Harbor Asset Planning Inc. acquired a new stake in The Home Depot, Inc. (NYSE:HD - Free Report) in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 1,863 shares of the home improvement retailer's stock, valued at approximately $683,000.

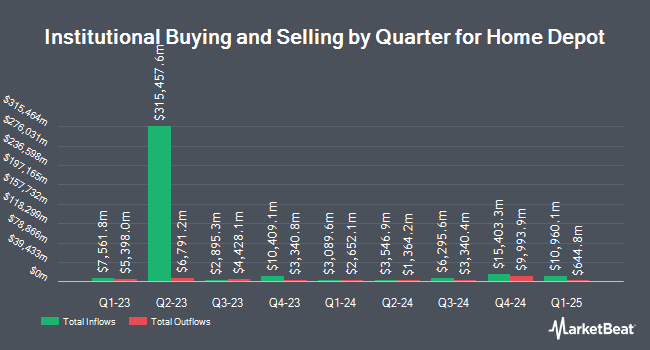

Several other hedge funds and other institutional investors have also made changes to their positions in the business. Vanguard Group Inc. boosted its stake in shares of Home Depot by 0.8% in the first quarter. Vanguard Group Inc. now owns 96,484,199 shares of the home improvement retailer's stock valued at $35,360,494,000 after purchasing an additional 720,447 shares during the period. Asset Planning Services Inc. LA ADV boosted its stake in shares of Home Depot by 99,400.7% in the first quarter. Asset Planning Services Inc. LA ADV now owns 18,975,772 shares of the home improvement retailer's stock valued at $6,954,431,000 after purchasing an additional 18,956,701 shares during the period. Charles Schwab Investment Management Inc. lifted its stake in Home Depot by 6.6% in the first quarter. Charles Schwab Investment Management Inc. now owns 14,415,278 shares of the home improvement retailer's stock worth $5,282,398,000 after acquiring an additional 891,326 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its stake in Home Depot by 19.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 9,253,292 shares of the home improvement retailer's stock worth $3,391,240,000 after acquiring an additional 1,494,261 shares during the last quarter. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its stake in Home Depot by 5.6% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 8,949,404 shares of the home improvement retailer's stock worth $3,279,867,000 after acquiring an additional 477,192 shares during the last quarter. Hedge funds and other institutional investors own 70.86% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on HD. Robert W. Baird lifted their price target on shares of Home Depot from $425.00 to $450.00 and gave the stock an "outperform" rating in a research note on Wednesday, August 20th. Wolfe Research began coverage on shares of Home Depot in a research note on Thursday, September 18th. They issued an "outperform" rating and a $497.00 price target for the company. Oppenheimer lifted their price target on shares of Home Depot from $400.00 to $420.00 and gave the stock a "market perform" rating in a research note on Thursday, September 25th. Weiss Ratings reiterated a "buy (b)" rating on shares of Home Depot in a research note on Wednesday, October 8th. Finally, Wells Fargo & Company lifted their price target on shares of Home Depot from $420.00 to $450.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 20th. One analyst has rated the stock with a Strong Buy rating, nineteen have issued a Buy rating and six have given a Hold rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $435.42.

Read Our Latest Stock Report on HD

Home Depot Stock Down 0.2%

Shares of NYSE:HD opened at $387.40 on Friday. The company has a market capitalization of $385.61 billion, a PE ratio of 26.32, a P/E/G ratio of 3.68 and a beta of 1.00. The company has a current ratio of 1.15, a quick ratio of 0.34 and a debt-to-equity ratio of 4.31. The Home Depot, Inc. has a twelve month low of $326.31 and a twelve month high of $439.37. The firm has a 50 day simple moving average of $403.62 and a 200-day simple moving average of $377.73.

Home Depot (NYSE:HD - Get Free Report) last announced its earnings results on Tuesday, August 19th. The home improvement retailer reported $4.68 EPS for the quarter, missing analysts' consensus estimates of $4.69 by ($0.01). The business had revenue of $45.28 billion during the quarter, compared to analyst estimates of $45.43 billion. Home Depot had a net margin of 8.86% and a return on equity of 193.99%. The business's revenue was up 4.9% compared to the same quarter last year. During the same period in the previous year, the firm earned $4.60 earnings per share. Home Depot has set its FY 2025 guidance at 14.940-14.940 EPS. On average, equities analysts predict that The Home Depot, Inc. will post 15.13 EPS for the current fiscal year.

Home Depot Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, September 18th. Stockholders of record on Thursday, September 4th were issued a $2.30 dividend. This represents a $9.20 dividend on an annualized basis and a dividend yield of 2.4%. The ex-dividend date of this dividend was Thursday, September 4th. Home Depot's payout ratio is presently 62.50%.

Insiders Place Their Bets

In other news, EVP William D. Bastek sold 3,783 shares of Home Depot stock in a transaction on Friday, August 22nd. The shares were sold at an average price of $410.23, for a total value of $1,551,900.09. Following the transaction, the executive vice president directly owned 24,235 shares of the company's stock, valued at $9,941,924.05. The trade was a 13.50% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, CEO Edward P. Decker sold 32,897 shares of Home Depot stock in a transaction on Thursday, August 21st. The shares were sold at an average price of $397.22, for a total transaction of $13,067,346.34. Following the completion of the transaction, the chief executive officer directly owned 122,425 shares in the company, valued at $48,629,658.50. The trade was a 21.18% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 48,835 shares of company stock worth $19,623,432. Corporate insiders own 0.10% of the company's stock.

Home Depot Profile

(

Free Report)

The Home Depot, Inc operates as a home improvement retailer in the United States and internationally. It sells various building materials, home improvement products, lawn and garden products, and décor products, as well as facilities maintenance, repair, and operations products. The company also offers installation services for flooring, water heaters, bath, garage doors, cabinets, cabinet makeovers, countertops, sheds, furnaces and central air systems, and windows.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report