Hancock Whitney Corp purchased a new position in shares of First Financial Bankshares, Inc. (NASDAQ:FFIN - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 15,277 shares of the bank's stock, valued at approximately $549,000.

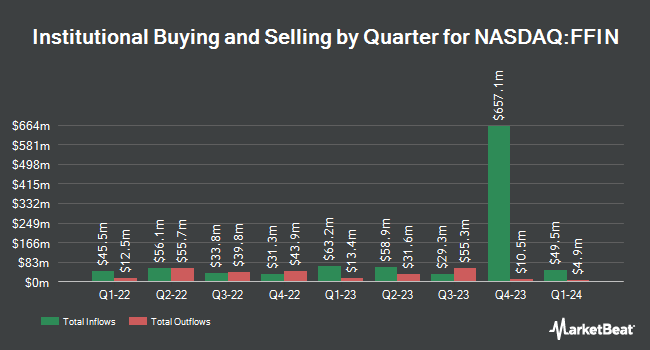

Several other institutional investors have also modified their holdings of the company. State of Michigan Retirement System grew its position in shares of First Financial Bankshares by 1.0% during the first quarter. State of Michigan Retirement System now owns 30,763 shares of the bank's stock worth $1,105,000 after acquiring an additional 300 shares during the last quarter. Louisiana State Employees Retirement System grew its position in shares of First Financial Bankshares by 0.8% during the first quarter. Louisiana State Employees Retirement System now owns 36,000 shares of the bank's stock worth $1,293,000 after acquiring an additional 300 shares during the last quarter. Numerai GP LLC grew its position in shares of First Financial Bankshares by 1.8% during the fourth quarter. Numerai GP LLC now owns 18,033 shares of the bank's stock worth $650,000 after acquiring an additional 312 shares during the last quarter. 49 Wealth Management LLC grew its position in shares of First Financial Bankshares by 4.7% during the fourth quarter. 49 Wealth Management LLC now owns 7,825 shares of the bank's stock worth $282,000 after acquiring an additional 350 shares during the last quarter. Finally, KBC Group NV grew its position in shares of First Financial Bankshares by 6.8% during the first quarter. KBC Group NV now owns 5,792 shares of the bank's stock worth $208,000 after acquiring an additional 370 shares during the last quarter. Institutional investors own 69.78% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently commented on the stock. Keefe, Bruyette & Woods upped their price target on shares of First Financial Bankshares from $36.00 to $38.00 and gave the stock a "market perform" rating in a research report on Friday, July 18th. Cantor Fitzgerald began coverage on shares of First Financial Bankshares in a report on Wednesday. They issued a "neutral" rating and a $39.00 price objective for the company. Finally, Hovde Group upped their price objective on shares of First Financial Bankshares from $38.00 to $39.00 and gave the stock a "market perform" rating in a report on Monday, July 21st. Five investment analysts have rated the stock with a Hold rating, Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $39.20.

View Our Latest Report on First Financial Bankshares

First Financial Bankshares Stock Performance

NASDAQ FFIN traded down $0.10 on Friday, reaching $36.00. The company's stock had a trading volume of 111,149 shares, compared to its average volume of 529,449. First Financial Bankshares, Inc. has a twelve month low of $30.58 and a twelve month high of $44.66. The stock has a market cap of $5.15 billion, a PE ratio of 20.93 and a beta of 0.89. The firm's 50 day moving average is $36.24 and its two-hundred day moving average is $35.49.

First Financial Bankshares (NASDAQ:FFIN - Get Free Report) last posted its quarterly earnings data on Thursday, July 17th. The bank reported $0.47 EPS for the quarter, beating analysts' consensus estimates of $0.45 by $0.02. First Financial Bankshares had a net margin of 31.01% and a return on equity of 14.69%. The company had revenue of $156.60 million during the quarter, compared to analyst estimates of $156.41 million. During the same period in the prior year, the firm earned $0.37 earnings per share. Equities research analysts anticipate that First Financial Bankshares, Inc. will post 1.78 EPS for the current fiscal year.

First Financial Bankshares Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, October 1st. Stockholders of record on Monday, September 15th will be issued a $0.19 dividend. The ex-dividend date is Monday, September 15th. This represents a $0.76 dividend on an annualized basis and a dividend yield of 2.1%. First Financial Bankshares's dividend payout ratio is currently 44.19%.

About First Financial Bankshares

(

Free Report)

First Financial Bankshares, Inc, through its subsidiaries, provides commercial banking products and services in Texas. The company offers checking, savings and time deposits; automated teller machines, drive-in, and night deposit services; safe deposit facilities, remote deposit capture, internet banking, mobile banking, payroll cards, funds transfer, and performing other customary commercial banking services; securities brokerage services; and trust and wealth management services, including wealth management, estates administration, oil and gas management, testamentary trusts, revocable and irrevocable trusts, and agency accounts.

See Also

Before you consider First Financial Bankshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Financial Bankshares wasn't on the list.

While First Financial Bankshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.