Groupe la Francaise lowered its holdings in shares of Chipotle Mexican Grill, Inc. (NYSE:CMG - Free Report) by 42.7% in the first quarter, according to its most recent disclosure with the SEC. The firm owned 229,623 shares of the restaurant operator's stock after selling 171,449 shares during the period. Groupe la Francaise's holdings in Chipotle Mexican Grill were worth $11,692,000 as of its most recent filing with the SEC.

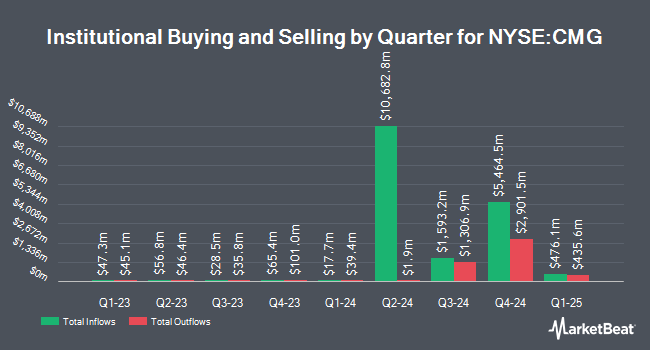

A number of other hedge funds and other institutional investors have also bought and sold shares of CMG. Nuveen LLC bought a new position in Chipotle Mexican Grill during the first quarter worth about $535,023,000. DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main lifted its position in Chipotle Mexican Grill by 4,138,574.1% during the fourth quarter. DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main now owns 8,318,735 shares of the restaurant operator's stock worth $501,620,000 after acquiring an additional 8,318,534 shares during the last quarter. Goldman Sachs Group Inc. lifted its position in Chipotle Mexican Grill by 98.1% during the first quarter. Goldman Sachs Group Inc. now owns 9,900,521 shares of the restaurant operator's stock worth $497,105,000 after acquiring an additional 4,903,969 shares during the last quarter. Montrusco Bolton Investments Inc. lifted its position in Chipotle Mexican Grill by 5,319.7% during the first quarter. Montrusco Bolton Investments Inc. now owns 4,848,990 shares of the restaurant operator's stock worth $235,580,000 after acquiring an additional 4,759,520 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD lifted its position in Chipotle Mexican Grill by 7.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 56,827,332 shares of the restaurant operator's stock worth $2,853,302,000 after acquiring an additional 4,027,016 shares during the last quarter. Institutional investors own 91.30% of the company's stock.

Chipotle Mexican Grill Price Performance

CMG traded up $0.24 during trading on Wednesday, hitting $42.76. 5,227,189 shares of the stock traded hands, compared to its average volume of 14,154,637. Chipotle Mexican Grill, Inc. has a twelve month low of $41.18 and a twelve month high of $66.74. The company has a market cap of $57.33 billion, a price-to-earnings ratio of 38.18, a PEG ratio of 2.17 and a beta of 1.05. The business has a 50 day moving average price of $49.23 and a 200 day moving average price of $50.37.

Chipotle Mexican Grill (NYSE:CMG - Get Free Report) last announced its quarterly earnings data on Wednesday, July 23rd. The restaurant operator reported $0.33 EPS for the quarter, beating the consensus estimate of $0.32 by $0.01. Chipotle Mexican Grill had a net margin of 13.32% and a return on equity of 43.50%. The business had revenue of $3.06 billion during the quarter, compared to the consensus estimate of $3.11 billion. During the same period in the previous year, the business earned $0.34 earnings per share. The company's revenue was up 3.0% on a year-over-year basis. On average, equities research analysts predict that Chipotle Mexican Grill, Inc. will post 1.29 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several equities research analysts have issued reports on the stock. Raymond James Financial cut their price objective on shares of Chipotle Mexican Grill from $60.00 to $56.00 and set an "outperform" rating for the company in a research report on Friday, August 15th. Barclays cut their price objective on shares of Chipotle Mexican Grill from $55.00 to $53.00 and set an "equal weight" rating for the company in a research report on Thursday, July 24th. TD Securities restated a "buy" rating and set a $57.00 price objective on shares of Chipotle Mexican Grill in a research report on Wednesday, June 18th. Wells Fargo & Company cut their price objective on shares of Chipotle Mexican Grill from $65.00 to $60.00 and set an "overweight" rating for the company in a research report on Thursday, July 24th. Finally, Melius started coverage on shares of Chipotle Mexican Grill in a research report on Monday, July 14th. They issued a "hold" rating and a $60.00 price target for the company. One equities research analyst has rated the stock with a Strong Buy rating, nineteen have issued a Buy rating and eight have issued a Hold rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $60.22.

Get Our Latest Stock Report on Chipotle Mexican Grill

Insider Buying and Selling at Chipotle Mexican Grill

In other Chipotle Mexican Grill news, insider Roger E. Theodoredis sold 113,875 shares of the business's stock in a transaction on Monday, June 2nd. The shares were sold at an average price of $49.70, for a total transaction of $5,659,587.50. Following the sale, the insider owned 109,815 shares of the company's stock, valued at approximately $5,457,805.50. The trade was a 50.91% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Insiders own 1.02% of the company's stock.

Chipotle Mexican Grill Company Profile

(

Free Report)

Chipotle Mexican Grill, Inc, together with its subsidiaries, owns and operates Chipotle Mexican Grill restaurants. It sells food and beverages through offering burritos, burrito bowls, quesadillas, tacos, and salads. The company also provides delivery and related services its app and website. It has operations in the United States, Canada, France, Germany, and the United Kingdom.

Read More

Before you consider Chipotle Mexican Grill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipotle Mexican Grill wasn't on the list.

While Chipotle Mexican Grill currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report