Harvest Portfolios Group Inc. trimmed its holdings in IREN Limited (NASDAQ:IREN - Free Report) by 34.1% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 46,016 shares of the company's stock after selling 23,785 shares during the quarter. Harvest Portfolios Group Inc.'s holdings in IREN were worth $280,000 at the end of the most recent reporting period.

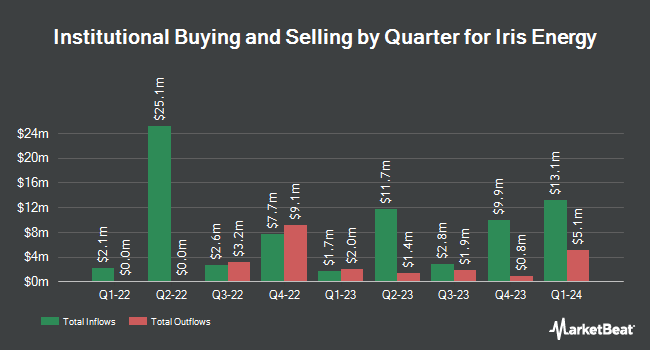

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the business. Vident Advisory LLC grew its holdings in IREN by 26.1% in the 4th quarter. Vident Advisory LLC now owns 2,937,918 shares of the company's stock worth $28,850,000 after buying an additional 608,736 shares in the last quarter. Regal Partners Ltd grew its holdings in IREN by 93.9% in the 4th quarter. Regal Partners Ltd now owns 1,697,554 shares of the company's stock worth $16,670,000 after buying an additional 822,251 shares in the last quarter. Two Sigma Investments LP grew its holdings in IREN by 193.2% in the 4th quarter. Two Sigma Investments LP now owns 1,602,642 shares of the company's stock worth $15,738,000 after buying an additional 1,056,005 shares in the last quarter. Exchange Traded Concepts LLC grew its holdings in IREN by 46.8% in the 1st quarter. Exchange Traded Concepts LLC now owns 1,020,084 shares of the company's stock worth $6,212,000 after buying an additional 325,327 shares in the last quarter. Finally, Two Seas Capital LP grew its holdings in IREN by 212.7% in the 4th quarter. Two Seas Capital LP now owns 860,000 shares of the company's stock worth $8,445,000 after buying an additional 585,000 shares in the last quarter. 41.08% of the stock is owned by institutional investors.

IREN Stock Up 14.9%

Shares of NASDAQ:IREN traded up $3.44 during midday trading on Monday, hitting $26.48. 76,287,263 shares of the stock were exchanged, compared to its average volume of 24,413,336. The company has a debt-to-equity ratio of 0.53, a quick ratio of 4.29 and a current ratio of 4.29. IREN Limited has a 52-week low of $5.13 and a 52-week high of $29.50. The business's fifty day simple moving average is $17.65 and its two-hundred day simple moving average is $11.28. The company has a market capitalization of $4.97 billion, a PE ratio of 44.88 and a beta of 4.03.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on IREN. JPMorgan Chase & Co. reaffirmed a "neutral" rating and set a $16.00 price target (up from $12.00) on shares of IREN in a research note on Monday, July 28th. Macquarie increased their price target on IREN from $20.00 to $33.00 and gave the company an "outperform" rating in a research note on Friday. Cantor Fitzgerald increased their price target on IREN from $27.00 to $41.00 and gave the company an "overweight" rating in a research note on Friday. B. Riley increased their price target on IREN from $22.00 to $29.00 and gave the company a "buy" rating in a research note on Friday. Finally, Roth Capital reaffirmed a "buy" rating on shares of IREN in a research note on Friday. Eight equities research analysts have rated the stock with a Buy rating and two have given a Hold rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $29.88.

Read Our Latest Research Report on IREN

IREN Company Profile

(

Free Report)

IREN Limited, formerly known as Iris Energy Limited, owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

Featured Articles

Before you consider IREN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IREN wasn't on the list.

While IREN currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.