Motley Fool Wealth Management LLC cut its stake in shares of Guidewire Software, Inc. (NYSE:GWRE - Free Report) by 7.8% during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 51,659 shares of the technology company's stock after selling 4,356 shares during the quarter. Motley Fool Wealth Management LLC owned about 0.06% of Guidewire Software worth $9,679,000 at the end of the most recent quarter.

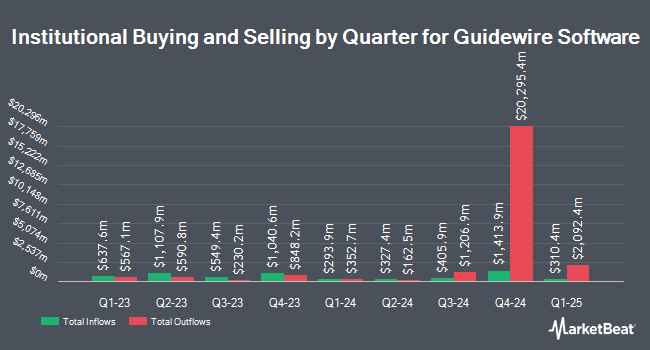

A number of other institutional investors and hedge funds have also made changes to their positions in the stock. Cerity Partners LLC grew its stake in Guidewire Software by 3.2% in the 4th quarter. Cerity Partners LLC now owns 22,506 shares of the technology company's stock valued at $3,836,000 after acquiring an additional 707 shares during the last quarter. Legal & General Group Plc grew its stake in Guidewire Software by 10.4% in the 4th quarter. Legal & General Group Plc now owns 144,478 shares of the technology company's stock valued at $24,356,000 after acquiring an additional 13,595 shares during the last quarter. FIL Ltd grew its stake in Guidewire Software by 27.3% in the 4th quarter. FIL Ltd now owns 28,000 shares of the technology company's stock valued at $4,720,000 after acquiring an additional 6,000 shares during the last quarter. Advisory Services Network LLC acquired a new stake in Guidewire Software in the 4th quarter valued at about $259,000. Finally, Scotia Capital Inc. grew its stake in Guidewire Software by 2.0% in the 4th quarter. Scotia Capital Inc. now owns 11,978 shares of the technology company's stock valued at $2,019,000 after acquiring an additional 230 shares during the last quarter.

Insider Transactions at Guidewire Software

In related news, President John P. Mullen sold 3,000 shares of the firm's stock in a transaction that occurred on Tuesday, July 1st. The shares were sold at an average price of $235.05, for a total value of $705,150.00. Following the transaction, the president owned 146,489 shares in the company, valued at approximately $34,432,239.45. This trade represents a 2.01% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, insider James Winston King sold 2,482 shares of the firm's stock in a transaction that occurred on Monday, July 14th. The shares were sold at an average price of $220.65, for a total transaction of $547,653.30. Following the completion of the transaction, the insider owned 37,441 shares in the company, valued at $8,261,356.65. The trade was a 6.22% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 24,342 shares of company stock worth $5,572,791 in the last three months. Company insiders own 0.48% of the company's stock.

Guidewire Software Trading Down 1.8%

Shares of GWRE stock opened at $213.46 on Monday. The firm has a market cap of $17.97 billion, a P/E ratio of 533.64, a PEG ratio of 15.04 and a beta of 1.16. Guidewire Software, Inc. has a 1-year low of $142.94 and a 1-year high of $263.20. The company has a debt-to-equity ratio of 0.49, a current ratio of 3.23 and a quick ratio of 3.23. The firm's 50-day simple moving average is $232.54 and its 200-day simple moving average is $211.52.

Guidewire Software (NYSE:GWRE - Get Free Report) last announced its quarterly earnings data on Tuesday, June 3rd. The technology company reported $0.88 earnings per share for the quarter, topping the consensus estimate of $0.47 by $0.41. The business had revenue of $293.51 million for the quarter, compared to analyst estimates of $286.40 million. Guidewire Software had a net margin of 3.04% and a return on equity of 6.96%. The company's revenue was up 22.0% on a year-over-year basis. During the same period in the prior year, the firm posted $0.26 EPS. As a group, equities analysts forecast that Guidewire Software, Inc. will post 0.52 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on GWRE shares. DA Davidson reissued a "neutral" rating and issued a $226.00 price objective on shares of Guidewire Software in a research note on Wednesday, June 4th. The Goldman Sachs Group increased their price objective on shares of Guidewire Software from $235.00 to $270.00 and gave the company a "buy" rating in a research note on Wednesday, June 4th. Royal Bank Of Canada reissued an "outperform" rating and issued a $290.00 price objective on shares of Guidewire Software in a research note on Monday, June 23rd. JPMorgan Chase & Co. raised their price target on shares of Guidewire Software from $271.00 to $288.00 and gave the stock an "overweight" rating in a research note on Wednesday, June 25th. Finally, Oppenheimer raised their price target on shares of Guidewire Software from $230.00 to $275.00 and gave the stock an "outperform" rating in a research note on Wednesday, June 4th. One research analyst has rated the stock with a sell rating, three have issued a hold rating and eleven have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $250.92.

Get Our Latest Analysis on GWRE

About Guidewire Software

(

Free Report)

Guidewire Software, Inc provides a platform for property and casualty (P&C) insurers worldwide. The company offers Guidewire InsuranceSuite Cloud, such as PolicyCenter Cloud, BillingCenter Cloud, and ClaimCenter Cloud applications. It also provides Guidewire InsuranceNow, a cloud-based platform that offers policy, billing, and claims management functionality to insurers; and Guidewire InsuranceSuite for Self-Managed.

Read More

Want to see what other hedge funds are holding GWRE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Guidewire Software, Inc. (NYSE:GWRE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Guidewire Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guidewire Software wasn't on the list.

While Guidewire Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.