Gordian Capital Singapore Pte Ltd raised its holdings in shares of Alibaba Group Holding Limited (NYSE:BABA - Free Report) by 580.1% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 23,682 shares of the specialty retailer's stock after purchasing an additional 20,200 shares during the period. Alibaba Group accounts for about 2.0% of Gordian Capital Singapore Pte Ltd's holdings, making the stock its 13th largest holding. Gordian Capital Singapore Pte Ltd's holdings in Alibaba Group were worth $3,132,000 at the end of the most recent quarter.

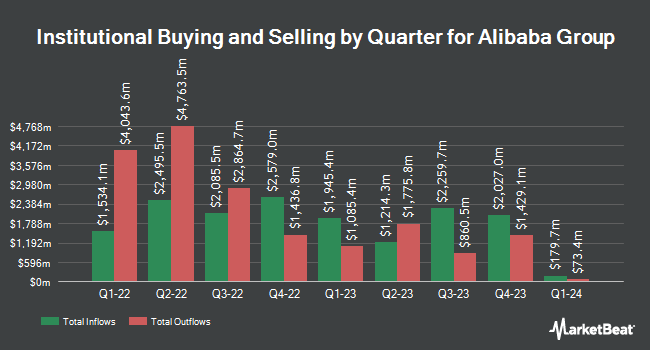

A number of other hedge funds and other institutional investors have also bought and sold shares of BABA. Brighton Jones LLC raised its position in Alibaba Group by 40.4% during the 4th quarter. Brighton Jones LLC now owns 3,411 shares of the specialty retailer's stock valued at $289,000 after purchasing an additional 981 shares during the last quarter. First Trust Advisors LP raised its position in Alibaba Group by 2.2% during the 4th quarter. First Trust Advisors LP now owns 47,897 shares of the specialty retailer's stock valued at $4,061,000 after purchasing an additional 1,037 shares during the last quarter. Kovitz Investment Group Partners LLC raised its position in Alibaba Group by 6.7% during the 4th quarter. Kovitz Investment Group Partners LLC now owns 9,205 shares of the specialty retailer's stock valued at $780,000 after purchasing an additional 579 shares during the last quarter. Beacon Pointe Advisors LLC raised its position in Alibaba Group by 9.7% during the 4th quarter. Beacon Pointe Advisors LLC now owns 6,354 shares of the specialty retailer's stock valued at $539,000 after purchasing an additional 561 shares during the last quarter. Finally, Northern Trust Corp raised its position in Alibaba Group by 48.0% during the 4th quarter. Northern Trust Corp now owns 1,512,959 shares of the specialty retailer's stock valued at $128,284,000 after purchasing an additional 490,913 shares during the last quarter. Institutional investors own 13.47% of the company's stock.

Alibaba Group Stock Up 13.0%

BABA stock traded up $15.54 on Monday, reaching $135.11. 82,003,855 shares of the company traded hands, compared to its average volume of 14,601,554. Alibaba Group Holding Limited has a one year low of $80.06 and a one year high of $148.43. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.55 and a quick ratio of 1.55. The company has a market cap of $322.14 billion, a P/E ratio of 15.71, a price-to-earnings-growth ratio of 1.99 and a beta of 0.11. The firm has a fifty day simple moving average of $117.51 and a 200-day simple moving average of $121.72.

Analyst Upgrades and Downgrades

A number of research analysts have commented on BABA shares. Arete lowered Alibaba Group from a "buy" rating to a "neutral" rating and set a $153.00 price target for the company. in a research report on Tuesday, June 24th. Morgan Stanley set a $180.00 target price on Alibaba Group in a research report on Wednesday, May 14th. Jefferies Financial Group set a $165.00 target price on Alibaba Group in a research report on Friday. Robert W. Baird decreased their target price on Alibaba Group from $147.00 to $142.00 and set an "outperform" rating for the company in a research report on Friday, May 16th. Finally, Mizuho decreased their target price on Alibaba Group from $170.00 to $160.00 and set an "outperform" rating for the company in a research report on Friday, May 16th. Eleven analysts have rated the stock with a Buy rating and two have given a Hold rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $159.69.

Get Our Latest Report on Alibaba Group

Alibaba Group Company Profile

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

Featured Articles

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.