Hardy Reed LLC purchased a new position in shares of Thor Industries, Inc. (NYSE:THO - Free Report) during the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm purchased 2,413 shares of the RV manufacturer's stock, valued at approximately $214,000.

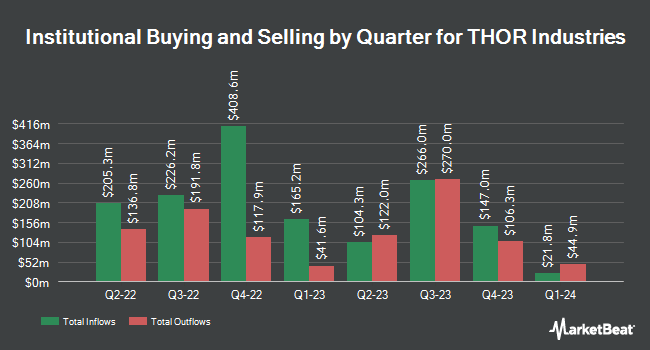

Several other large investors also recently bought and sold shares of the stock. UMB Bank n.a. grew its holdings in shares of Thor Industries by 135.6% during the first quarter. UMB Bank n.a. now owns 483 shares of the RV manufacturer's stock worth $37,000 after purchasing an additional 278 shares during the last quarter. Signaturefd LLC boosted its holdings in shares of Thor Industries by 86.6% in the second quarter. Signaturefd LLC now owns 446 shares of the RV manufacturer's stock valued at $40,000 after acquiring an additional 207 shares during the period. Parallel Advisors LLC grew its position in shares of Thor Industries by 198.3% during the second quarter. Parallel Advisors LLC now owns 516 shares of the RV manufacturer's stock worth $46,000 after acquiring an additional 343 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. increased its holdings in shares of Thor Industries by 66.6% in the 2nd quarter. Mirae Asset Global Investments Co. Ltd. now owns 563 shares of the RV manufacturer's stock valued at $50,000 after acquiring an additional 225 shares during the period. Finally, Whittier Trust Co. of Nevada Inc. boosted its stake in shares of Thor Industries by 96.3% during the first quarter. Whittier Trust Co. of Nevada Inc. now owns 805 shares of the RV manufacturer's stock worth $61,000 after buying an additional 395 shares during the period. Institutional investors and hedge funds own 96.71% of the company's stock.

Thor Industries Trading Down 2.4%

NYSE THO opened at $106.50 on Tuesday. Thor Industries, Inc. has a 52 week low of $63.15 and a 52 week high of $118.85. The stock has a market cap of $5.61 billion, a P/E ratio of 25.54, a PEG ratio of 1.87 and a beta of 1.35. The company has a current ratio of 1.75, a quick ratio of 0.90 and a debt-to-equity ratio of 0.21. The company's fifty day simple moving average is $104.53 and its 200-day simple moving average is $89.64.

Thor Industries announced that its Board of Directors has authorized a share repurchase program on Monday, June 23rd that authorizes the company to buyback $400.00 million in outstanding shares. This buyback authorization authorizes the RV manufacturer to purchase up to 8.8% of its stock through open market purchases. Stock buyback programs are often a sign that the company's management believes its shares are undervalued.

Wall Street Analyst Weigh In

Several brokerages have weighed in on THO. Truist Financial lifted their target price on Thor Industries from $86.00 to $115.00 and gave the company a "hold" rating in a research note on Wednesday, September 3rd. Zacks Research raised Thor Industries from a "strong sell" rating to a "hold" rating in a report on Wednesday, September 3rd. DA Davidson upped their price objective on Thor Industries from $78.00 to $102.00 and gave the stock a "neutral" rating in a report on Tuesday, September 30th. Robert W. Baird upped their price target on shares of Thor Industries from $90.00 to $110.00 and gave the stock a "neutral" rating in a research note on Thursday, September 25th. Finally, Bank of America increased their target price on shares of Thor Industries from $100.00 to $120.00 and gave the company a "buy" rating in a report on Wednesday, September 10th. Two analysts have rated the stock with a Buy rating and ten have assigned a Hold rating to the company. According to MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $105.25.

Get Our Latest Stock Report on THO

About Thor Industries

(

Free Report)

THOR Industries, Inc designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Canada, and Europe. The company offers travel trailers; gasoline and diesel Class A, Class B, and Class C motorhomes; conventional travel trailers and fifth wheels; luxury fifth wheels; and motorcaravans, caravans, campervans, and urban vehicles.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Thor Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thor Industries wasn't on the list.

While Thor Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.