QRG Capital Management Inc. lifted its stake in Haleon PLC Sponsored ADR (NYSE:HLN - Free Report) by 13.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 513,162 shares of the company's stock after purchasing an additional 61,194 shares during the quarter. QRG Capital Management Inc.'s holdings in Haleon were worth $5,321,000 at the end of the most recent reporting period.

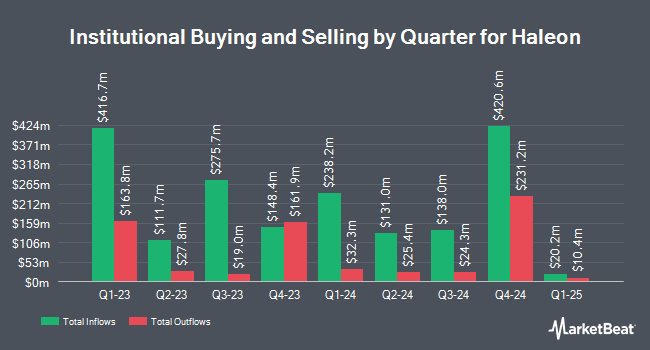

Several other hedge funds and other institutional investors have also recently made changes to their positions in HLN. Hanson & Doremus Investment Management increased its holdings in shares of Haleon by 234.1% in the second quarter. Hanson & Doremus Investment Management now owns 2,372 shares of the company's stock valued at $25,000 after purchasing an additional 1,662 shares during the last quarter. Bartlett & CO. Wealth Management LLC increased its stake in Haleon by 135.9% during the first quarter. Bartlett & CO. Wealth Management LLC now owns 2,588 shares of the company's stock worth $27,000 after acquiring an additional 1,491 shares during the last quarter. Banque Transatlantique SA acquired a new stake in Haleon during the first quarter worth $27,000. Opal Wealth Advisors LLC acquired a new stake in Haleon during the first quarter worth $29,000. Finally, Ransom Advisory Ltd acquired a new stake in Haleon during the first quarter worth $31,000. Institutional investors and hedge funds own 6.67% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have issued reports on HLN. Weiss Ratings reissued a "hold (c)" rating on shares of Haleon in a research note on Saturday, September 27th. Barclays cut Haleon from an "overweight" rating to an "equal weight" rating in a research note on Tuesday, September 16th. Wall Street Zen cut Haleon from a "buy" rating to a "hold" rating in a research note on Saturday, July 12th. Finally, The Goldman Sachs Group raised Haleon from a "neutral" rating to a "buy" rating in a research note on Wednesday, September 10th. One investment analyst has rated the stock with a Strong Buy rating, three have issued a Buy rating and six have given a Hold rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $12.33.

View Our Latest Stock Report on HLN

Haleon Trading Up 0.6%

Shares of NYSE HLN opened at $8.94 on Monday. Haleon PLC Sponsored ADR has a twelve month low of $8.71 and a twelve month high of $11.42. The company has a current ratio of 0.87, a quick ratio of 0.63 and a debt-to-equity ratio of 0.48. The stock has a fifty day simple moving average of $9.50 and a 200-day simple moving average of $10.07. The stock has a market capitalization of $39.81 billion, a PE ratio of 22.91, a PEG ratio of 2.65 and a beta of 0.20.

Haleon Increases Dividend

The business also recently announced a semi-annual dividend, which was paid on Thursday, September 18th. Investors of record on Friday, August 15th were paid a dividend of $0.0555 per share. This represents a yield of 190.0%. The ex-dividend date of this dividend was Friday, August 15th. This is a positive change from Haleon's previous semi-annual dividend of $0.05. Haleon's payout ratio is presently 28.21%.

Haleon Profile

(

Free Report)

Haleon plc, together with its subsidiaries, engages in the research, development, manufacture, and sale of various consumer healthcare products in North America, Europe, the Middle East, Africa, Latin America, and the Asia Pacific. The company provides oral health products, such as toothpastes, mouth washes, and denture care products under the Sensodyne, Polident, Parodontax, Biotene brands; and vitamins, minerals, and supplements under Centrum, Emergen-C, Caltrate brands.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Haleon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haleon wasn't on the list.

While Haleon currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.