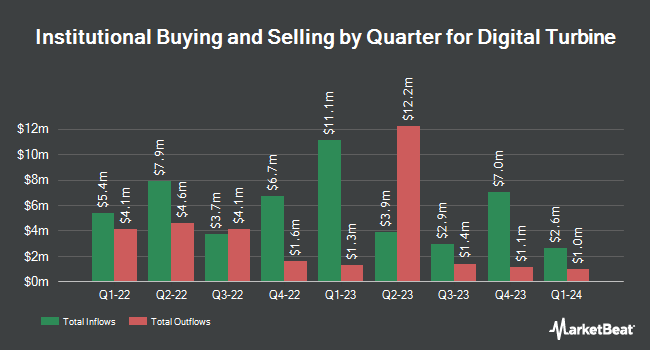

Harbor Capital Advisors Inc. acquired a new position in Digital Turbine, Inc. (NASDAQ:APPS - Free Report) in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 2,039,091 shares of the software maker's stock, valued at approximately $12,031,000. Harbor Capital Advisors Inc. owned approximately 1.91% of Digital Turbine as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in APPS. Strs Ohio acquired a new position in shares of Digital Turbine during the first quarter worth about $41,000. Caitong International Asset Management Co. Ltd bought a new position in shares of Digital Turbine in the 1st quarter worth about $45,000. Thompson Davis & CO. Inc. acquired a new position in Digital Turbine during the 1st quarter valued at about $47,000. Hsbc Holdings PLC purchased a new position in shares of Digital Turbine in the first quarter worth approximately $51,000. Finally, Pallas Capital Advisors LLC acquired a new stake in Digital Turbine in the first quarter valued at approximately $58,000. 63.66% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several research analysts have recently issued reports on the company. Wall Street Zen downgraded Digital Turbine from a "buy" rating to a "hold" rating in a research note on Saturday, August 9th. Bank of America upgraded Digital Turbine from an "underperform" rating to a "neutral" rating and boosted their target price for the stock from $4.50 to $5.50 in a research report on Wednesday, August 6th. Finally, Craig Hallum increased their target price on Digital Turbine from $7.00 to $8.00 and gave the stock a "buy" rating in a research note on Wednesday, August 6th. One equities research analyst has rated the stock with a Buy rating and two have given a Hold rating to the company's stock. According to MarketBeat, Digital Turbine currently has a consensus rating of "Hold" and a consensus target price of $5.17.

View Our Latest Research Report on Digital Turbine

Digital Turbine Trading Up 3.4%

NASDAQ:APPS traded up $0.18 during midday trading on Friday, reaching $5.52. 3,985,812 shares of the stock traded hands, compared to its average volume of 2,944,966. Digital Turbine, Inc. has a 12 month low of $1.18 and a 12 month high of $7.77. The company has a debt-to-equity ratio of 2.63, a quick ratio of 1.09 and a current ratio of 1.09. The company has a fifty day moving average of $4.75 and a 200 day moving average of $4.30. The stock has a market capitalization of $598.26 million, a P/E ratio of -7.17, a PEG ratio of 3.41 and a beta of 2.29.

Digital Turbine (NASDAQ:APPS - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The software maker reported $0.05 earnings per share for the quarter, missing the consensus estimate of $0.10 by ($0.05). Digital Turbine had a negative net margin of 15.93% and a positive return on equity of 2.24%. The firm had revenue of $130.93 million for the quarter, compared to analysts' expectations of $121.94 million. Digital Turbine has set its FY 2026 guidance at EPS. On average, research analysts predict that Digital Turbine, Inc. will post -0.03 EPS for the current year.

Digital Turbine Profile

(

Free Report)

Digital Turbine, Inc, through its subsidiaries, operates a mobile growth platform for advertisers, publishers, carriers, and device original equipment manufacturers (OEMs). The company operates through two segments, On Device Solutions and App Growth Platform. Its application media platform delivers mobile applications to various publishers, carriers, OEMs, and devices; and content media platform offers news, weather, sports, and other content, as well as programmatic advertising and media content delivery services, and sponsored and editorial content media.

Recommended Stories

Before you consider Digital Turbine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digital Turbine wasn't on the list.

While Digital Turbine currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.