Ground Swell Capital LLC purchased a new position in shares of Marriott International, Inc. (NASDAQ:MAR - Free Report) in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 941 shares of the company's stock, valued at approximately $257,000.

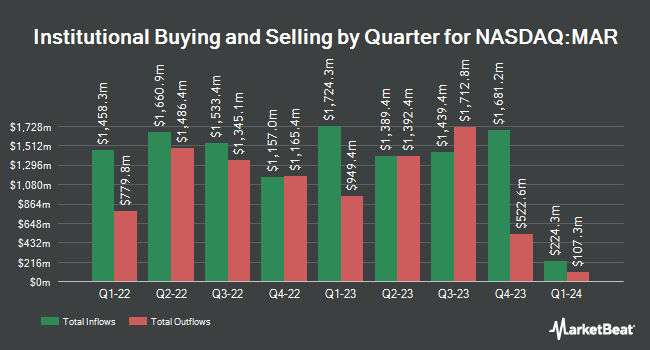

Other hedge funds also recently made changes to their positions in the company. Nissay Asset Management Corp Japan ADV raised its holdings in Marriott International by 9.5% during the first quarter. Nissay Asset Management Corp Japan ADV now owns 62,995 shares of the company's stock worth $15,005,000 after purchasing an additional 5,482 shares in the last quarter. Permanens Capital L.P. boosted its stake in shares of Marriott International by 15.6% in the first quarter. Permanens Capital L.P. now owns 15,396 shares of the company's stock valued at $3,667,000 after buying an additional 2,076 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in Marriott International by 3.8% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 219,939 shares of the company's stock worth $52,389,000 after acquiring an additional 8,149 shares in the last quarter. Swedbank AB lifted its holdings in Marriott International by 1.3% in the first quarter. Swedbank AB now owns 68,429 shares of the company's stock valued at $16,300,000 after acquiring an additional 881 shares during the period. Finally, Sequoia Financial Advisors LLC increased its holdings in shares of Marriott International by 11.9% in the 1st quarter. Sequoia Financial Advisors LLC now owns 13,441 shares of the company's stock valued at $3,202,000 after purchasing an additional 1,432 shares in the last quarter. Institutional investors and hedge funds own 70.70% of the company's stock.

Marriott International Price Performance

NASDAQ:MAR opened at $269.70 on Friday. The firm has a market cap of $73.21 billion, a PE ratio of 30.41, a P/E/G ratio of 2.81 and a beta of 1.35. The firm has a 50 day simple moving average of $265.74 and a 200-day simple moving average of $261.01. Marriott International, Inc. has a 1-year low of $205.40 and a 1-year high of $307.52.

Marriott International (NASDAQ:MAR - Get Free Report) last released its earnings results on Tuesday, August 5th. The company reported $2.65 earnings per share for the quarter, hitting the consensus estimate of $2.65. The firm had revenue of $6.74 billion for the quarter, compared to the consensus estimate of $6.66 billion. Marriott International had a negative return on equity of 93.44% and a net margin of 9.60%.The firm's revenue for the quarter was up 4.7% compared to the same quarter last year. During the same period in the prior year, the business posted $2.50 earnings per share. Marriott International has set its FY 2025 guidance at 9.850-10.080 EPS. Q3 2025 guidance at 2.310-2.390 EPS. As a group, sell-side analysts expect that Marriott International, Inc. will post 10.1 earnings per share for the current fiscal year.

Marriott International declared that its board has authorized a stock repurchase plan on Thursday, August 7th that permits the company to repurchase 25,000,000 outstanding shares. This repurchase authorization permits the company to repurchase shares of its stock through open market purchases. Shares repurchase plans are often a sign that the company's board of directors believes its stock is undervalued.

Marriott International Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 30th. Shareholders of record on Thursday, August 21st were given a dividend of $0.67 per share. This represents a $2.68 dividend on an annualized basis and a yield of 1.0%. The ex-dividend date of this dividend was Thursday, August 21st. Marriott International's payout ratio is 30.21%.

Wall Street Analysts Forecast Growth

Several research analysts have weighed in on the stock. Weiss Ratings restated a "buy (b-)" rating on shares of Marriott International in a research report on Wednesday, October 8th. Barclays decreased their target price on Marriott International from $276.00 to $262.00 and set an "equal weight" rating on the stock in a research report on Friday, October 3rd. Truist Financial boosted their price objective on shares of Marriott International from $273.00 to $278.00 and gave the stock a "hold" rating in a research report on Wednesday, September 3rd. BMO Capital Markets cut their target price on shares of Marriott International from $285.00 to $280.00 and set a "market perform" rating for the company in a research report on Wednesday, August 6th. Finally, Robert W. Baird dropped their price objective on shares of Marriott International from $287.00 to $285.00 and set a "neutral" rating for the company in a research note on Tuesday. Two equities research analysts have rated the stock with a Strong Buy rating, seven have assigned a Buy rating and twelve have issued a Hold rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $283.17.

Check Out Our Latest Stock Report on MAR

Marriott International Company Profile

(

Free Report)

Marriott International, Inc engages in operating, franchising, and licensing hotel, residential, timeshare, and other lodging properties worldwide. It operates its properties under the JW Marriott, The Ritz-Carlton, The Luxury Collection, W Hotels, St. Regis, EDITION, Bvlgari, Marriott Hotels, Sheraton, Westin, Autograph Collection, Renaissance Hotels, Le Méridien, Delta Hotels by Marriott, Tribute Portfolio, Gaylord Hotels, Design Hotels, Marriott Executive Apartments, Apartments by Marriott Bonvoy, Courtyard by Marriott, Fairfield by Marriott, Residence Inn by Marriott, SpringHill Suites by Marriott, Four Points by Sheraton, TownePlace Suites by Marriott, Aloft Hotels, AC Hotels by Marriott, Moxy Hotels, Element Hotels, Protea Hotels by Marriott, City Express by Marriott, and St.

Further Reading

Want to see what other hedge funds are holding MAR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Marriott International, Inc. (NASDAQ:MAR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Marriott International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marriott International wasn't on the list.

While Marriott International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report