R Squared Ltd increased its holdings in Granite Construction Incorporated (NYSE:GVA - Free Report) by 144.6% in the 1st quarter, according to its most recent filing with the SEC. The institutional investor owned 5,870 shares of the construction company's stock after buying an additional 3,470 shares during the quarter. R Squared Ltd's holdings in Granite Construction were worth $443,000 at the end of the most recent reporting period.

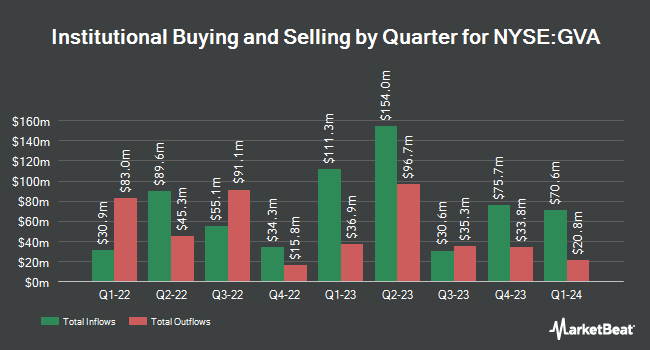

A number of other large investors have also made changes to their positions in GVA. Norges Bank purchased a new position in Granite Construction in the 4th quarter worth approximately $31,855,000. First Trust Advisors LP lifted its holdings in Granite Construction by 35.1% in the 4th quarter. First Trust Advisors LP now owns 1,131,419 shares of the construction company's stock worth $99,237,000 after purchasing an additional 294,200 shares in the last quarter. Millennium Management LLC lifted its holdings in Granite Construction by 11.0% in the 4th quarter. Millennium Management LLC now owns 2,651,676 shares of the construction company's stock worth $232,579,000 after purchasing an additional 263,302 shares in the last quarter. Voya Investment Management LLC raised its holdings in shares of Granite Construction by 1,058.0% during the 4th quarter. Voya Investment Management LLC now owns 214,777 shares of the construction company's stock worth $18,838,000 after acquiring an additional 196,229 shares in the last quarter. Finally, GAMMA Investing LLC raised its holdings in shares of Granite Construction by 7,509.2% during the 1st quarter. GAMMA Investing LLC now owns 165,729 shares of the construction company's stock worth $12,496,000 after acquiring an additional 163,551 shares in the last quarter.

Analyst Ratings Changes

Separately, The Goldman Sachs Group upped their price objective on Granite Construction from $69.00 to $76.00 and gave the stock a "sell" rating in a report on Monday, May 5th.

Read Our Latest Stock Analysis on GVA

Granite Construction Price Performance

Shares of GVA traded up $2.18 during mid-day trading on Tuesday, hitting $94.97. 171,501 shares of the stock were exchanged, compared to its average volume of 606,649. The company has a market cap of $4.15 billion, a PE ratio of 39.57 and a beta of 1.39. Granite Construction Incorporated has a 52-week low of $66.99 and a 52-week high of $105.20. The firm has a 50-day moving average of $92.09 and a two-hundred day moving average of $85.17. The company has a debt-to-equity ratio of 0.71, a quick ratio of 1.44 and a current ratio of 1.57.

Granite Construction Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Monday, June 30th were given a dividend of $0.13 per share. The ex-dividend date of this dividend was Monday, June 30th. This represents a $0.52 annualized dividend and a dividend yield of 0.5%. Granite Construction's payout ratio is currently 21.67%.

Insider Buying and Selling at Granite Construction

In other news, SVP Brian R. Dowd sold 2,025 shares of the business's stock in a transaction that occurred on Wednesday, May 28th. The stock was sold at an average price of $91.76, for a total transaction of $185,814.00. Following the transaction, the senior vice president owned 18,819 shares of the company's stock, valued at approximately $1,726,831.44. The trade was a 9.72% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Corporate insiders own 0.81% of the company's stock.

About Granite Construction

(

Free Report)

Granite Construction Incorporated operates as an infrastructure contractor in the United States. It operates through two segments: Construction and Materials segments. The Construction segment engages in the construction and rehabilitation of roads, pavement preservation, bridges, rail lines, airports, marine ports, dams, reservoirs, aqueducts, infrastructure, and site development for use by the public and water-related construction for municipal agencies, commercial water suppliers, industrial facilities, and energy companies; and construction of various complex projects, including infrastructure/site development, mining, public safety, tunnel, solar storage, and power related projects.

Read More

Before you consider Granite Construction, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Granite Construction wasn't on the list.

While Granite Construction currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.