Great Lakes Advisors LLC cut its stake in shares of Integer Holdings Corporation (NYSE:ITGR - Free Report) by 11.7% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 36,377 shares of the medical equipment provider's stock after selling 4,836 shares during the quarter. Great Lakes Advisors LLC owned approximately 0.10% of Integer worth $4,293,000 at the end of the most recent reporting period.

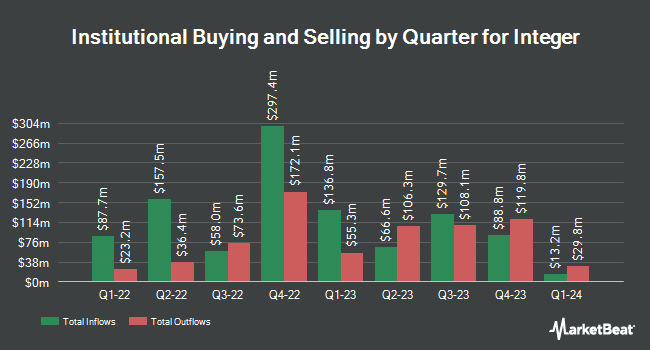

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Opal Wealth Advisors LLC purchased a new stake in Integer in the first quarter valued at approximately $28,000. AdvisorNet Financial Inc acquired a new stake in Integer in the first quarter valued at $28,000. SVB Wealth LLC acquired a new stake in Integer in the first quarter valued at $35,000. Bessemer Group Inc. grew its holdings in Integer by 73.1% in the first quarter. Bessemer Group Inc. now owns 296 shares of the medical equipment provider's stock valued at $35,000 after purchasing an additional 125 shares during the last quarter. Finally, Headlands Technologies LLC boosted its stake in shares of Integer by 1,234.8% during the first quarter. Headlands Technologies LLC now owns 1,228 shares of the medical equipment provider's stock valued at $145,000 after acquiring an additional 1,136 shares during the last quarter. 99.29% of the stock is owned by institutional investors and hedge funds.

Integer Price Performance

NYSE ITGR traded up $0.07 during trading hours on Monday, reaching $101.41. 101,544 shares of the company's stock were exchanged, compared to its average volume of 463,545. The stock has a market cap of $3.55 billion, a PE ratio of 44.70, a price-to-earnings-growth ratio of 0.80 and a beta of 1.03. Integer Holdings Corporation has a one year low of $100.75 and a one year high of $146.36. The firm has a fifty day moving average of $109.53 and a 200-day moving average of $115.83. The company has a current ratio of 3.41, a quick ratio of 2.18 and a debt-to-equity ratio of 0.72.

Integer (NYSE:ITGR - Get Free Report) last posted its quarterly earnings data on Thursday, July 24th. The medical equipment provider reported $1.55 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.57 by ($0.02). The firm had revenue of $476.00 million for the quarter, compared to analyst estimates of $464.37 million. Integer had a return on equity of 12.27% and a net margin of 4.61%.The firm's quarterly revenue was up 11.4% compared to the same quarter last year. During the same period in the prior year, the company posted $1.30 EPS. Integer has set its FY 2025 guidance at 6.250-6.510 EPS. On average, equities research analysts predict that Integer Holdings Corporation will post 6.01 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts recently weighed in on the company. Truist Financial reduced their target price on Integer from $145.00 to $137.00 and set a "buy" rating on the stock in a research report on Friday, July 25th. Raymond James Financial dropped their target price on Integer from $150.00 to $143.00 and set an "outperform" rating on the stock in a report on Friday, July 25th. Wall Street Zen upgraded Integer from a "hold" rating to a "buy" rating in a report on Saturday, August 30th. Citigroup upgraded Integer from a "hold" rating to a "strong-buy" rating and raised their price objective for the company from $133.00 to $140.00 in a research note on Thursday, May 22nd. Finally, Wells Fargo & Company decreased their target price on Integer from $152.00 to $132.00 and set an "overweight" rating for the company in a research report on Friday, July 25th. One equities research analyst has rated the stock with a Strong Buy rating, seven have issued a Buy rating and one has given a Hold rating to the company's stock. According to MarketBeat, Integer presently has a consensus rating of "Buy" and a consensus price target of $140.25.

View Our Latest Analysis on Integer

Integer Company Profile

(

Free Report)

Integer Holdings Corporation operates as a medical device outsource manufacturer in the United States, Puerto Rico, Costa Rica, and internationally. It operates through two segments, Medical and Non-Medical. The company offers products for interventional cardiology, structural heart, heart failure, peripheral vascular, neurovascular, interventional oncology, electrophysiology, vascular access, infusion therapy, hemodialysis, non-vascular, urology, and gastroenterology procedures.

Further Reading

Before you consider Integer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Integer wasn't on the list.

While Integer currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.