HBK Investments L P decreased its holdings in Dutch Bros Inc. (NYSE:BROS - Free Report) by 33.3% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 200,000 shares of the company's stock after selling 100,000 shares during the quarter. HBK Investments L P owned approximately 0.13% of Dutch Bros worth $12,348,000 as of its most recent filing with the SEC.

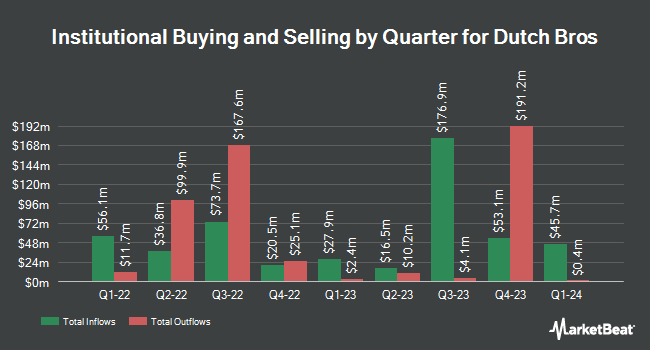

Other institutional investors have also modified their holdings of the company. AdvisorNet Financial Inc acquired a new position in shares of Dutch Bros in the first quarter worth about $31,000. Cullen Frost Bankers Inc. acquired a new position in shares of Dutch Bros in the first quarter worth about $31,000. Gould Capital LLC lifted its stake in shares of Dutch Bros by 20.4% in the fourth quarter. Gould Capital LLC now owns 826 shares of the company's stock worth $43,000 after acquiring an additional 140 shares in the last quarter. Bernard Wealth Management Corp. acquired a new position in shares of Dutch Bros in the fourth quarter worth about $43,000. Finally, GAMMA Investing LLC lifted its stake in shares of Dutch Bros by 85.3% in the first quarter. GAMMA Investing LLC now owns 821 shares of the company's stock worth $51,000 after acquiring an additional 378 shares in the last quarter. Institutional investors and hedge funds own 85.54% of the company's stock.

Insider Buying and Selling

In related news, Chairman Travis Boersma sold 1,250,371 shares of the stock in a transaction that occurred on Friday, August 22nd. The stock was sold at an average price of $65.17, for a total value of $81,486,678.07. Following the completion of the transaction, the chairman directly owned 1,279,144 shares of the company's stock, valued at $83,361,814.48. This represents a 49.43% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, major shareholder Dm Individual Aggregator, Llc sold 482,750 shares of the stock in a transaction that occurred on Friday, August 22nd. The stock was sold at an average price of $65.17, for a total value of $31,460,817.50. Following the completion of the transaction, the insider directly owned 1,279,144 shares of the company's stock, valued at $83,361,814.48. This trade represents a 27.40% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 3,161,101 shares of company stock valued at $207,633,882 over the last three months. Corporate insiders own 42.40% of the company's stock.

Analyst Upgrades and Downgrades

BROS has been the topic of several research reports. CICC Research initiated coverage on Dutch Bros in a research note on Monday, June 30th. They set an "outperform" rating and a $80.00 price objective on the stock. Royal Bank Of Canada upped their price objective on Dutch Bros from $83.00 to $85.00 and gave the company an "outperform" rating in a research note on Thursday, August 7th. Bank of America upped their price objective on Dutch Bros from $80.00 to $84.00 and gave the company an "overweight" rating in a research note on Thursday, August 7th. Melius Research upgraded Dutch Bros to a "strong-buy" rating in a research note on Monday, July 14th. Finally, The Goldman Sachs Group initiated coverage on Dutch Bros in a research note on Thursday, June 26th. They set a "neutral" rating and a $75.00 price objective on the stock. Two analysts have rated the stock with a Strong Buy rating, sixteen have issued a Buy rating and two have given a Hold rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average target price of $80.06.

Check Out Our Latest Stock Report on BROS

Dutch Bros Stock Performance

Shares of NYSE:BROS traded down $5.40 during trading on Friday, hitting $66.03. 6,117,093 shares of the company traded hands, compared to its average volume of 3,301,563. The stock has a market capitalization of $10.86 billion, a price-to-earnings ratio of 140.49, a PEG ratio of 4.01 and a beta of 2.64. The business's fifty day moving average is $65.12 and its 200-day moving average is $65.74. Dutch Bros Inc. has a one year low of $30.49 and a one year high of $86.88. The company has a quick ratio of 1.42, a current ratio of 1.64 and a debt-to-equity ratio of 0.69.

Dutch Bros (NYSE:BROS - Get Free Report) last posted its earnings results on Wednesday, August 6th. The company reported $0.26 EPS for the quarter, beating the consensus estimate of $0.18 by $0.08. Dutch Bros had a return on equity of 8.86% and a net margin of 3.94%.The company had revenue of $415.81 million during the quarter, compared to analyst estimates of $403.24 million. During the same period in the prior year, the company earned $0.19 earnings per share. The business's revenue was up 28.0% compared to the same quarter last year. As a group, equities analysts predict that Dutch Bros Inc. will post 0.57 earnings per share for the current fiscal year.

About Dutch Bros

(

Free Report)

Dutch Bros Inc, together with its subsidiaries, operates and franchises drive-thru shops in the United States. The company operates through Company-Operated Shops and Franchising and Other segments. It serves through company-operated shops and online channels under Dutch Bros; Dutch Bros Coffee; Dutch Bros Rebel; Dutch Bros; and Blue Rebel brands.

Featured Stories

Before you consider Dutch Bros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dutch Bros wasn't on the list.

While Dutch Bros currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.