Headlands Technologies LLC boosted its holdings in Ecolab Inc. (NYSE:ECL - Free Report) by 37.7% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 12,744 shares of the basic materials company's stock after acquiring an additional 3,488 shares during the quarter. Headlands Technologies LLC's holdings in Ecolab were worth $3,231,000 as of its most recent filing with the SEC.

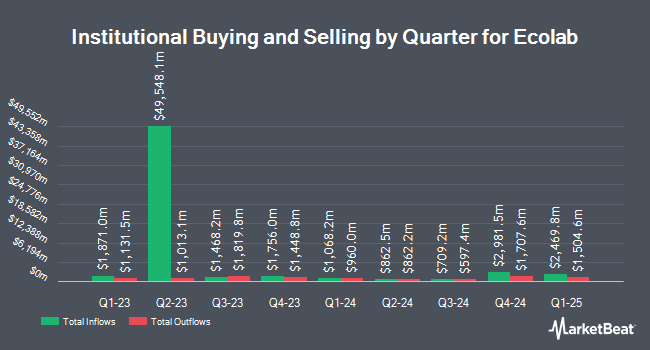

Other large investors have also recently bought and sold shares of the company. Forum Financial Management LP grew its holdings in Ecolab by 2.8% in the 1st quarter. Forum Financial Management LP now owns 1,449 shares of the basic materials company's stock valued at $367,000 after buying an additional 40 shares during the period. Belpointe Asset Management LLC grew its holdings in Ecolab by 1.5% in the 4th quarter. Belpointe Asset Management LLC now owns 2,980 shares of the basic materials company's stock valued at $755,000 after buying an additional 43 shares during the period. Palumbo Wealth Management LLC lifted its stake in shares of Ecolab by 5.0% in the 1st quarter. Palumbo Wealth Management LLC now owns 902 shares of the basic materials company's stock valued at $229,000 after purchasing an additional 43 shares in the last quarter. Kirtland Hills Capital Management LLC lifted its stake in shares of Ecolab by 2.0% in the 1st quarter. Kirtland Hills Capital Management LLC now owns 2,199 shares of the basic materials company's stock valued at $525,000 after purchasing an additional 43 shares in the last quarter. Finally, Blue Trust Inc. lifted its stake in shares of Ecolab by 1.8% in the 1st quarter. Blue Trust Inc. now owns 2,774 shares of the basic materials company's stock valued at $703,000 after purchasing an additional 48 shares in the last quarter. Hedge funds and other institutional investors own 74.91% of the company's stock.

Ecolab Stock Up 1.1%

Shares of ECL traded up $3.06 during trading on Friday, reaching $272.83. The company's stock had a trading volume of 833,178 shares, compared to its average volume of 1,143,075. The company has a fifty day moving average of $267.21 and a two-hundred day moving average of $257.51. Ecolab Inc. has a twelve month low of $221.62 and a twelve month high of $274.17. The company has a market cap of $77.38 billion, a price-to-earnings ratio of 36.43, a P/E/G ratio of 2.76 and a beta of 1.06. The company has a quick ratio of 1.12, a current ratio of 1.44 and a debt-to-equity ratio of 0.80.

Ecolab (NYSE:ECL - Get Free Report) last announced its earnings results on Tuesday, July 29th. The basic materials company reported $1.89 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.90 by ($0.01). Ecolab had a net margin of 13.59% and a return on equity of 22.52%. The business had revenue of $4.03 billion during the quarter, compared to analyst estimates of $4.03 billion. On average, sell-side analysts predict that Ecolab Inc. will post 7.54 EPS for the current fiscal year.

Ecolab Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Tuesday, September 16th will be given a dividend of $0.65 per share. This represents a $2.60 annualized dividend and a dividend yield of 1.0%. The ex-dividend date of this dividend is Tuesday, September 16th. Ecolab's dividend payout ratio is currently 34.71%.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the company. Stifel Nicolaus reduced their price objective on Ecolab from $307.00 to $303.00 and set a "buy" rating on the stock in a research note on Wednesday, April 30th. Citigroup reduced their price objective on Ecolab from $320.00 to $315.00 and set a "buy" rating on the stock in a research note on Wednesday, July 30th. Mizuho lifted their price objective on Ecolab from $285.00 to $305.00 and gave the company an "outperform" rating in a research note on Tuesday, July 15th. Barclays reduced their price objective on Ecolab from $300.00 to $275.00 and set an "overweight" rating on the stock in a research note on Thursday, April 17th. Finally, Baird R W raised Ecolab from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, July 30th. Three investment analysts have rated the stock with a hold rating, thirteen have given a buy rating and three have given a strong buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Buy" and a consensus price target of $290.71.

Check Out Our Latest Stock Report on ECL

About Ecolab

(

Free Report)

Ecolab Inc provides water, hygiene, and infection prevention solutions and services in the United States and internationally. The company operates through three segments: Global Industrial; Global Institutional & Specialty; and Global Healthcare & Life Sciences. The Global Industrial segment offers water treatment and process applications, and cleaning and sanitizing solutions to manufacturing, food and beverage processing, transportation, chemical, metals and mining, power generation, pulp and paper, commercial laundry, petroleum, refining, and petrochemical industries.

Featured Stories

Before you consider Ecolab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ecolab wasn't on the list.

While Ecolab currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.