Kaiser Aluminum by 7.3% in the first quarter. Cetera Investment Advisers now owns 4,217 shares of the industrial products company's stock worth $256,000 after purchasing an additional 287 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in Kaiser Aluminum by 3.6% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 9,094 shares of the industrial products company's stock worth $639,000 after purchasing an additional 317 shares in the last quarter. Two Sigma Investments LP raised its holdings in Kaiser Aluminum by 12.8% in the fourth quarter. Two Sigma Investments LP now owns 4,804 shares of the industrial products company's stock worth $338,000 after purchasing an additional 546 shares in the last quarter. Finally, Avidian Wealth Enterprises LLC raised its holdings in Kaiser Aluminum by 15.8% in the first quarter. Avidian Wealth Enterprises LLC now owns 4,118 shares of the industrial products company's stock worth $250,000 after purchasing an additional 561 shares in the last quarter. 99.29% of the stock is currently owned by institutional investors.

Kaiser Aluminum Stock Performance

NASDAQ KALU traded up $0.44 during trading hours on Tuesday, reaching $76.21. The stock had a trading volume of 5,947 shares, compared to its average volume of 130,493. The company has a debt-to-equity ratio of 1.39, a quick ratio of 1.30 and a current ratio of 2.70. Kaiser Aluminum Corporation has a 52-week low of $46.81 and a 52-week high of $97.00. The stock has a fifty day moving average of $78.72 and a 200 day moving average of $72.69. The stock has a market cap of $1.23 billion, a P/E ratio of 19.59 and a beta of 1.54.

Kaiser Aluminum (NASDAQ:KALU - Get Free Report) last released its quarterly earnings data on Wednesday, July 23rd. The industrial products company reported $1.21 EPS for the quarter, topping the consensus estimate of $0.49 by $0.72. Kaiser Aluminum had a return on equity of 8.03% and a net margin of 2.05%.The business had revenue of $823.10 million for the quarter, compared to analyst estimates of $786.70 million. Sell-side analysts predict that Kaiser Aluminum Corporation will post 5.14 earnings per share for the current year.

Kaiser Aluminum Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, August 15th. Shareholders of record on Friday, July 25th were given a $0.77 dividend. This represents a $3.08 annualized dividend and a yield of 4.0%. The ex-dividend date was Friday, July 25th. Kaiser Aluminum's dividend payout ratio is currently 79.18%.

Analyst Upgrades and Downgrades

A number of equities analysts have commented on the stock. Wall Street Zen upgraded shares of Kaiser Aluminum from a "hold" rating to a "buy" rating in a report on Tuesday, September 2nd. JPMorgan Chase & Co. boosted their target price on shares of Kaiser Aluminum from $64.00 to $82.00 and gave the stock a "neutral" rating in a report on Monday, July 28th. One research analyst has rated the stock with a Buy rating and two have issued a Hold rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $78.00.

View Our Latest Analysis on Kaiser Aluminum

Kaiser Aluminum Profile

(

Free Report)

Kaiser Aluminum Corporation, together with its subsidiaries, engages in manufacture and sale of semi-fabricated specialty aluminum mill products in the United States and internationally. It offers rolled, extruded, and drawn aluminum products used for aerospace and defense, aluminum beverage and food packaging, automotive and general engineering products.

Further Reading

Before you consider Kaiser Aluminum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kaiser Aluminum wasn't on the list.

While Kaiser Aluminum currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.