Great Lakes Advisors LLC cut its stake in shares of Teekay Tankers Ltd. (NYSE:TNK - Free Report) by 15.1% during the 1st quarter, according to its most recent filing with the SEC. The institutional investor owned 58,438 shares of the shipping company's stock after selling 10,413 shares during the period. Great Lakes Advisors LLC owned approximately 0.17% of Teekay Tankers worth $2,236,000 at the end of the most recent reporting period.

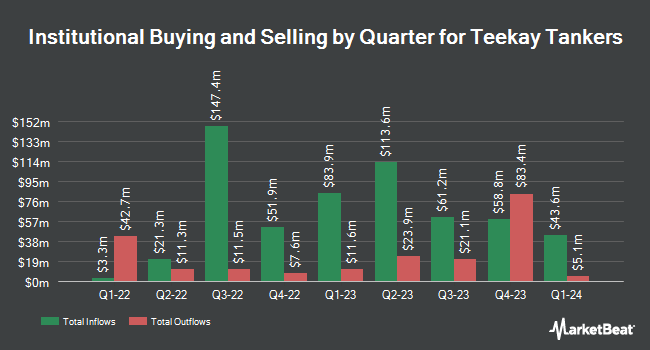

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Martingale Asset Management L P lifted its position in Teekay Tankers by 0.4% during the 1st quarter. Martingale Asset Management L P now owns 64,789 shares of the shipping company's stock worth $2,479,000 after acquiring an additional 248 shares in the last quarter. Allspring Global Investments Holdings LLC lifted its position in Teekay Tankers by 0.8% during the 1st quarter. Allspring Global Investments Holdings LLC now owns 38,123 shares of the shipping company's stock worth $1,459,000 after acquiring an additional 285 shares in the last quarter. TD Private Client Wealth LLC lifted its position in Teekay Tankers by 19.7% during the 1st quarter. TD Private Client Wealth LLC now owns 1,844 shares of the shipping company's stock worth $71,000 after acquiring an additional 304 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its position in Teekay Tankers by 3.8% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 13,653 shares of the shipping company's stock worth $543,000 after acquiring an additional 494 shares in the last quarter. Finally, Blue Trust Inc. lifted its position in Teekay Tankers by 49.3% during the 1st quarter. Blue Trust Inc. now owns 1,720 shares of the shipping company's stock worth $66,000 after acquiring an additional 568 shares in the last quarter. 52.67% of the stock is owned by institutional investors and hedge funds.

Teekay Tankers Price Performance

Shares of Teekay Tankers stock traded down $1.59 during trading on Tuesday, hitting $54.38. The stock had a trading volume of 131,128 shares, compared to its average volume of 520,398. The firm has a market cap of $1.87 billion and a P/E ratio of 6.74. The business has a fifty day moving average of $46.47 and a two-hundred day moving average of $43.34. Teekay Tankers Ltd. has a fifty-two week low of $33.35 and a fifty-two week high of $62.45.

Teekay Tankers (NYSE:TNK - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The shipping company reported $1.41 earnings per share for the quarter, missing the consensus estimate of $1.59 by ($0.18). Teekay Tankers had a net margin of 28.94% and a return on equity of 11.48%. The firm had revenue of $154.23 million during the quarter, compared to analyst estimates of $162.67 million. During the same quarter last year, the company earned $3.11 EPS. As a group, research analysts forecast that Teekay Tankers Ltd. will post 7.13 earnings per share for the current year.

Teekay Tankers Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, August 22nd. Investors of record on Monday, August 11th were given a $0.25 dividend. The ex-dividend date was Monday, August 11th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 1.8%. Teekay Tankers's dividend payout ratio (DPR) is 12.42%.

Analyst Upgrades and Downgrades

Several equities analysts recently commented on TNK shares. Zacks Research raised Teekay Tankers from a "strong sell" rating to a "hold" rating in a research report on Monday, September 8th. Jefferies Financial Group reissued a "buy" rating and set a $55.00 price target on shares of Teekay Tankers in a research report on Thursday, July 31st. One analyst has rated the stock with a Strong Buy rating, two have given a Buy rating, one has given a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, Teekay Tankers has a consensus rating of "Moderate Buy" and an average target price of $50.67.

Read Our Latest Stock Report on TNK

About Teekay Tankers

(

Free Report)

Teekay Tankers Ltd. provides crude oil and other marine transportation services to oil industries in Bermuda and internationally. The company offers voyage and time charter services; offshore ship-to-ship transfer services of commodities primarily crude oil and refined oil products; and tanker commercial and technical management services.

Featured Articles

Before you consider Teekay Tankers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teekay Tankers wasn't on the list.

While Teekay Tankers currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.