HB Wealth Management LLC increased its stake in shares of CMS Energy Corporation (NYSE:CMS - Free Report) by 20.1% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 27,919 shares of the utilities provider's stock after acquiring an additional 4,665 shares during the period. HB Wealth Management LLC's holdings in CMS Energy were worth $2,097,000 as of its most recent filing with the Securities & Exchange Commission.

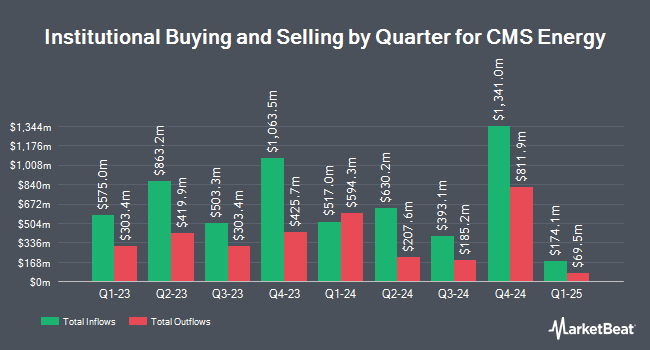

Several other institutional investors and hedge funds have also recently modified their holdings of CMS. Sigma Planning Corp grew its holdings in CMS Energy by 0.4% in the first quarter. Sigma Planning Corp now owns 32,045 shares of the utilities provider's stock valued at $2,407,000 after purchasing an additional 142 shares during the period. Sage Mountain Advisors LLC raised its stake in CMS Energy by 4.5% during the first quarter. Sage Mountain Advisors LLC now owns 3,360 shares of the utilities provider's stock worth $252,000 after purchasing an additional 144 shares during the period. Sumitomo Life Insurance Co. boosted its holdings in shares of CMS Energy by 1.3% in the 1st quarter. Sumitomo Life Insurance Co. now owns 11,233 shares of the utilities provider's stock valued at $844,000 after purchasing an additional 146 shares during the last quarter. Spire Wealth Management grew its stake in shares of CMS Energy by 6.4% during the 1st quarter. Spire Wealth Management now owns 2,550 shares of the utilities provider's stock valued at $191,000 after buying an additional 154 shares during the period. Finally, Private Trust Co. NA increased its holdings in shares of CMS Energy by 14.4% during the 1st quarter. Private Trust Co. NA now owns 1,466 shares of the utilities provider's stock worth $110,000 after buying an additional 185 shares during the last quarter. Hedge funds and other institutional investors own 93.57% of the company's stock.

CMS Energy Stock Performance

CMS traded up $0.40 on Friday, hitting $74.20. 1,104,406 shares of the company's stock were exchanged, compared to its average volume of 2,482,815. The company has a current ratio of 1.06, a quick ratio of 0.84 and a debt-to-equity ratio of 1.87. The stock has a fifty day moving average of $70.39 and a two-hundred day moving average of $70.88. The firm has a market cap of $22.19 billion, a PE ratio of 22.00, a P/E/G ratio of 2.68 and a beta of 0.38. CMS Energy Corporation has a twelve month low of $63.97 and a twelve month high of $76.45.

CMS Energy (NYSE:CMS - Get Free Report) last posted its earnings results on Thursday, July 31st. The utilities provider reported $0.71 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.67 by $0.04. The company had revenue of $1.84 billion for the quarter, compared to analysts' expectations of $1.68 billion. CMS Energy had a return on equity of 12.06% and a net margin of 13.10%. The firm's quarterly revenue was up 14.4% compared to the same quarter last year. During the same period last year, the business posted $0.66 earnings per share. On average, research analysts anticipate that CMS Energy Corporation will post 3.59 earnings per share for the current fiscal year.

CMS Energy Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, August 29th. Investors of record on Friday, August 8th will be given a $0.5425 dividend. This represents a $2.17 dividend on an annualized basis and a yield of 2.9%. The ex-dividend date is Friday, August 8th. CMS Energy's dividend payout ratio is currently 64.39%.

Analyst Ratings Changes

CMS has been the topic of a number of research analyst reports. Wells Fargo & Company lifted their target price on CMS Energy from $78.00 to $82.00 and gave the company an "overweight" rating in a report on Friday, April 25th. Jefferies Financial Group boosted their target price on CMS Energy from $77.00 to $83.00 and gave the stock a "buy" rating in a report on Monday, April 21st. Scotiabank reissued an "outperform" rating and set a $81.00 target price (up previously from $77.00) on shares of CMS Energy in a research report on Friday, April 25th. Evercore ISI lifted their price target on shares of CMS Energy from $73.00 to $76.00 and gave the company an "in-line" rating in a research report on Monday, April 28th. Finally, Barclays raised their target price on shares of CMS Energy from $77.00 to $78.00 and gave the company an "overweight" rating in a research note on Tuesday, July 22nd. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $77.25.

View Our Latest Report on CMS Energy

Insider Transactions at CMS Energy

In other CMS Energy news, SVP Brandon J. Hofmeister sold 2,198 shares of the stock in a transaction on Tuesday, May 6th. The stock was sold at an average price of $73.61, for a total transaction of $161,794.78. Following the completion of the transaction, the senior vice president directly owned 69,571 shares of the company's stock, valued at approximately $5,121,121.31. This trade represents a 3.06% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 0.40% of the stock is owned by corporate insiders.

CMS Energy Company Profile

(

Free Report)

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources.

See Also

Before you consider CMS Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CMS Energy wasn't on the list.

While CMS Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.