Graham Capital Management L.P. acquired a new position in shares of Core Scientific, Inc. (NASDAQ:CORZ - Free Report) in the first quarter, according to the company in its most recent filing with the SEC. The firm acquired 99,833 shares of the company's stock, valued at approximately $723,000.

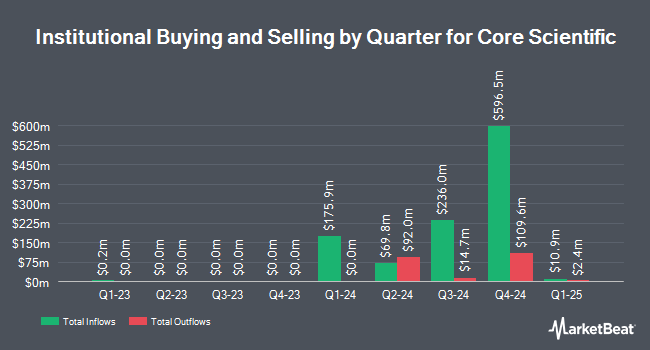

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in CORZ. Driehaus Capital Management LLC increased its position in Core Scientific by 112.1% during the 4th quarter. Driehaus Capital Management LLC now owns 10,264,204 shares of the company's stock worth $144,212,000 after purchasing an additional 5,424,901 shares in the last quarter. Situational Awareness LP acquired a new stake in Core Scientific in the 1st quarter worth about $32,736,000. Fred Alger Management LLC acquired a new stake in Core Scientific in the 4th quarter worth about $62,011,000. Clearline Capital LP acquired a new stake in Core Scientific in the 4th quarter worth about $29,447,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its stake in Core Scientific by 1,204.9% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 1,662,406 shares of the company's stock worth $23,357,000 after buying an additional 1,535,012 shares during the last quarter.

Analyst Ratings Changes

A number of analysts have issued reports on the company. Canaccord Genuity Group reissued a "buy" rating and issued a $17.00 price target on shares of Core Scientific in a research note on Friday, June 27th. HC Wainwright reissued a "neutral" rating on shares of Core Scientific in a research note on Monday, August 11th. Arete assumed coverage on Core Scientific in a research note on Tuesday, July 22nd. They issued a "buy" rating and a $20.00 price target on the stock. Jefferies Financial Group raised their price target on Core Scientific from $16.00 to $22.00 and gave the stock a "buy" rating in a research note on Monday, August 18th. Finally, Citizens Jmp lowered Core Scientific from a "strong-buy" rating to a "hold" rating in a research note on Monday, July 14th. One analyst has rated the stock with a Strong Buy rating, nine have issued a Buy rating, eleven have assigned a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat.com, Core Scientific presently has an average rating of "Hold" and an average target price of $18.32.

Check Out Our Latest Research Report on CORZ

Insider Buying and Selling at Core Scientific

In other news, insider Todd M. Duchene sold 7,759 shares of Core Scientific stock in a transaction dated Wednesday, June 25th. The stock was sold at an average price of $12.39, for a total value of $96,134.01. Following the transaction, the insider directly owned 2,049,689 shares of the company's stock, valued at $25,395,646.71. The trade was a 0.38% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this link. 1.40% of the stock is owned by corporate insiders.

Core Scientific Price Performance

Shares of NASDAQ CORZ remained flat at $13.62 during midday trading on Friday. The stock had a trading volume of 9,308,720 shares, compared to its average volume of 15,854,694. The company has a market cap of $4.16 billion, a P/E ratio of -24.32 and a beta of 6.59. Core Scientific, Inc. has a fifty-two week low of $6.20 and a fifty-two week high of $18.63. The business has a fifty day moving average of $14.20 and a two-hundred day moving average of $11.17.

Core Scientific (NASDAQ:CORZ - Get Free Report) last released its quarterly earnings data on Friday, August 8th. The company reported ($0.04) earnings per share for the quarter, beating the consensus estimate of ($0.07) by $0.03. The firm had revenue of $78.63 million during the quarter, compared to analyst estimates of $82.09 million. The firm's quarterly revenue was down 44.3% on a year-over-year basis. On average, sell-side analysts anticipate that Core Scientific, Inc. will post 0.52 earnings per share for the current fiscal year.

About Core Scientific

(

Free Report)

Core Scientific, Inc provides digital asset mining services in North America. It operates through two segments, Mining and Hosting. The company offers blockchain infrastructure, software solutions, and services; and operates data center mining facilities. It also mines digital assets for its own account; and provides hosting services for other large bitcoin miners, which include deployment, monitoring, trouble shooting, optimization, and maintenance of its customers' digital asset mining equipment.

Featured Articles

Before you consider Core Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Scientific wasn't on the list.

While Core Scientific currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.